Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Essential of Accounting for Governmental and Not-For-Profit Organizations, Paul Copley, 14th Edition. 8-14 vith ued 11 3. Make sure that total debits equal total credits

Essential of Accounting for Governmental and Not-For-Profit Organizations, Paul Copley, 14th Edition. 8-14

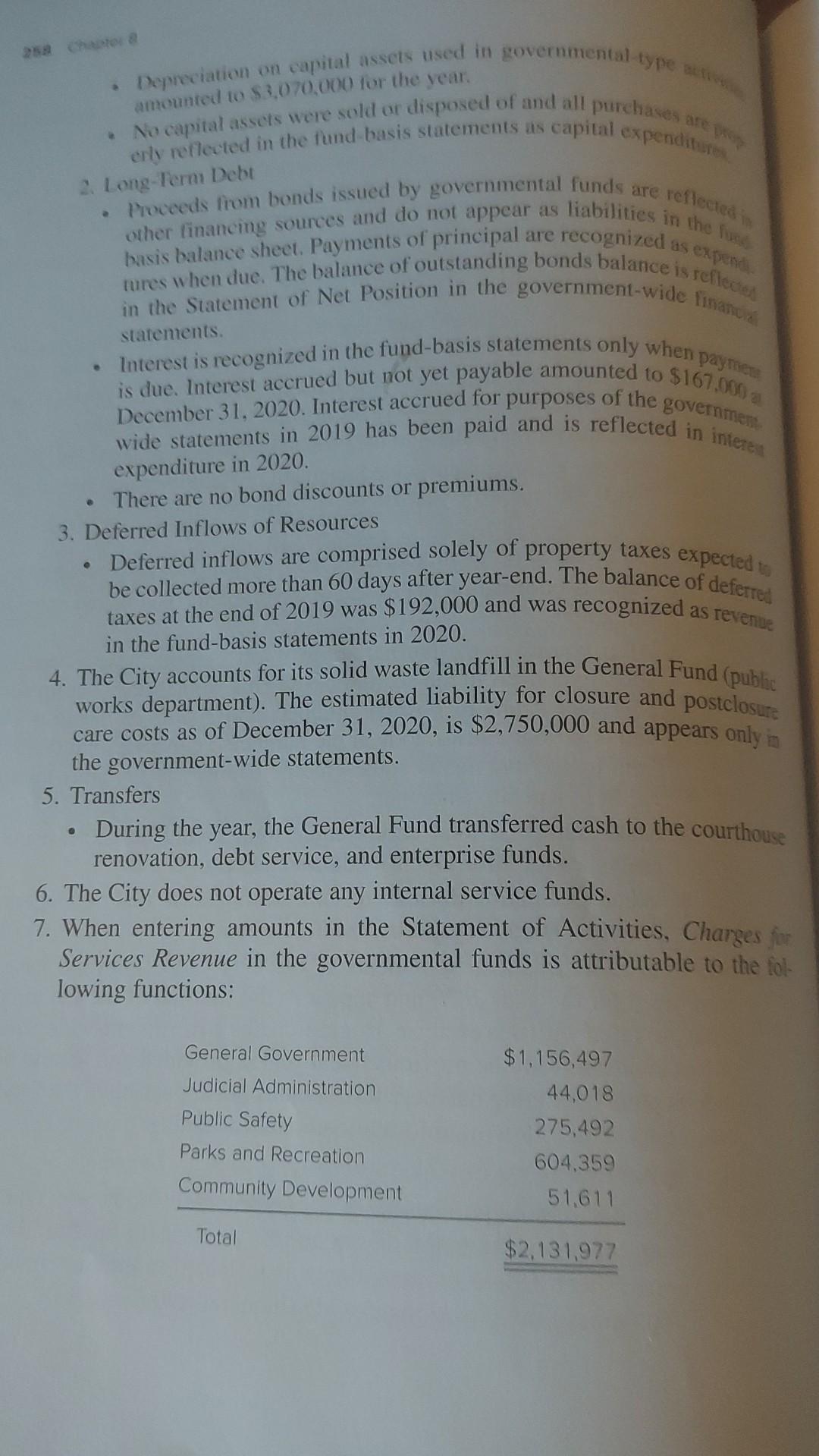

vith ued 11 3. Make sure that total debits equal total credits in the last column (balances for government-wide statements). 4. When calculating Restricted Net Position, recall that permanent fund principal is added to restricted fund balances. 8-14. The fund-basis financial statements of the City of Cottonwood have been completed for the year 2020 and appear in the first tab of the Excel spread- sheet provided with this exercise. In addition, the government-wide Statement of Net Position from the previous fiscal year is provided and should be used to determine beginning balances for accounts not appearing in the fund-basis statements. The following information is also available: und nd 1. Capital Assets d of . Capital assets purchased by governmental funds are charged to capital expenditure and do not appear as assets in the fund-basis bal- ance sheet. However, the balance is reflected in the Statement of Net Position in the government-wide financial statements. 25 Chapter amounted to $3,070,000 for the year. 2. Long-Term Debt as expend paymen Depreciation on capital assets used in governmental types No capital assets were sold or disposed of and all purchases are erly reflected in the fund basis statements as capital expenditures Proceeds from bonds issued by governmental funds are reflected in other financmg sources and do not appear as liabilities in the fun tures when due. The balance of outstanding bonds balance is reflect basis balance sheet. Payments of principal are recognized in the Statement of Net Position in the government-wide finanud statements Interest is recognized in the fund-basis statements only when is due. Interest accrued but not yet payable amounted to $167.000) December 31, 2020. Interest accrued for purposes of the governmem. wide statements in 2019 has been paid and is reflected in interes expenditure in 2020. There are no bond discounts or premiums. 3. Deferred Inflows of Resources Deferred inflows are comprised solely of property taxes expected to be collected more than 60 days after year-end. The balance of deferred taxes at the end of 2019 was $192,000 and was recognized as revenue in the fund-basis statements in 2020. 4. The City accounts for its solid waste landfill in the General Fund (public works department). The estimated liability for closure and postclosure care costs as of December 31, 2020, is $2,750,000 and appears only in the government-wide statements. 5. Transfers During the year, the General Fund transferred cash to the courthouse renovation, debt service, and enterprise funds. 6. The City does not operate any internal service funds. 7. When entering amounts in the Statement of Activities, Charges for Services Revenue in the governmental funds is attributable to the fol lowing functions: General Government Judicial Administration Public Safety Parks and Recreation Community Development $1,156,497 44,018 275,492 604.359 51,611 Total $2.131.977 Government-wide Statements, Capital Assets, Long-Term Debt 259 Ruined separate tab is provided in Excel for each of these steps: 'se the Excel template provided to complete the following requirements: a Prepare the journal entries necessary to convert the governmental fund financial statements to the accrual basis of accounting. 1. Post the journal entries to the conversion worksheet provided. c. Prepare a government-wide Statement of Activities and Statement of Net Position for the year 2020. here. This is an involved problem, requiring many steps. Here are some hints: 1. Tab 1 is information to be used in the problem. You do not enter anything 2. After you make the journal entries (Tab 2), post these to the worksheet to convert to the accrual basis. This worksheet is set up so that you enter debits as positive numbers and credits as negative. After you post your entries, look at the numbers below the total credit column to see that deb- its equal credits. If not, you probably entered a credit as a positive number. 3. Make sure that total debits equal total credits in the last column (balances for government-wide statements). 4. When calculating Restricted Net Position, recall that permanent fund principal is added to restricted fund balances. ontinuous Problem The continuous problem is available in Connect through the Additional Student Resources in the eBook or instructor library. Complete the assign- ments for Chapter 8

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started