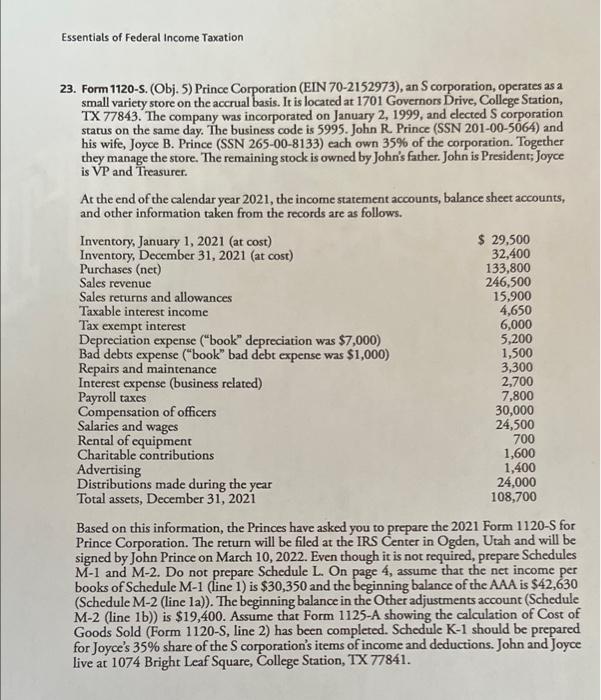

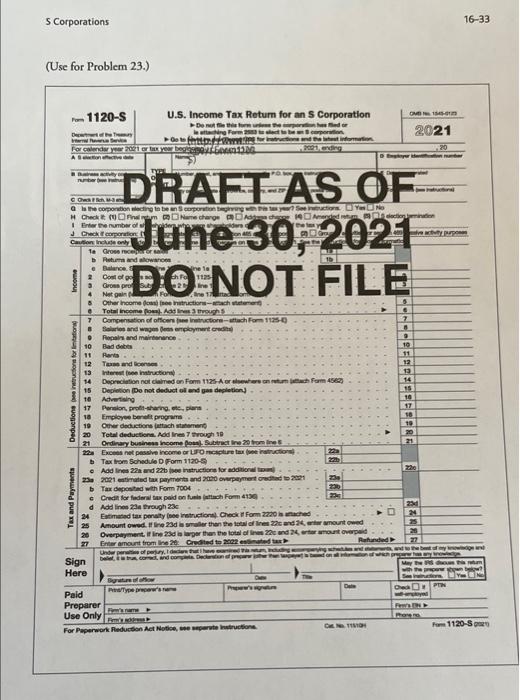

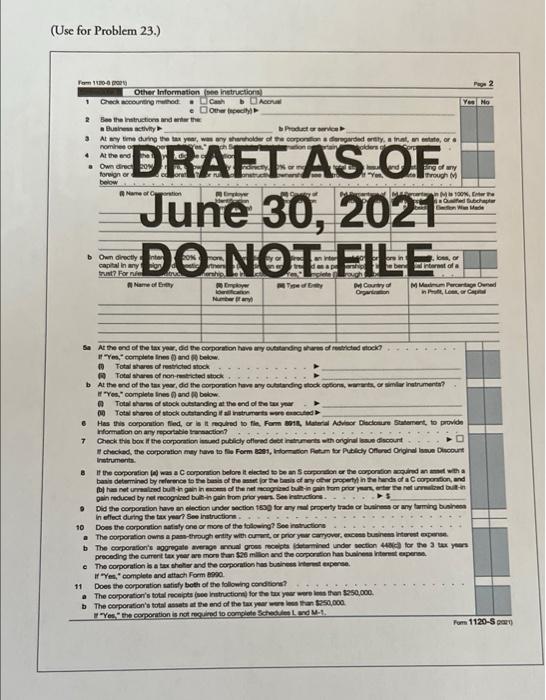

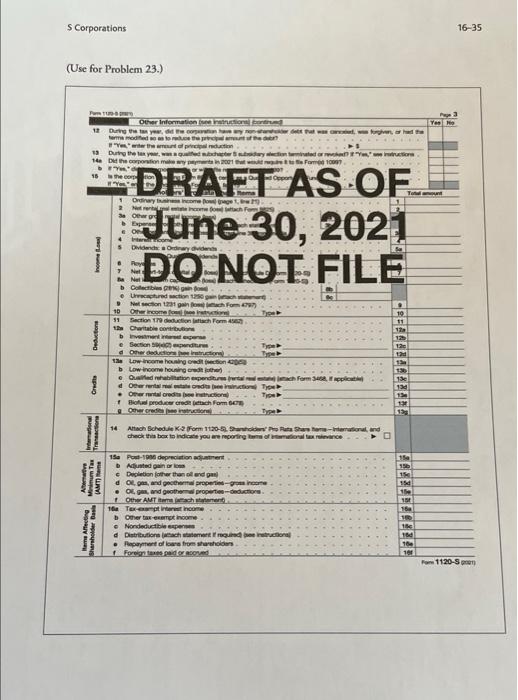

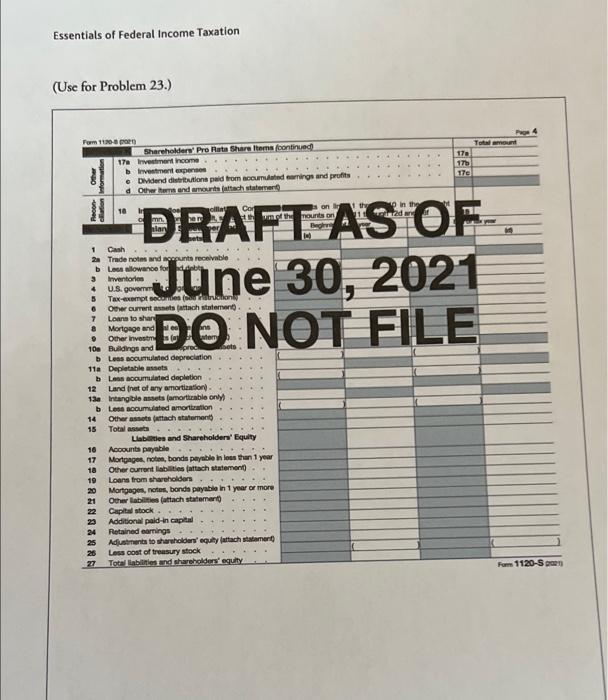

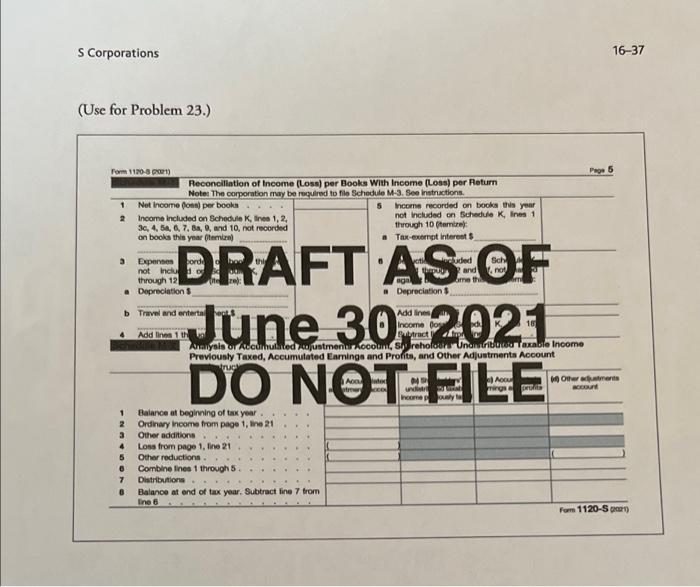

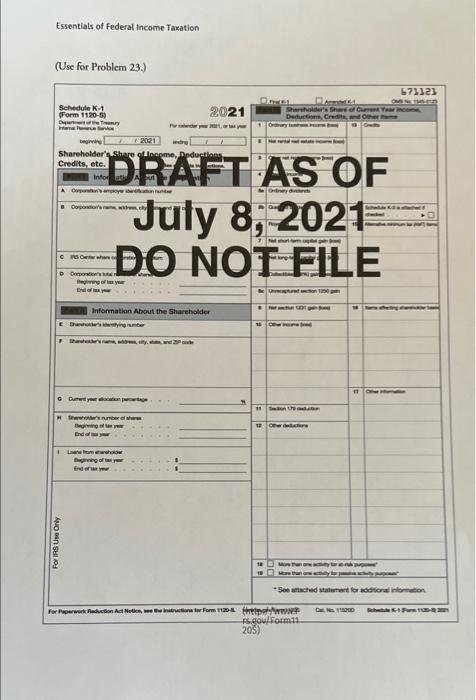

Essentials of Federal Income Taxation 23. Form 1120-S. (Obj. 5) Prince Corporation (EIN 70-2152973), an Scorporation, operates as a small variety store on the accrual basis. It is located at 1701 Governors Drive, College Station, TX 77843. The company was incorporated on January 2, 1999, and elected S corporation status on the same day. The business code is 5995. John R. Prince (SSN 201-00-5064) and his wife, Joyce B. Prince (SSN 265-00-8133) each own 35% of the corporation. Together they manage the store. The remaining stock is owned by John's father. John is President; Joyce is VP and Treasurer. At the end of the calendar year 2021, the income statement accounts, balance sheet accounts, and other information taken from the records are as follows. Inventory, January 1, 2021 (at cost) $ 29,500 Inventory, December 31, 2021 (at cost) 32,400 Purchases (net) 133,800 Sales revenue 246,500 Sales returns and allowances 15,900 Taxable interest income 4,650 Tax exempt interest 6,000 Depreciation expense ("book" depreciation was $7,000) 5,200 Bad debts expense ("book" bad debt expense was $1,000) 1,500 Repairs and maintenance 3,300 Interest expense (business related) 2,700 Payroll taxes 7,800 Compensation of officers 30,000 Salaries and wages 24,500 Rental of equipment 700 Charitable contributions 1,600 Advertising 1,400 Distributions made during the year 24,000 Total assets, December 31, 2021 108,700 Based on this information, the Princes have asked you to prepare the 2021 Form 1120-S for Prince Corporation. The return will be filed at the IRS Center in Ogden, Utah and will be signed by John Prince on March 10, 2022. Even though it is not required, prepare Schedules M-1 and M-2. Do not prepare Schedule L. On page 4, assume that the net income per books of Schedule M-1 (line 1) is $30,350 and the beginning balance of the AAA is $42,630 (Schedule M-2 (line la)). The beginning balance in the Other adjustments account (Schedule M-2 (line 1b)) is $19,400. Assume that Form 1125-A showing the calculation of Cost of Goods Sold (Form 1120-s, line 2) has been completed. Schedule K-1 should be prepared for Joyce's 35% share of the corporation's items of income and deductions. John and Joyce live at 1074 Bright Leaf Square, College Station, TX 77841. 5 Corporations 16-33 (Use for Problem 23.) - 1120-5 U.S. Income Tax Return for an S Corporation Do me this Bed Den por tra B Barrondheim For calend your or you SOT GAN MO15- 2021 20 Oh als the companion acting to the corporation programm # Check them me charge de 19 Entre number of Check comparation Caution Ince only DRAFT AS OF June 30, 2021 DO NOT FILE Income 10 11 12 Deductions to conformation behandwa . Balance Cost of 1125 3 Grompre 4 Net gan ine Other Income fonctions-achten 5 Total income font. Addinough 7 Compensation of office intruction-tech Form 1125- 7 Salaries and wagen en entployment credi Repair and maince 10 Bad de Ranta Team and Boes 13 Intereste naruto 13 14 Depreciation not claimed on Form 1125-Aer when 14 15 Depiction (Do not deduct al and gas depletion 15 Advertising 18 17 Permion, pro-sharing toplar 10 Employee benefit programs 19 Other deduction attach statement 20 Total deductions. Addins rough 10 21 Ordinary business income poslustratine 20 tonnes 21 Excoes not possive income or UFO lure larructions Textrom Schedule D Form 1120- Add lines 22 and 22 struction for addition 2 2001 stated tax payments and 700 operert odhad to 2021 Tax deposited with Form 7004 c Credit for federal tax pold on ach Form 4130 d Add lines Prough 23 251 24 Estimated tax penalty retruction. Check it om 2220 nached 24 25 Amount owed in 23 laser than the total of lines 22 and wount owed 25 20 Overpayment. I line 25d is borger than the total of 220 32 overald 20 27 En amount from line 2 Gredited te 2002 estas Randed 27 Un property.com Sign bedoeld May Here PG Dale Tepper's Paid DPH Preparer Use Only For Paperwork Reduction Act Notice, we are stron DEMON Fam 1120-S emm doub ELEER A ... Tax and Payment (Use for Problem 23.) Form1700 Other Information instruction 1 Crack Recording to Ch AC e od 2 Beethactions de the Busty Product 3 Atery time during the tax year, we any whole of the corporation garded witty, struntate, or nomine At the end . Own direct of any tormignor below Name of M190, ch Made DRAELAS OF June 30, 2021 DO NOT FILE b Own directly capital in any Internet of are of my Tie Pogoy way My Orion MM Port Owe into 7 8 Se At the end of the tax your, did the corporation have any outstanding area of related mack Yes, completenes and below Totales of resided ock Total shares of non-retted stock b At the end of the tax year, dd the corporation have an outstanding stock coton, warts, or similar instrumenta? Yes." completenes and below Total shares of stock outstanding at the end of the box your 00 Total shares of stock outstanding instruments 6 Hes this corporation filed, or truered to in Form 2016, Maria Amor Decore Statement to provide Information on any reportable traction? Check this box if the corporation and publicly offered ones with originale discount checked the corporation may have to e Form 2001, Hordon Ramtor Policy Offered Origin Discount rutruments If the corporation was a corporation before it clected to be an Scarpondow the corporation and and with a base determined by reference to the basis of the thesis of property in the hands of a corporation, and than redbungan of the grad being tromprory, artered in pain reduced by recognized bungan trom priory. Sections Did the corporation have an election under section 1999 for any property trade or business or any wming busine In effect during the ta yuan See Instructions 10 Does the corporation is one or more of the following? Soe instructions The corporation owns a pass through entity with out, or prior your cover, co business Intorst part b The corporation's aggregate average group and under section 40 for the 3 lux years preceding the current tax your are more than $20 million and the corporation has business Intermeer The corporation is a tax sher and the corporation has business experse "Yes, complete and attach Form 1990 Does the corporation satisfy both of the following conditions? . The corporation's totalmente struction for the tax yw wore than $250,000 b The corporation's to set the end of the tax you than 50,000 Yes the corporation is not to complete Sched and M-1 Tom 1120-5 11 S Corporations 16-35 (Use for Problem 23.) YHO Other Information contar 1 Durga dura #production 1 Dut the you, with stay contaminated more 14 the 2001 om 1000 19 HT. Cape To 1 Oyuncome Org . DRAET AS OF June 30, 2021 DO NOT FILE Dvd Oy noen Loe Pey Nel BAN Congo Udon 120ch Nel con ganch for 10 Onco 51 Section 1 och Form the Charitable Deduction . 10 11 17 NA 12 10 12 1 Credit Second To Other du The lower housing credit ton blow-income housing der Quilted button expedita Form Other relaterte ricono Orrial credito To Bodrach Form Orion De 13 130 13 14 reaction Anach Schedule 2 Form 1120-takuta Sham-hation, and check this box to indicate you are reporting of Aten Minimum Tax JAM 15 Powdepreciation Adjusted an Deponerten and a d Olge, and other properties income Olgaand get properties Other AMT schwer 16 Tescomptencome Other are income Nordeductible espero & Distribution schement moindructional . Repertoire from shoes Foreign tato padre 150 16 150 15 15 16 are Alecting Mareholder Best 16 10 16 180 om 1120-Spen Essentials of Federal Income Taxation (Use for Problem 23.) om 1120-3D Shareholders' Pro Reta Share Items fontinued 17 Investment income Drvestment expenses Dividend distribution paid from Bedags and profits d other hand amount attach statement Totalment 17a 17 175 10 on mounts 1 Cash 2 Tradenotes and counts receivable blowance for 3 Inventor 4 U.S. GOVTT 5 Tax-exemption . Other current assets attach statement 7 Loans to share 8 Mortgage and Other investm DRAFT AS OF. June 30, 2021 DO NOT FILE b Luas accumulated depreciation 110 Deplotable assets b Les accumulated depletion 12 Land heat of any amortization 1a Intangible assets (amortizable only bLose acumulated amortion 14 Other as attach statement 15 Totalas Llabetes and Shareholders' Equity 16 Accounts payable 17 Mortgage note, bonda payable in oss than 1 year 18 Other current liabilities attach statement 19 Loans from shareholders Mortgage, notes, bonda payable in 1 year or more 21 Other labis attach statement 22 Capital stock Additional paid in capital 24 Retained earnings Adjustments to shareholders' equity attach staterer 26 Los cost of treasury stock 27 Totables and shareholders equity NBRBNB From 1120-5 s Corporations 16-37 (Use for Problem 23.) Page 5 Form 1170-8 Reconciliation of Income (Loss) per Books With Income (Loss) per Return Note: The corporation may be required to file Schedule M-3.See ristructions 1 Net Income on) per books 5 Income recorded on books this year 2 Income included on Schedule Klea 1, 2 not included on schedule K in 1 30, 4, 5, 6, 7, 8, 9, and 10, not recorded through 10 tamil on books this year temi & Taxexempt interest a Experten not inclu ded and ano # Depreciations a Depreciation b Travel and entertalet Add in los Add lines the Arnlysis or Accumulated justmenu Accoun, Syrehotours Unonserita Taxable income Previously Taxed, Accumulated Earnings and Profits, and Other Adjustments Account Moments LE COM DRAFT AS OF June 30=2021 DO NOTEILE 1 2 3 4 Balance of beginning of tax year Ordinary Income from page 1, Ine 21 Other additions Los from page 1. line 21 Other reductions Combine lines 1 through 5 Distributions Balance at end of tax year. Subtract line 7 from line 6 8 7 6 Form 1120- S2) Essentials of Federal Income Taxation (Use for Problem 23.) 673123 Share there oferim Deducom Credit Schedule K-1 Form 1120-5 2021 Theory Intima 2021 w Shareholder Share oncome, Deductions Credits, etc. Info www 1 Dyd . DRAFT AS OF July 8, 2021 DO NOT FILE CO D D Mego Drallax Information About the Shareholder E B 16 Her Begge Ed TE nego! For IRS Use Only Scoached staforditional con For Power Reduction Ad Hoc w Form 1 httpwww C D Foulformit 205) Essentials of Federal Income Taxation 23. Form 1120-S. (Obj. 5) Prince Corporation (EIN 70-2152973), an Scorporation, operates as a small variety store on the accrual basis. It is located at 1701 Governors Drive, College Station, TX 77843. The company was incorporated on January 2, 1999, and elected S corporation status on the same day. The business code is 5995. John R. Prince (SSN 201-00-5064) and his wife, Joyce B. Prince (SSN 265-00-8133) each own 35% of the corporation. Together they manage the store. The remaining stock is owned by John's father. John is President; Joyce is VP and Treasurer. At the end of the calendar year 2021, the income statement accounts, balance sheet accounts, and other information taken from the records are as follows. Inventory, January 1, 2021 (at cost) $ 29,500 Inventory, December 31, 2021 (at cost) 32,400 Purchases (net) 133,800 Sales revenue 246,500 Sales returns and allowances 15,900 Taxable interest income 4,650 Tax exempt interest 6,000 Depreciation expense ("book" depreciation was $7,000) 5,200 Bad debts expense ("book" bad debt expense was $1,000) 1,500 Repairs and maintenance 3,300 Interest expense (business related) 2,700 Payroll taxes 7,800 Compensation of officers 30,000 Salaries and wages 24,500 Rental of equipment 700 Charitable contributions 1,600 Advertising 1,400 Distributions made during the year 24,000 Total assets, December 31, 2021 108,700 Based on this information, the Princes have asked you to prepare the 2021 Form 1120-S for Prince Corporation. The return will be filed at the IRS Center in Ogden, Utah and will be signed by John Prince on March 10, 2022. Even though it is not required, prepare Schedules M-1 and M-2. Do not prepare Schedule L. On page 4, assume that the net income per books of Schedule M-1 (line 1) is $30,350 and the beginning balance of the AAA is $42,630 (Schedule M-2 (line la)). The beginning balance in the Other adjustments account (Schedule M-2 (line 1b)) is $19,400. Assume that Form 1125-A showing the calculation of Cost of Goods Sold (Form 1120-s, line 2) has been completed. Schedule K-1 should be prepared for Joyce's 35% share of the corporation's items of income and deductions. John and Joyce live at 1074 Bright Leaf Square, College Station, TX 77841. 5 Corporations 16-33 (Use for Problem 23.) - 1120-5 U.S. Income Tax Return for an S Corporation Do me this Bed Den por tra B Barrondheim For calend your or you SOT GAN MO15- 2021 20 Oh als the companion acting to the corporation programm # Check them me charge de 19 Entre number of Check comparation Caution Ince only DRAFT AS OF June 30, 2021 DO NOT FILE Income 10 11 12 Deductions to conformation behandwa . Balance Cost of 1125 3 Grompre 4 Net gan ine Other Income fonctions-achten 5 Total income font. Addinough 7 Compensation of office intruction-tech Form 1125- 7 Salaries and wagen en entployment credi Repair and maince 10 Bad de Ranta Team and Boes 13 Intereste naruto 13 14 Depreciation not claimed on Form 1125-Aer when 14 15 Depiction (Do not deduct al and gas depletion 15 Advertising 18 17 Permion, pro-sharing toplar 10 Employee benefit programs 19 Other deduction attach statement 20 Total deductions. Addins rough 10 21 Ordinary business income poslustratine 20 tonnes 21 Excoes not possive income or UFO lure larructions Textrom Schedule D Form 1120- Add lines 22 and 22 struction for addition 2 2001 stated tax payments and 700 operert odhad to 2021 Tax deposited with Form 7004 c Credit for federal tax pold on ach Form 4130 d Add lines Prough 23 251 24 Estimated tax penalty retruction. Check it om 2220 nached 24 25 Amount owed in 23 laser than the total of lines 22 and wount owed 25 20 Overpayment. I line 25d is borger than the total of 220 32 overald 20 27 En amount from line 2 Gredited te 2002 estas Randed 27 Un property.com Sign bedoeld May Here PG Dale Tepper's Paid DPH Preparer Use Only For Paperwork Reduction Act Notice, we are stron DEMON Fam 1120-S emm doub ELEER A ... Tax and Payment (Use for Problem 23.) Form1700 Other Information instruction 1 Crack Recording to Ch AC e od 2 Beethactions de the Busty Product 3 Atery time during the tax year, we any whole of the corporation garded witty, struntate, or nomine At the end . Own direct of any tormignor below Name of M190, ch Made DRAELAS OF June 30, 2021 DO NOT FILE b Own directly capital in any Internet of are of my Tie Pogoy way My Orion MM Port Owe into 7 8 Se At the end of the tax your, did the corporation have any outstanding area of related mack Yes, completenes and below Totales of resided ock Total shares of non-retted stock b At the end of the tax year, dd the corporation have an outstanding stock coton, warts, or similar instrumenta? Yes." completenes and below Total shares of stock outstanding at the end of the box your 00 Total shares of stock outstanding instruments 6 Hes this corporation filed, or truered to in Form 2016, Maria Amor Decore Statement to provide Information on any reportable traction? Check this box if the corporation and publicly offered ones with originale discount checked the corporation may have to e Form 2001, Hordon Ramtor Policy Offered Origin Discount rutruments If the corporation was a corporation before it clected to be an Scarpondow the corporation and and with a base determined by reference to the basis of the thesis of property in the hands of a corporation, and than redbungan of the grad being tromprory, artered in pain reduced by recognized bungan trom priory. Sections Did the corporation have an election under section 1999 for any property trade or business or any wming busine In effect during the ta yuan See Instructions 10 Does the corporation is one or more of the following? Soe instructions The corporation owns a pass through entity with out, or prior your cover, co business Intorst part b The corporation's aggregate average group and under section 40 for the 3 lux years preceding the current tax your are more than $20 million and the corporation has business Intermeer The corporation is a tax sher and the corporation has business experse "Yes, complete and attach Form 1990 Does the corporation satisfy both of the following conditions? . The corporation's totalmente struction for the tax yw wore than $250,000 b The corporation's to set the end of the tax you than 50,000 Yes the corporation is not to complete Sched and M-1 Tom 1120-5 11 S Corporations 16-35 (Use for Problem 23.) YHO Other Information contar 1 Durga dura #production 1 Dut the you, with stay contaminated more 14 the 2001 om 1000 19 HT. Cape To 1 Oyuncome Org . DRAET AS OF June 30, 2021 DO NOT FILE Dvd Oy noen Loe Pey Nel BAN Congo Udon 120ch Nel con ganch for 10 Onco 51 Section 1 och Form the Charitable Deduction . 10 11 17 NA 12 10 12 1 Credit Second To Other du The lower housing credit ton blow-income housing der Quilted button expedita Form Other relaterte ricono Orrial credito To Bodrach Form Orion De 13 130 13 14 reaction Anach Schedule 2 Form 1120-takuta Sham-hation, and check this box to indicate you are reporting of Aten Minimum Tax JAM 15 Powdepreciation Adjusted an Deponerten and a d Olge, and other properties income Olgaand get properties Other AMT schwer 16 Tescomptencome Other are income Nordeductible espero & Distribution schement moindructional . Repertoire from shoes Foreign tato padre 150 16 150 15 15 16 are Alecting Mareholder Best 16 10 16 180 om 1120-Spen Essentials of Federal Income Taxation (Use for Problem 23.) om 1120-3D Shareholders' Pro Reta Share Items fontinued 17 Investment income Drvestment expenses Dividend distribution paid from Bedags and profits d other hand amount attach statement Totalment 17a 17 175 10 on mounts 1 Cash 2 Tradenotes and counts receivable blowance for 3 Inventor 4 U.S. GOVTT 5 Tax-exemption . Other current assets attach statement 7 Loans to share 8 Mortgage and Other investm DRAFT AS OF. June 30, 2021 DO NOT FILE b Luas accumulated depreciation 110 Deplotable assets b Les accumulated depletion 12 Land heat of any amortization 1a Intangible assets (amortizable only bLose acumulated amortion 14 Other as attach statement 15 Totalas Llabetes and Shareholders' Equity 16 Accounts payable 17 Mortgage note, bonda payable in oss than 1 year 18 Other current liabilities attach statement 19 Loans from shareholders Mortgage, notes, bonda payable in 1 year or more 21 Other labis attach statement 22 Capital stock Additional paid in capital 24 Retained earnings Adjustments to shareholders' equity attach staterer 26 Los cost of treasury stock 27 Totables and shareholders equity NBRBNB From 1120-5 s Corporations 16-37 (Use for Problem 23.) Page 5 Form 1170-8 Reconciliation of Income (Loss) per Books With Income (Loss) per Return Note: The corporation may be required to file Schedule M-3.See ristructions 1 Net Income on) per books 5 Income recorded on books this year 2 Income included on Schedule Klea 1, 2 not included on schedule K in 1 30, 4, 5, 6, 7, 8, 9, and 10, not recorded through 10 tamil on books this year temi & Taxexempt interest a Experten not inclu ded and ano # Depreciations a Depreciation b Travel and entertalet Add in los Add lines the Arnlysis or Accumulated justmenu Accoun, Syrehotours Unonserita Taxable income Previously Taxed, Accumulated Earnings and Profits, and Other Adjustments Account Moments LE COM DRAFT AS OF June 30=2021 DO NOTEILE 1 2 3 4 Balance of beginning of tax year Ordinary Income from page 1, Ine 21 Other additions Los from page 1. line 21 Other reductions Combine lines 1 through 5 Distributions Balance at end of tax year. Subtract line 7 from line 6 8 7 6 Form 1120- S2) Essentials of Federal Income Taxation (Use for Problem 23.) 673123 Share there oferim Deducom Credit Schedule K-1 Form 1120-5 2021 Theory Intima 2021 w Shareholder Share oncome, Deductions Credits, etc. Info www 1 Dyd . DRAFT AS OF July 8, 2021 DO NOT FILE CO D D Mego Drallax Information About the Shareholder E B 16 Her Begge Ed TE nego! For IRS Use Only Scoached staforditional con For Power Reduction Ad Hoc w Form 1 httpwww C D Foulformit 205)