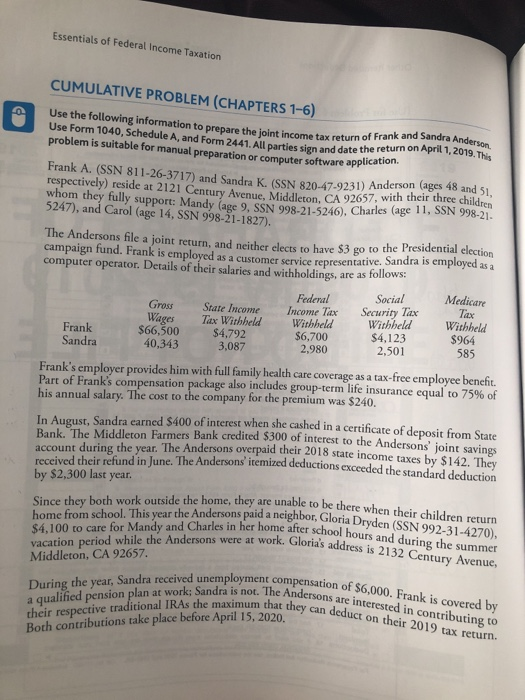

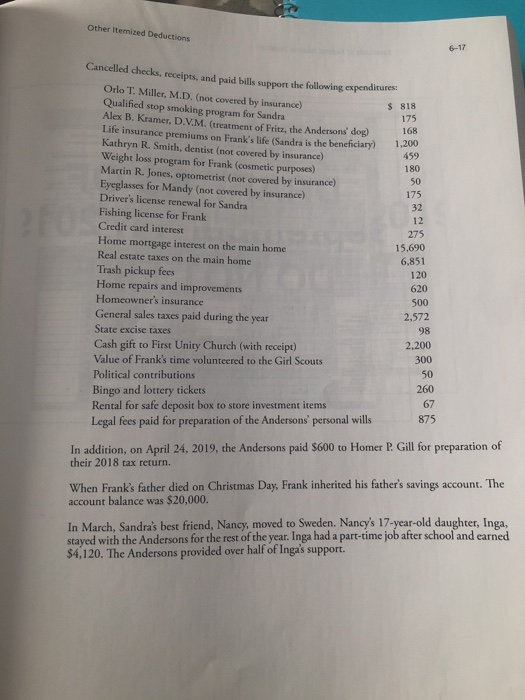

Essentials of Federal Income Taxation CUMULATIVE PROBLEM (CHAPTERS 1-6) of Frank and Sandra Anderson Use the following information to prepare the loint income tax return of me Use Form 1040, Schedule A, and Form 2441. All parties sian and date the red problem is suitable for manual preparation or computer software applica Frank A. (SSN 811-26-3717) and Sandra K. ISSN 820-47-9231) Ander respectively) reside at 2121 Century Avenue Midi CA 92657, with their three children whom they fully support: Mandy (age 9. SSN 998-21-5240. Charles (age 11, SSN 998-21- 5247), and Carol (age 14, SSN 998-21-1827). The Andersons file a joint return, and neither clects to have $3 go to the $3 go to the Presidential election campaign fund. Frank is employed as a customer service representative. Sandra is employed as a computer operator Details of their salaries and withholdings, are as follow Federal Social Medicare Gross State Income Income Tax Security Tax Tix Wages Tax Withheld Withheld Withheld Withheld Frank $66,500 $4,792 $6,700 $4,123 $964 Sandra 40,343 3,087 2,980 2,501 585 Frank's employer provides him with full family health care coverage as a tax-free employee benefit. Part of Frank's compensation package also includes group-term life insurance equal to 75% of his annual salary. The cost to the company for the premium was $240. In August, Sandra earned $400 of interest when she cashed in a certificate of deposit from State Bank. The Middleton Farmers Bank credited $300 of interest to the Andersons' joint savings account during the year. The Andersons overpaid their 2018 state income taxes bus received their refund in June. The Andersons itemized deductions exceeded the star by $2,300 last year. Since they both work outside the home, they are unable to be there home from school. This year the Andersons paid a neighbor, Gloria D. $4.100 to care for Mandy and Charles in her home after school ba vacation period while the Andersons were at work. Gloria's Middleton, CA 92657. me they are unable to be there when their children return ons paid a neighbor, Gloria Dryden (SSN 992-31-4270), in her home after school hours and during the summer work. Gloria's address is 2132 Century Avenue, a qualified During the year, Sandra received unemployment col a qualified pension plan at work: Sandra is not. Th their respective traditional IRAs the maximum th Both contributions take place before April 15, 2020. ployment compensation of $6,000. Frank is covered by not, The Andersons are interested in contributing to aximum that they can deduct on their 2019 tax return. April 15, 2020. traditional IRAS. Other itemized Deductions 6-17 175 32 Cancelled checks, receipts, and paid bills support the following expenditures Orlo T. Miller, M.D. (not covered by Insurance) Qualified stop smoking program for Sandra $ 818 175 Alex B. Kramer, D.V.M. (treatment of Fritz, the Andersons dog) 168 Life insurance premiums on Frank's life (Sandra is the beneficiary) Kathryn R. Smith, dentist (not covered by insurance) . 459 Weight loss program for Frank (cosmetic purposes) 180 Martin R. Jones, optometrist (not covered by insurance) Eyeglasses for Mandy (not covered by insurance) Driver's license renewal for Sandra Fishing license for Frank Credit card interest 275 Home mortgage interest on the main home 15.690 Real estate taxes on the main home Trash pickup fees 120 Home repairs and improvements 620 Homeowner's insurance 500 General sales taxes paid during the year 2,572 State excise taxes Cash gift to First Unity Church (with receipt) 300 Value of Frank's time volunteered to the Girl Scouts 50 Political contributions 260 Bingo and lottery tickets Rental for safe deposit box to store investment items Legal fees paid for preparation of the Andersons' personal wills 6,851 98 2,200 67 875 In addition, on April 24, 2019, the Andersons paid $600 to Homer P. Gill for preparation of their 2018 tax return. When Frank's father died on Christmas Day, Frank inherited his father's savings account. The account balance was $20,000. In March, Sandra's best friend, Nancy, moved to Sweden. Nancy's 17-year-old daughter, Inga. staved with the Andersons for the rest of the year. Inga had a part-time job after school and earned $4,120. The Andersons provided over half of Inga's support. Essentials of Federal Income Taxation CUMULATIVE PROBLEM (CHAPTERS 1-6) of Frank and Sandra Anderson Use the following information to prepare the loint income tax return of me Use Form 1040, Schedule A, and Form 2441. All parties sian and date the red problem is suitable for manual preparation or computer software applica Frank A. (SSN 811-26-3717) and Sandra K. ISSN 820-47-9231) Ander respectively) reside at 2121 Century Avenue Midi CA 92657, with their three children whom they fully support: Mandy (age 9. SSN 998-21-5240. Charles (age 11, SSN 998-21- 5247), and Carol (age 14, SSN 998-21-1827). The Andersons file a joint return, and neither clects to have $3 go to the $3 go to the Presidential election campaign fund. Frank is employed as a customer service representative. Sandra is employed as a computer operator Details of their salaries and withholdings, are as follow Federal Social Medicare Gross State Income Income Tax Security Tax Tix Wages Tax Withheld Withheld Withheld Withheld Frank $66,500 $4,792 $6,700 $4,123 $964 Sandra 40,343 3,087 2,980 2,501 585 Frank's employer provides him with full family health care coverage as a tax-free employee benefit. Part of Frank's compensation package also includes group-term life insurance equal to 75% of his annual salary. The cost to the company for the premium was $240. In August, Sandra earned $400 of interest when she cashed in a certificate of deposit from State Bank. The Middleton Farmers Bank credited $300 of interest to the Andersons' joint savings account during the year. The Andersons overpaid their 2018 state income taxes bus received their refund in June. The Andersons itemized deductions exceeded the star by $2,300 last year. Since they both work outside the home, they are unable to be there home from school. This year the Andersons paid a neighbor, Gloria D. $4.100 to care for Mandy and Charles in her home after school ba vacation period while the Andersons were at work. Gloria's Middleton, CA 92657. me they are unable to be there when their children return ons paid a neighbor, Gloria Dryden (SSN 992-31-4270), in her home after school hours and during the summer work. Gloria's address is 2132 Century Avenue, a qualified During the year, Sandra received unemployment col a qualified pension plan at work: Sandra is not. Th their respective traditional IRAs the maximum th Both contributions take place before April 15, 2020. ployment compensation of $6,000. Frank is covered by not, The Andersons are interested in contributing to aximum that they can deduct on their 2019 tax return. April 15, 2020. traditional IRAS. Other itemized Deductions 6-17 175 32 Cancelled checks, receipts, and paid bills support the following expenditures Orlo T. Miller, M.D. (not covered by Insurance) Qualified stop smoking program for Sandra $ 818 175 Alex B. Kramer, D.V.M. (treatment of Fritz, the Andersons dog) 168 Life insurance premiums on Frank's life (Sandra is the beneficiary) Kathryn R. Smith, dentist (not covered by insurance) . 459 Weight loss program for Frank (cosmetic purposes) 180 Martin R. Jones, optometrist (not covered by insurance) Eyeglasses for Mandy (not covered by insurance) Driver's license renewal for Sandra Fishing license for Frank Credit card interest 275 Home mortgage interest on the main home 15.690 Real estate taxes on the main home Trash pickup fees 120 Home repairs and improvements 620 Homeowner's insurance 500 General sales taxes paid during the year 2,572 State excise taxes Cash gift to First Unity Church (with receipt) 300 Value of Frank's time volunteered to the Girl Scouts 50 Political contributions 260 Bingo and lottery tickets Rental for safe deposit box to store investment items Legal fees paid for preparation of the Andersons' personal wills 6,851 98 2,200 67 875 In addition, on April 24, 2019, the Andersons paid $600 to Homer P. Gill for preparation of their 2018 tax return. When Frank's father died on Christmas Day, Frank inherited his father's savings account. The account balance was $20,000. In March, Sandra's best friend, Nancy, moved to Sweden. Nancy's 17-year-old daughter, Inga. staved with the Andersons for the rest of the year. Inga had a part-time job after school and earned $4,120. The Andersons provided over half of Inga's support