Establish an export sale price to prepare a quote for farm equipment.

Analyze the pricing strategy, with steps to arrive at the price and rationale.

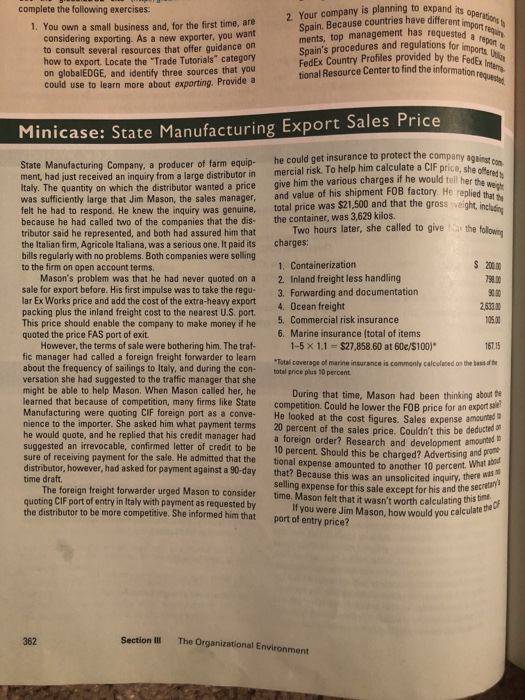

complete the following exercises: 1. You own a small business and, for the first time, are considering exporting. As a new exporter, you want to consult several resources that offer guidance on how to export. Locate the "Trade Tutorials" category on globalEDGE, and identify three sources that you could use to learn more about exporting. Provide a 2. Your company is planning to expand its Spain. Because countries have different ments, top management has requested Spain's procedures and regulations for im FedEx Country Profiles provided by the Fede tional Resource Center to find the information its operos m.importe toda a of imports. Die Fedex Itar mation e Minicase: State Manufacturing Export Sales Price any against con Forice, she offered tell her the weg he could get insurance to protect the company an... mercial risk. To help him calculate a CIF price she give him the various charges if he would tell her the and value of his shipment FOB factory. He replied total price was $21.500 and that the gross weight in the container, was 3,629 kilos. two hours later, she called to give the following charges: t the gross weight, including State Manufacturing Company, a producer of farm equip- ment, had just received an inquiry from a larne distributor in Italy. The quantity on which the distributor wanted a price was sufficiently large that Jim Mason, the sales manager felt he had to respond. He knew the inquiry was genuine because he had called two of the companies that the dis tributor said he represented, and both had assured him that the Italian firm, Agricole Italiana, was a serious one. It paid its bills regularly with no problems. Both companies were selling to the firm on open account terms. Mason's problem was that he had never quoted on a sale for export before. His first impulse was to take the regu- lar Ex Works price and add the cost of the extra-heavy export packing plus the inland freight cost to the nearest U.S. port. This price should enable the company to make money if he quoted the price FAS port of exit. However, the terms of sale were bothering him. The traf- fic manager had called a foreign freight forwarder to learn about the frequency of sailings to Italy, and during the con- versation she had suggested to the traffic manager that she might be able to help Mason. When Mason called her, he learned that because of competition, many firms like State Manufacturing were quoting CIF foreign port as a conve- nience to the importer. She asked him what payment terms he would quote, and he replied that his credit manager had suggested an irrevocable, confirmed letter of credit to be sure of receiving payment for the sale. He admitted that the distributor, however, had asked for payment against a 90-day time draft. The foreign freight forwarder urged Mason to consider quoting CIF port of entry in Italy with payment as requested by the distributor to be more competitive. She informed him that 1. Containerization $ 200.00 2. Inland freightless handling 79900 3. Forwarding and documentation 4. Ocean freight 2,532 5. Commercial risk insurance 10500 6. Marine insurance (total of items 1-5 X 1.1 = $27,858.60 at 60e/$100)* 167.15 *Total coverage of marine insurance is commonly calculated on the basis of the total price plus 10 percent During that time, Mason had been thinking about the competition. Could he lower the FOB price for an export a He looked at the cost figures. Sales expense amounted 20 percent of the sales price Couldn't this be deducted a foreign order? Research and development amoun. 10 p 10 percent. Should this be charged? Advertising and po tional expense amounted to another 10 percent. What that? Because this that? Because this was an unsolicited inquiry, there we selling expense for this sale excent for his and the secre time. Mason felt that it wasn't worth calculating this time If you were Jim Mason, how would you calculate for his and the secretary Section III The Organizational Environment