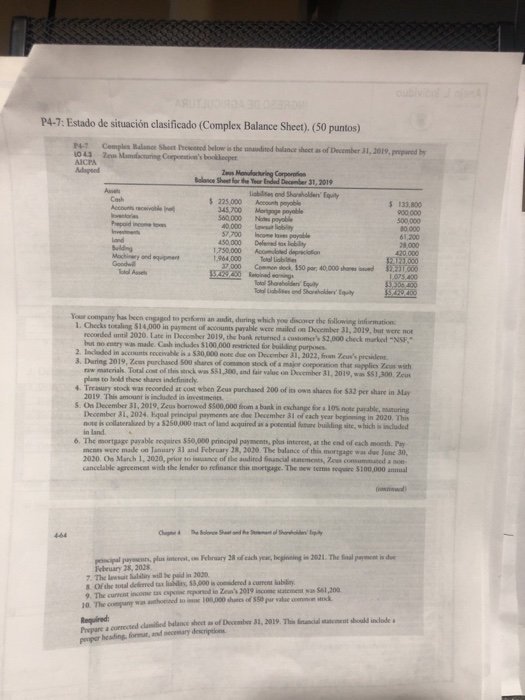

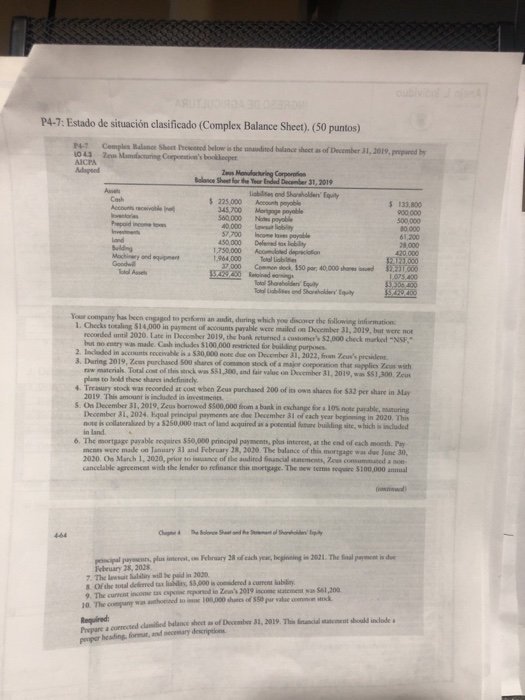

estado de situacion clasificado

P4-7: Estado de situacin clasificado (Complex Balance Sheet) (50 puntos) Complex Balance Sheet Tweed below is the audited balance sheet of December 31, 2019, prepared by 1043 Zu Macturing Corporis bookkeeper AICPA Adapted Zeus Monturing Corporation Balance Sheet for the Year End December 31, 2019 A Lisbond Shoholder' foily Cash $ 225.000 Achable $ 133,800 Acco 345700 Mortgage payable 900.000 560.000 500,000 Prepodneome 40.000 Low by 57700 Income payable 61,200 land 450,000 Dwered to Building 1750.000 1.964,000 32,123,000 Goodall 37000 Common ok. 150 por 40.000 hores SENZO Baling 1.025.00 To Shareholders 3.335.100 Tole sond Shareholders' Equity 10.000 18.000 00.000 Your company has been engaged to perform an audit, during which you discover the following information 1. Checis totaling $14,000 in payment of accounts payable weled on December 31, 2019, but were not recorded until 2020. Late in December 2019, the bank customer's $2.000 check marked "NIS" but no entry was made ab includes $100,000 restricted for building purposes 2. Inceded in accounts receivable is a $30,000 note do on December 31, 2022, from Zow's president 3. During 2019, Zens purchased Soo shares of common stock of a major corporation that supplies with raw materials. Total cost of this winck was 551,300, and fair value on December 31, 2019, was 551,300. Zeus plans to lead the shares indefinitely 4. Trewary stock was recorded at cost when Zeus purchased 200 of its own shares for $32 per share in May 2019. This amount is included in investments 5. On December 31, 2019, Zeus borrowed $500,000 from a bank in exchange for a los payable matering December 31, 2024. Equal principal payments are dee December 31 of each year beginning in 2020. This noteis collatered by a $250.000 tract of land acquired as a potential building site, which included in land 6. The mortgage payable requires 550,000 principal payments, plus interest, at the end of each month. memes were made on January 31 and February 28, 2010. The balance of this more was due June 30, 2020. On March 1, 2000, prior tone of the audied financial statements, es consumed a non cancelable agreement with the lender to refinance this more The terms require 5100,000 annual 4.64 Che Bolones Sheer and the Shows pencil pes, plus interest, February 2fach year, beginning i 2001. The folent is de February 28, 2028 7. The Lawsuit alty will be paid in 2030 8. Of the total deferred to as 55,000 is considered a currently 9. The current income tax reported in Zeus's 2019 income statement was 561,300 10. The company was to 100.000 of 50 per valor come Pupure corrected daited balance sheet of December 31, 2019. This francial statement should indude a paper heading format and eary description P4-7: Estado de situacin clasificado (Complex Balance Sheet) (50 puntos) Complex Balance Sheet Tweed below is the audited balance sheet of December 31, 2019, prepared by 1043 Zu Macturing Corporis bookkeeper AICPA Adapted Zeus Monturing Corporation Balance Sheet for the Year End December 31, 2019 A Lisbond Shoholder' foily Cash $ 225.000 Achable $ 133,800 Acco 345700 Mortgage payable 900.000 560.000 500,000 Prepodneome 40.000 Low by 57700 Income payable 61,200 land 450,000 Dwered to Building 1750.000 1.964,000 32,123,000 Goodall 37000 Common ok. 150 por 40.000 hores SENZO Baling 1.025.00 To Shareholders 3.335.100 Tole sond Shareholders' Equity 10.000 18.000 00.000 Your company has been engaged to perform an audit, during which you discover the following information 1. Checis totaling $14,000 in payment of accounts payable weled on December 31, 2019, but were not recorded until 2020. Late in December 2019, the bank customer's $2.000 check marked "NIS" but no entry was made ab includes $100,000 restricted for building purposes 2. Inceded in accounts receivable is a $30,000 note do on December 31, 2022, from Zow's president 3. During 2019, Zens purchased Soo shares of common stock of a major corporation that supplies with raw materials. Total cost of this winck was 551,300, and fair value on December 31, 2019, was 551,300. Zeus plans to lead the shares indefinitely 4. Trewary stock was recorded at cost when Zeus purchased 200 of its own shares for $32 per share in May 2019. This amount is included in investments 5. On December 31, 2019, Zeus borrowed $500,000 from a bank in exchange for a los payable matering December 31, 2024. Equal principal payments are dee December 31 of each year beginning in 2020. This noteis collatered by a $250.000 tract of land acquired as a potential building site, which included in land 6. The mortgage payable requires 550,000 principal payments, plus interest, at the end of each month. memes were made on January 31 and February 28, 2010. The balance of this more was due June 30, 2020. On March 1, 2000, prior tone of the audied financial statements, es consumed a non cancelable agreement with the lender to refinance this more The terms require 5100,000 annual 4.64 Che Bolones Sheer and the Shows pencil pes, plus interest, February 2fach year, beginning i 2001. The folent is de February 28, 2028 7. The Lawsuit alty will be paid in 2030 8. Of the total deferred to as 55,000 is considered a currently 9. The current income tax reported in Zeus's 2019 income statement was 561,300 10. The company was to 100.000 of 50 per valor come Pupure corrected daited balance sheet of December 31, 2019. This francial statement should indude a paper heading format and eary description