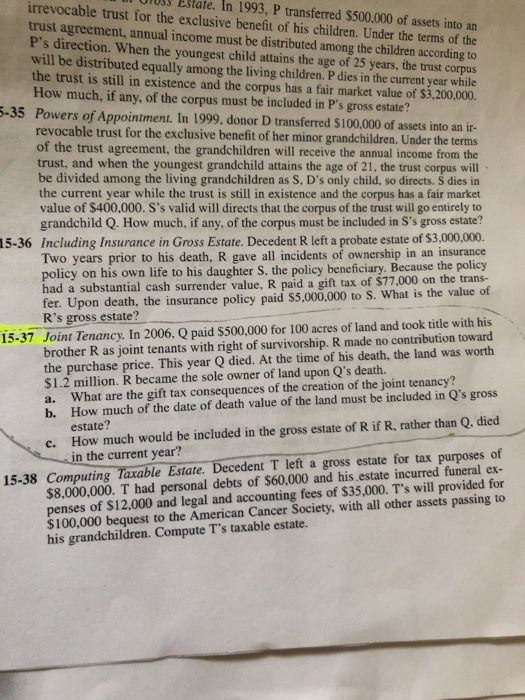

Estate. In 1993, P transferred $500,000 of assets into an irrevocable trust for the exclusive benefit of his children. Under the terms of the trust agreement, annual income must be distributed among the children according to P's direction. When the youngest child attains the age of 25 years, the trust corpus will be distributed equally among the living children. P dies in the current year while the trust is still in existence and the corpus has a fair market value of $3,200,000. How much, if any, of the corpus must be included in P's gross estate? 5-35 Powers of Appointment. In 1999, donor D transferred $100,000 of assets into an ir- revocable trust for the exclusive benefit of her minor grandchildren. Under the terms of the trust agreement, the grandchildren will receive the annual income from the trust, and when the youngest grandchild attains the age of 21, the trust corpus will be divided among the living grandchildren as S, D's only child, so directs. S dies in the current year while the trust is still in existence and the corpus has a fair market value of $400,000. S's valid will directs that the corpus of the trust will go entirely to grandchild Q. How much, if any, of the corpus must be included in S's gross estate? 15-36 Including Insurance in Gross Estate. Decedent R left a probate estate of $3,000,000. Two years prior to his death, R gave all incidents of ownership in an insurance policy on his own life to his daughter S, the policy beneficiary. Because the policy had a substantial cash surrender value, R paid fer. Upon death, the insurance policy paid $5,000,000 to S. What is the value of R's gross estate? 15-37 Joint Tenancy. In 2006, Q paid $500,000 for 100 acres of land and took title with his brother R as joint tenants with right of survivorship. R made no contribution toward the purchase price. This year Q died. At the time of his death, the land was worth $1.2 million. R became the sole owner of land upon Q's death. What are the gift tax consequences of the creation of the joint tenancy? b. How much of the date of death value of the land must be included in Q's gross estate? How much would be included in the gross estate of R if R, rather than Q, died gift tax of $77,000 on the trans- a. a. c. in the current year? $8,000,000. T had personal debts of $60,000 and his estate incurred funeral ex- penses of $12,000 and legal and accounting fees of $35,000. T's will provided for $100,000 bequest to the American Cancer Society, with all other assets passing to his grandchildren. Compute T's taxable estate. 15-38 Computing Taxable Estate. Decedent T left a gross estate for tax purposes of