Answered step by step

Verified Expert Solution

Question

1 Approved Answer

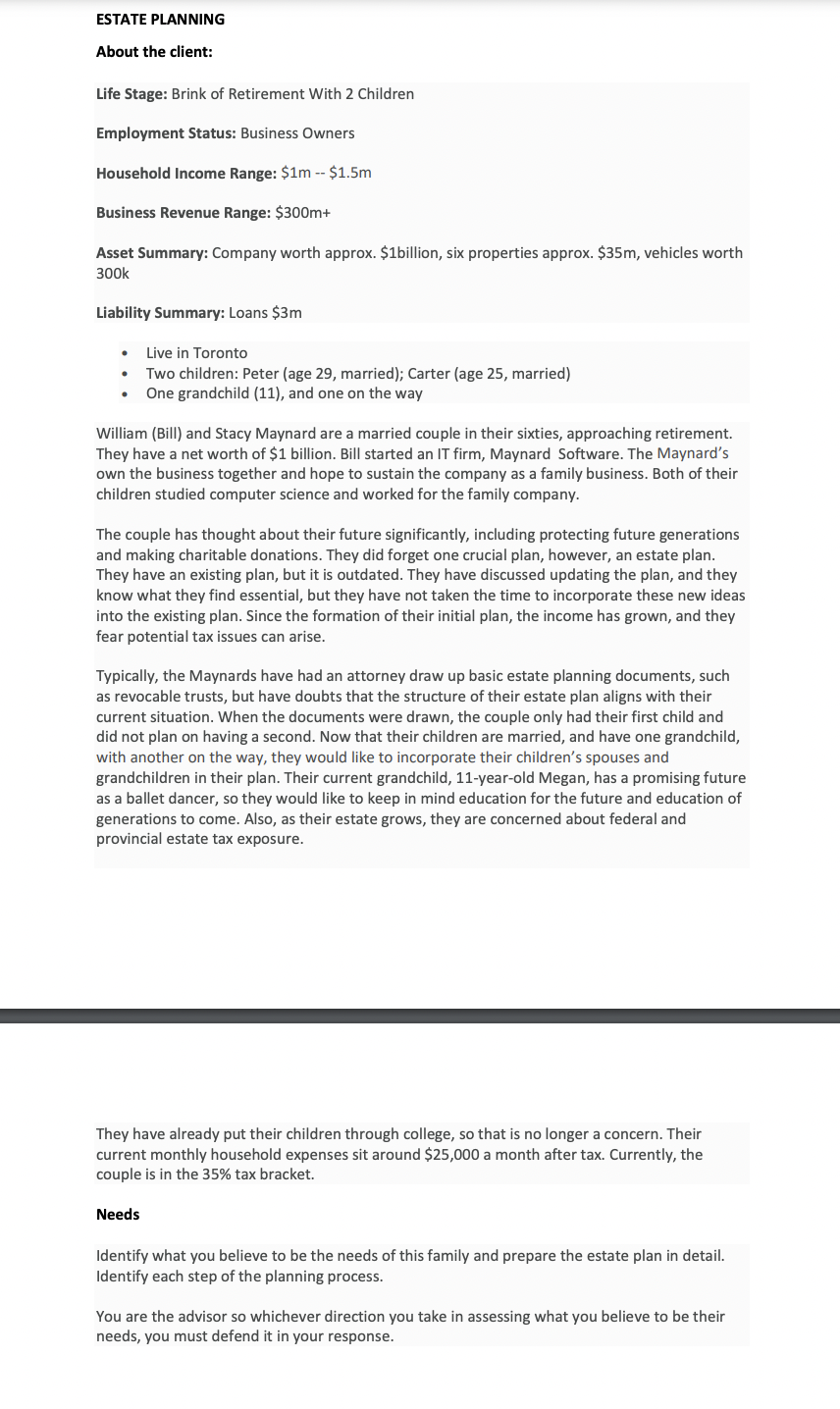

ESTATE PLANNING About the client: Life Stage: Brink of Retirement With 2 Children Employment Status: Business Owners Household Income Range: $ 1 m - -

ESTATE PLANNING

About the client:

Life Stage: Brink of Retirement With Children

Employment Status: Business Owners

Household Income Range: $ $m

Business Revenue Range: $

Asset Summary: Company worth approx. $ billion, six properties approx. $ vehicles worth

k

Liability Summary: Loans $

Live in Toronto

Two children: Peter age married; Carter age married

One grandchild and one on the way

William Bill and Stacy Maynard are a married couple in their sixties, approaching retirement.

They have a net worth of $ billion. Bill started an IT firm, Maynard Software. The Maynard's

own the business together and hope to sustain the company as a family business. Both of their

children studied computer science and worked for the family company.

The couple has thought about their future significantly, including protecting future generations

and making charitable donations. They did forget one crucial plan, however, an estate plan.

They have an existing plan, but it is outdated. They have discussed updating the plan, and they

know what they find essential, but they have not taken the time to incorporate these new ideas

into the existing plan. Since the formation of their initial plan, the income has grown, and they

fear potential tax issues can arise.

Typically, the Maynards have had an attorney draw up basic estate planning documents, such

as revocable trusts, but have doubts that the structure of their estate plan aligns with their

current situation. When the documents were drawn, the couple only had their first child and

did not plan on having a second. Now that their children are married, and have one grandchild,

with another on the way, they would like to incorporate their children's spouses and

grandchildren in their plan. Their current grandchild, yearold Megan, has a promising future

as a ballet dancer, so they would like to keep in mind education for the future and education of

generations to come. Also, as their estate grows, they are concerned about federal and

provincial estate tax exposure.

They have already put their children through college, so that is no longer a concern. Their

current monthly household expenses sit around $ a month after tax. Currently, the

couple is in the tax bracket.

Needs

Identify what you believe to be the needs of this family and prepare the estate plan in detail.

Identify each step of the planning process.

You are the advisor so whichever direction you take in assessing what you believe to be their

needs, you must defend it in your response.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started