Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Estimate enterprise value using perpetuity growth method and both of the year discounting and mid year discounting Your firm is considering the acquisition of a

Estimate enterprise value using perpetuity growth method and both of the year discounting and mid year discounting

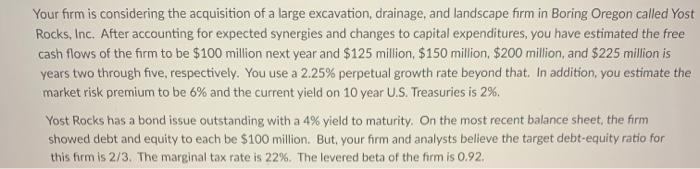

Your firm is considering the acquisition of a large excavation, drainage, and landscape firm in Boring Oregon called Yost Rocks, Inc. After accounting for expected synergies and changes to capital expenditures, you have estimated the free cash flows of the firm to be $100 million next year and $125 million $150 million $200 million, and $225 million is years two through five, respectively. You use a 2.25% perpetual growth rate beyond that. In addition, you estimate the market risk premium to be 6% and the current yield on 10 year U.S. Treasuries is 2%. Yost Rocks has a bond issue outstanding with a 4% yield to maturity. On the most recent balance sheet, the firm showed debt and equity to each be $100 million. But, your firm and analysts believe the target debt-equity ratio for this form is 2/3. The marginal tax rate is 22%. The levered beta of the firm is 0.92Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started