Estimate future income statements:

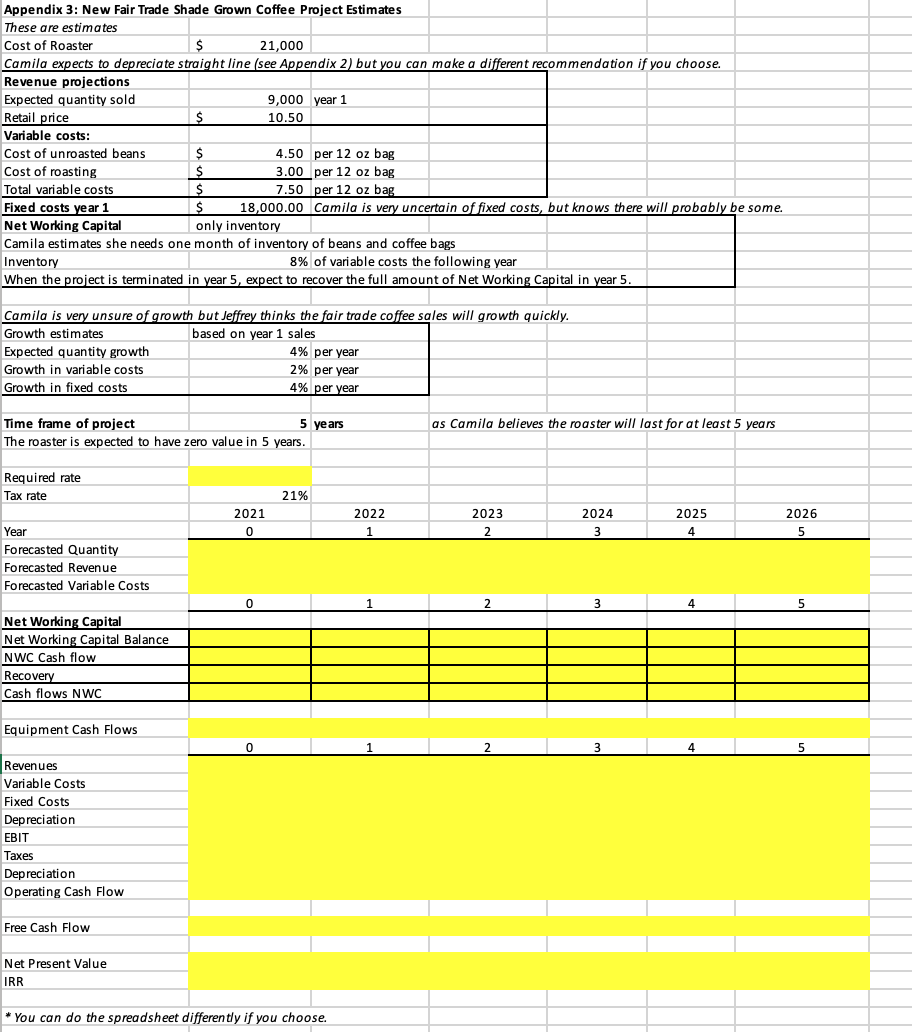

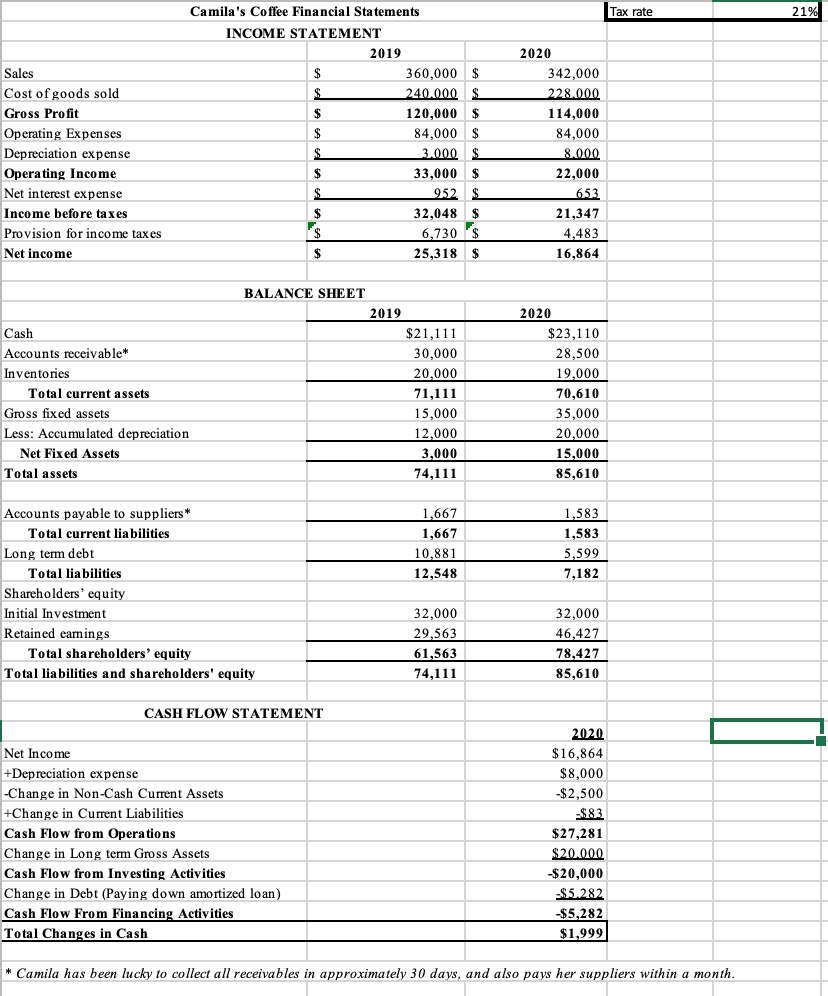

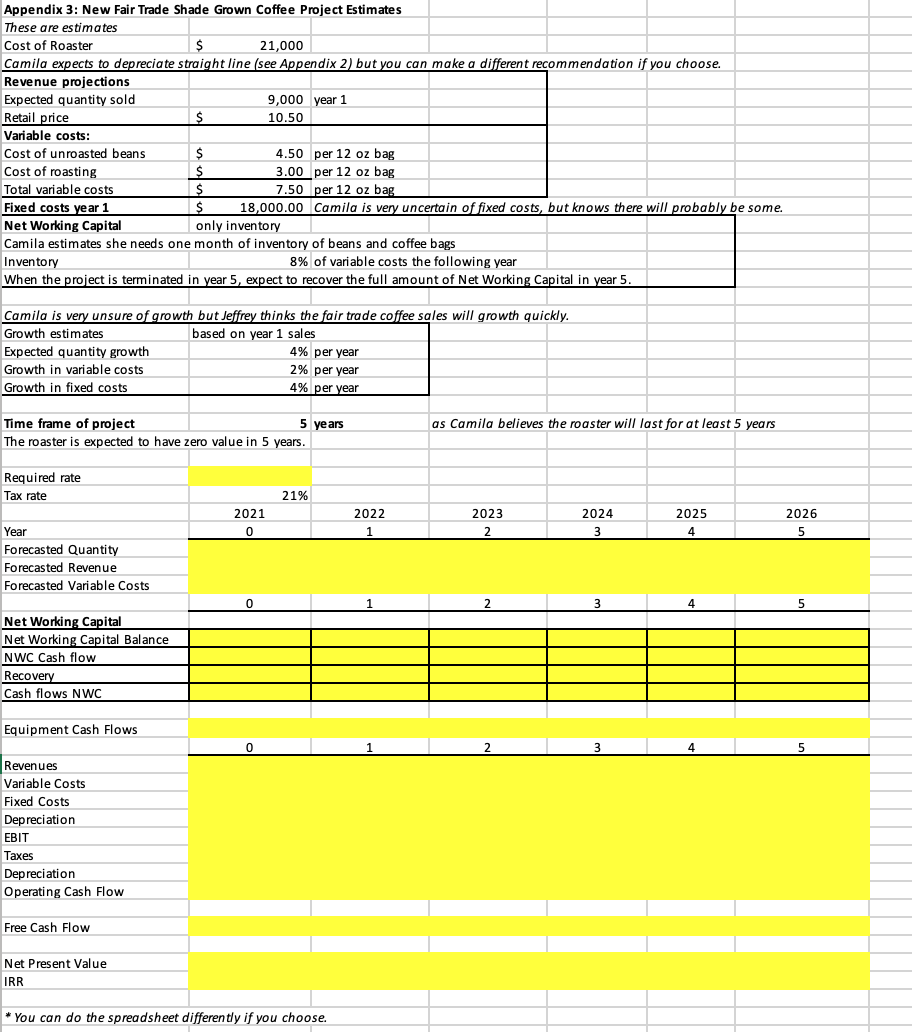

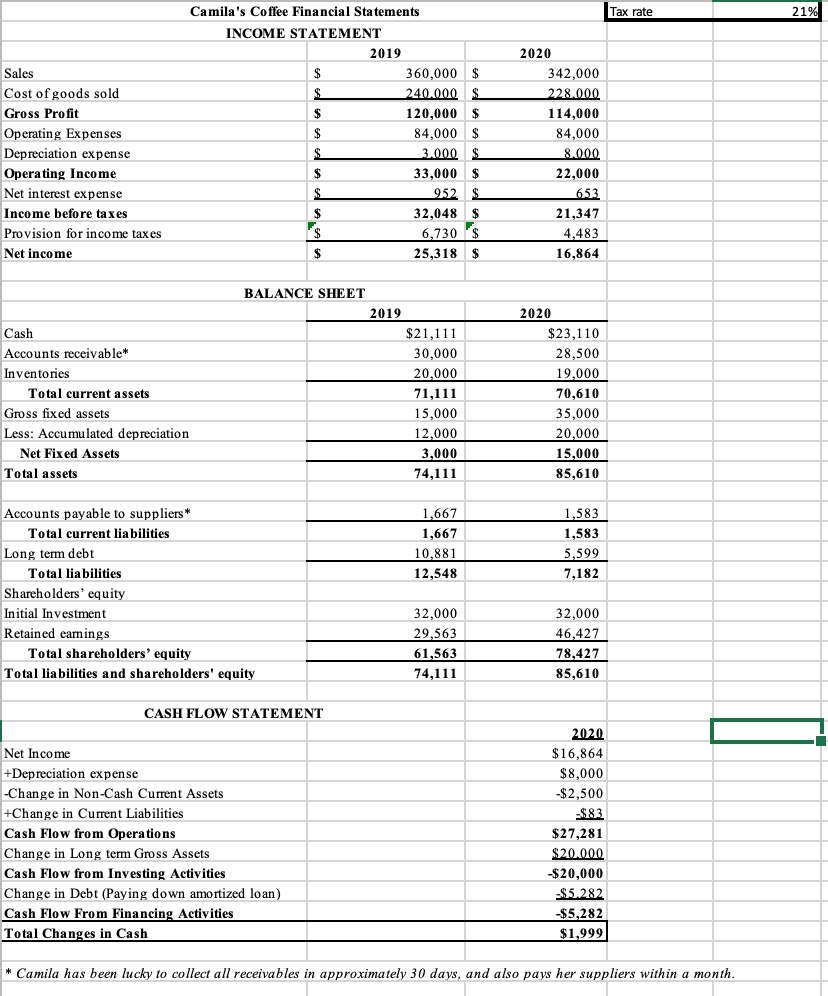

Appendix 3: New Fair Trade Shade Grown Coffee Project Estimates These are estimates Cost of Roaster $ 21,000 Camila expects to depreciate straight line (see Appendix 2) but you can make a different recommendation if you choose. Revenue projections Expected quantity sold 9,000 year 1 Retail price $ 10.50 Variable costs: : Cost of unroasted beans $ 4.50 per 12 oz bag Cost of roasting $ 3.00 per 12 oz bag Total variable costs $ 7.50 per 12 oz bag Fixed costs year 1 $ 18,000.00 Camila is very uncertain of fixed costs, but knows there will probably be some. Net Working Capital only inventory Camila estimates she needs one month of inventory of beans and coffee bags Inventory 8% of variable costs the following year When the project is terminated in year 5, expect to recover the full amount of Net Working Capital in year 5. Camila is very unsure of growth but Jeffrey thinks the fair trade coffee sales will growth quickly. Growth estimates based on year 1 sales Expected quantity growth 4% per year Growth in variable costs 2% per year Growth in fixed costs 4% per year Time frame of project 5 years The roaster is expected to have zero value in 5 years. as Camila believes the roaster will last for at least 5 years Required rate Tax rate 21% 2021 0 2022 1 2023 2. 2024 3 2025 4 2026 5 Year Forecasted Quantity Forecasted Revenue Forecasted Variable Costs 0 1 2 3 4 5 Net Working Capital Net Working Capital Balance NWC Cash flow Recovery Cash flows NWC Equipment Cash Flows 0 2 3 4 5 Revenues Variable Costs Fixed Costs Depreciation EBIT Taxes Depreciation Operating Cash Flow Free Cash Flow Net Present Value IRR You can do the spreadsheet differently if you choose. Tax rate 21% Sales Cost of goods sold Gross Profit Operating Expenses Depreciation expense Operating Income Net interest expense Income before taxes Provision for income taxes Net income Camila's Coffee Financial Statements INCOME STATEMENT 2019 $ 360,000 $ $ 240.000 $ $ 120,000 $ $ 84,000 $ $ 3.000 $ $ 33,000 $ $ 952 $ $ 32,048 $ '$ 6,730 $ $ 25,318 $ 2020 342,000 228.000 114,000 84,000 8.000 22,000 653 21,347 4,483 16,864 2020 Cash Accounts receivable* Inventories Total current assets Gross fixed assets Less: Accumulated depreciation Net Fixed Assets Total assets BALANCE SHEET 2019 $21,111 30,000 20,000 71,111 15,000 12,000 3,000 74,111 $23,110 28,500 19,000 70,610 35,000 20,000 15,000 85,610 1,667 1,667 10.881 12,548 1,583 1,583 5,599 7,182 Accounts payable to suppliers * Total current liabilities Long term debt Total liabilities Shareholders' equity Initial Investment Retained earnings Total shareholders' equity Total liabilities and shareholders' equity 32,000 29,563 61,563 74,111 32,000 46,427 78,427 85,610 CASH FLOW STATEMENT Net Income +Depreciation expense -Change in Non-Cash Current Assets +Change in Current Liabilities Cash Flow from Operations Change in Long term Gross Assets Cash Flow from Investing Activities Change in Debt (Paying down amortized loan) Cash Flow From Financing Activities Total Changes in Cash 2020 $16,864 $8,000 -$2,500 -$83 $27,281 $20.000 $20,000 -5.282 $5,282 $1,999 * Camila has been lucky to collect all receivables in approximately 30 days, and also pays her suppliers within a month