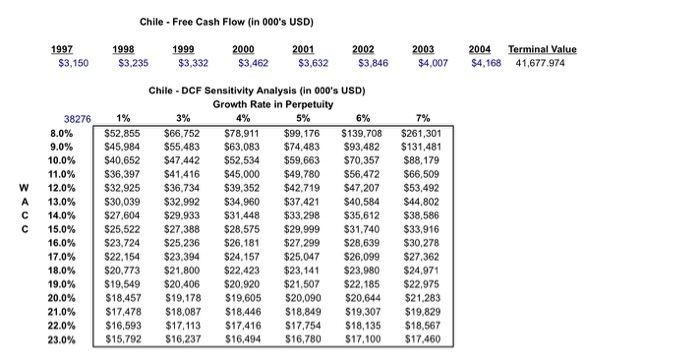

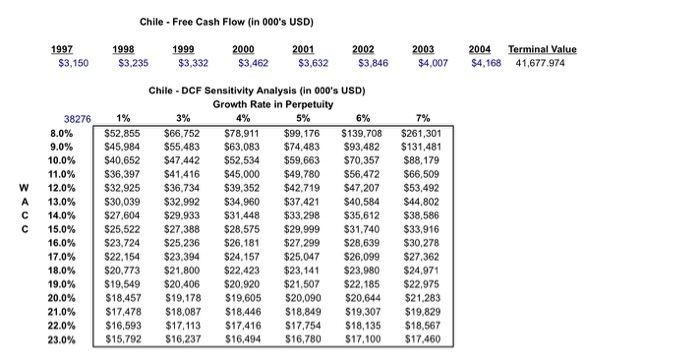

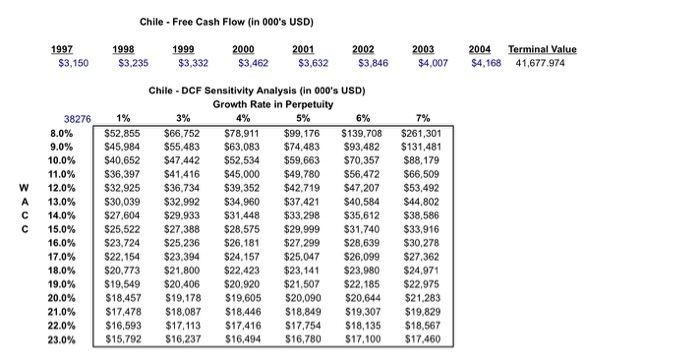

estimate required rates of return (WACC) for the cash flows originating in Chile from a local perspective and from a US $ perspective.

Chile - Free Cash Flow (in 000's USD) 1997 $3,150 1998 $3,235 1999 $3,332 2000 $3,462 2001 $3,632 2002 $3,846 2003 $4,007 2004 $4,168 Terminal Value 41,677,974 w 38276 8.0% 9.0% 10.0% 11.0% 12.0% 13.0% 14.0% 15.0% 16.0% 17.0% 18.0% 19.0% 20.0% 21.0% 22.0% 23.0% 1% $52,855 $45.984 $40,652 $36,397 $32,925 $30,039 $27,604 $25,522 $23.724 $22,154 $20.773 $19,549 $18,457 $17.478 $16,593 $15,792 Chile - DCF Sensitivity Analysis (in 000's USD) Growth Rate in Perpetuity 3% 4% 5% 6% $66.752 $78,911 $99,176 $139,708 $55.483 $63.083 $74,483 $93.482 $47,442 $52,534 $59,663 $70,357 $41.416 $45,000 $49,780 $56,472 $36.734 $39,352 $42.719 $47.207 $32,992 $34.960 $37,421 $40,584 $29.933 $31,448 $33,298 $35,612 $27,388 $28,575 $29,999 $31,740 $25,236 $26,181 $27.299 $28,639 $23,394 $24.157 $25,047 $26.099 $21,800 $22,423 $23,141 $23,980 $20,406 $20.920 $21,507 $22,185 $19,178 $19,605 $20,090 $20,644 $18,087 $18.446 $18,849 $19,307 $17,113 $17.416 $17.754 $18,135 $16,237 $16,494 $16,780 $17,100 7% $261,301 $131.481 $88,179 $66,509 $53,492 $44,802 $38,586 $33,916 $30,278 $27.362 $24.971 $22.975 $21,283 $19.829 $18,567 $17.460 Chile - Free Cash Flow (in 000's USD) 1997 $3,150 1998 $3,235 1999 $3,332 2000 $3,462 2001 $3,632 2002 $3,846 2003 $4,007 2004 $4,168 Terminal Value 41,677,974 w 38276 8.0% 9.0% 10.0% 11.0% 12.0% 13.0% 14.0% 15.0% 16.0% 17.0% 18.0% 19.0% 20.0% 21.0% 22.0% 23.0% 1% $52,855 $45.984 $40,652 $36,397 $32,925 $30,039 $27,604 $25,522 $23.724 $22,154 $20.773 $19,549 $18,457 $17.478 $16,593 $15,792 Chile - DCF Sensitivity Analysis (in 000's USD) Growth Rate in Perpetuity 3% 4% 5% 6% $66.752 $78,911 $99,176 $139,708 $55.483 $63.083 $74,483 $93.482 $47,442 $52,534 $59,663 $70,357 $41.416 $45,000 $49,780 $56,472 $36.734 $39,352 $42.719 $47.207 $32,992 $34.960 $37,421 $40,584 $29.933 $31,448 $33,298 $35,612 $27,388 $28,575 $29,999 $31,740 $25,236 $26,181 $27.299 $28,639 $23,394 $24.157 $25,047 $26.099 $21,800 $22,423 $23,141 $23,980 $20,406 $20.920 $21,507 $22,185 $19,178 $19,605 $20,090 $20,644 $18,087 $18.446 $18,849 $19,307 $17,113 $17.416 $17.754 $18,135 $16,237 $16,494 $16,780 $17,100 7% $261,301 $131.481 $88,179 $66,509 $53,492 $44,802 $38,586 $33,916 $30,278 $27.362 $24.971 $22.975 $21,283 $19.829 $18,567 $17.460