Answered step by step

Verified Expert Solution

Question

1 Approved Answer

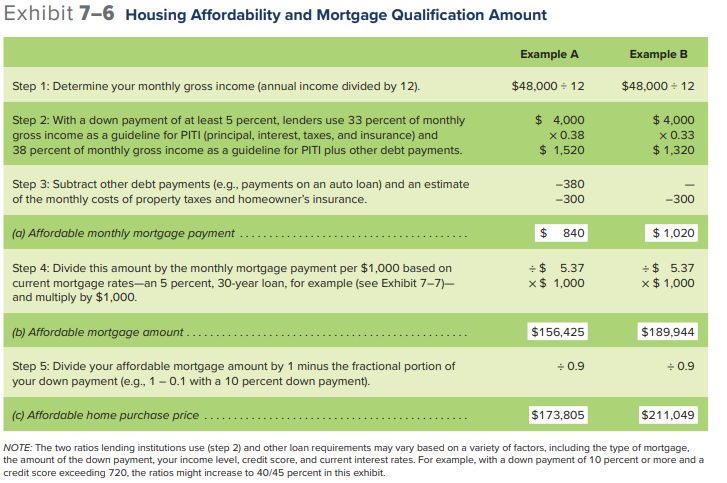

Estimate the affordable monthly mortgage payment, the affordable mortgage amount, and the affordable home purchase price for the following situation. Use Exhibit 7-6, Exhibit 7-7.

Estimate the affordable monthly mortgage payment, the affordable mortgage amount, and the affordable home purchase price for the following situation. Use Exhibit 7-6, Exhibit 7-7. (Round your intermediate and final answers to the nearest whole dollar.)

| Monthly gross income | $ 3,400 | |

|---|---|---|

| Other debt (monthly payment) | $ 205 | |

| 15-year loan at | 6 | percent |

| Down payment to be made (percent of purchase price) | 15 | percent |

| Monthly estimate for property taxes and insurance | $ 255 |

Exhibit 7-6 Housing Affordability and Mortgage Qualification Amount \begin{tabular}{|c|c|c|} \hline & Example A & Example B \\ \hline Step 1: Determine your monthly gross income (annual income divided by 12 ). & $48,00012 & $48,00012 \\ \hline Step2:Withadownpaymentofatleast5percent,lendersuse33percentofmonthlygrossincomeasaguidelineforPITI(principal,interest,taxes,andinsurance)and38percentofmonthlygrossincomeasaguidelineforPITIplusotherdebtpayments. & $4,0000.38$1,520 & $4,0000.33$1,320 \\ \hline Step3:Subtractotherdebtpayments(e.g.,paymentsonanautoloan)andanestimateofthemonthlycostsofpropertytaxesandhomeownersinsurance. & 380300 & -300 \\ \hline (a) Affordable monthly mortgage payment & $840 & $1,020 \\ \hline Step4:Dividethisamountbythemonthlymortgagepaymentper$1,000basedoncurrentmortgagerates-an5percent,30-yearloan,forexample(seeExhibit7-7)-andmultiplyby$1,000. & $$5.371,000 & $5.37$1,000 \\ \hline (b) Affordable mortgage amount.... & $156,425 & $189,944 \\ \hline Step5:Divideyouraffordablemortgageamountby1minusthefractionalportionofyourdownpayment(e.g.,10.1witha10percentdownpayment). & 0.9 & 0.9 \\ \hline (c) Affordable home purchase price & $173,805 & $211,049 \\ \hline \end{tabular} NOTE: The two ratios lending institutions use (step 2) and other loan requirements may vary based on a variety of factors, including the type of mortgage, the amount of the down payment, your income level, credit score, and current interest rates. For example, with a down payment of 10 percent or more and a credit score exceeding 720 , the ratios might increase to 40/45 percent in this exhibit. Exhibit 7-7 Mortgage Payment Factors (principal and interest factors per $1,000 of loan amount)

Exhibit 7-6 Housing Affordability and Mortgage Qualification Amount \begin{tabular}{|c|c|c|} \hline & Example A & Example B \\ \hline Step 1: Determine your monthly gross income (annual income divided by 12 ). & $48,00012 & $48,00012 \\ \hline Step2:Withadownpaymentofatleast5percent,lendersuse33percentofmonthlygrossincomeasaguidelineforPITI(principal,interest,taxes,andinsurance)and38percentofmonthlygrossincomeasaguidelineforPITIplusotherdebtpayments. & $4,0000.38$1,520 & $4,0000.33$1,320 \\ \hline Step3:Subtractotherdebtpayments(e.g.,paymentsonanautoloan)andanestimateofthemonthlycostsofpropertytaxesandhomeownersinsurance. & 380300 & -300 \\ \hline (a) Affordable monthly mortgage payment & $840 & $1,020 \\ \hline Step4:Dividethisamountbythemonthlymortgagepaymentper$1,000basedoncurrentmortgagerates-an5percent,30-yearloan,forexample(seeExhibit7-7)-andmultiplyby$1,000. & $$5.371,000 & $5.37$1,000 \\ \hline (b) Affordable mortgage amount.... & $156,425 & $189,944 \\ \hline Step5:Divideyouraffordablemortgageamountby1minusthefractionalportionofyourdownpayment(e.g.,10.1witha10percentdownpayment). & 0.9 & 0.9 \\ \hline (c) Affordable home purchase price & $173,805 & $211,049 \\ \hline \end{tabular} NOTE: The two ratios lending institutions use (step 2) and other loan requirements may vary based on a variety of factors, including the type of mortgage, the amount of the down payment, your income level, credit score, and current interest rates. For example, with a down payment of 10 percent or more and a credit score exceeding 720 , the ratios might increase to 40/45 percent in this exhibit. Exhibit 7-7 Mortgage Payment Factors (principal and interest factors per $1,000 of loan amount) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started