Answered step by step

Verified Expert Solution

Question

1 Approved Answer

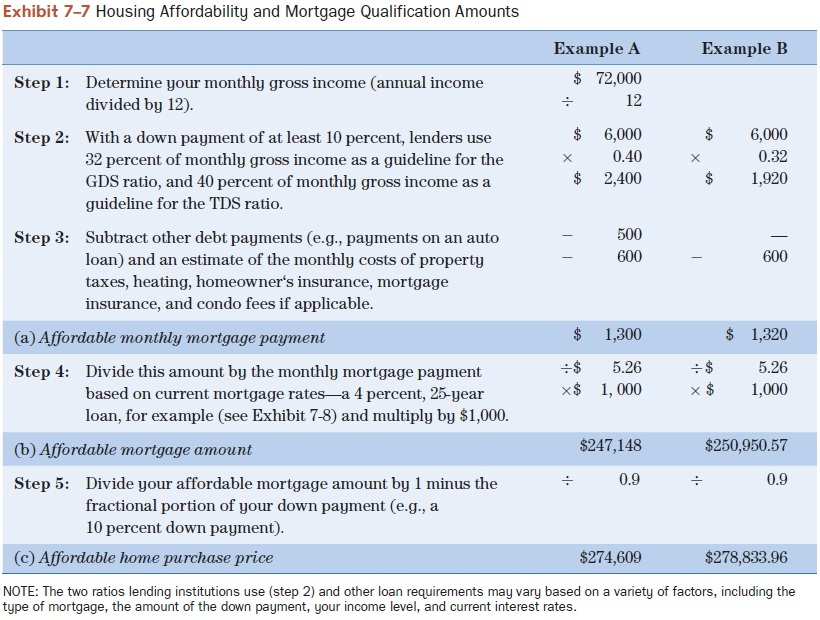

Estimate the affordable monthly mortgage payment, the affordable mortgage amount, and the affordable home purchase price for the following situation using the Total Debt Service

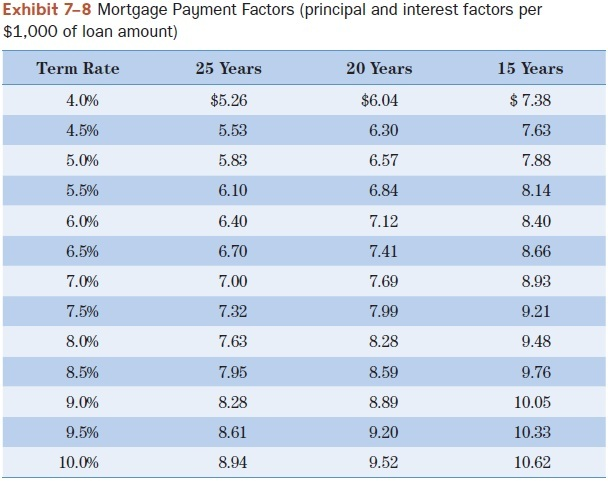

Estimate the affordable monthly mortgage payment, the affordable mortgage amount, and the affordable home purchase price for the following situation using the Total Debt Service ratio. (Refer to Exhibit 7-7 and Exhibit 7-8) (Round time value factor to 2 decimal places, intermediate and final answers to the nearest dollar amounts. Omit the "$" sign in your response.)

| Monthly gross income | $ | 4,200 | ||

| Down payment to be made (percent of purchase price) | 10 | percent | ||

| Other debt (monthly payment) | $ | 250 | ||

| Monthly estimate for property taxes and insurance | $ | 290 | ||

| 25-year loan at | 4.0 | percent | ||

| Affordable monthly mortgage payment | $ | |

| Affordable mortgage amount | $ | |

| Affordable home purchase price | $ | |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started