Answered step by step

Verified Expert Solution

Question

1 Approved Answer

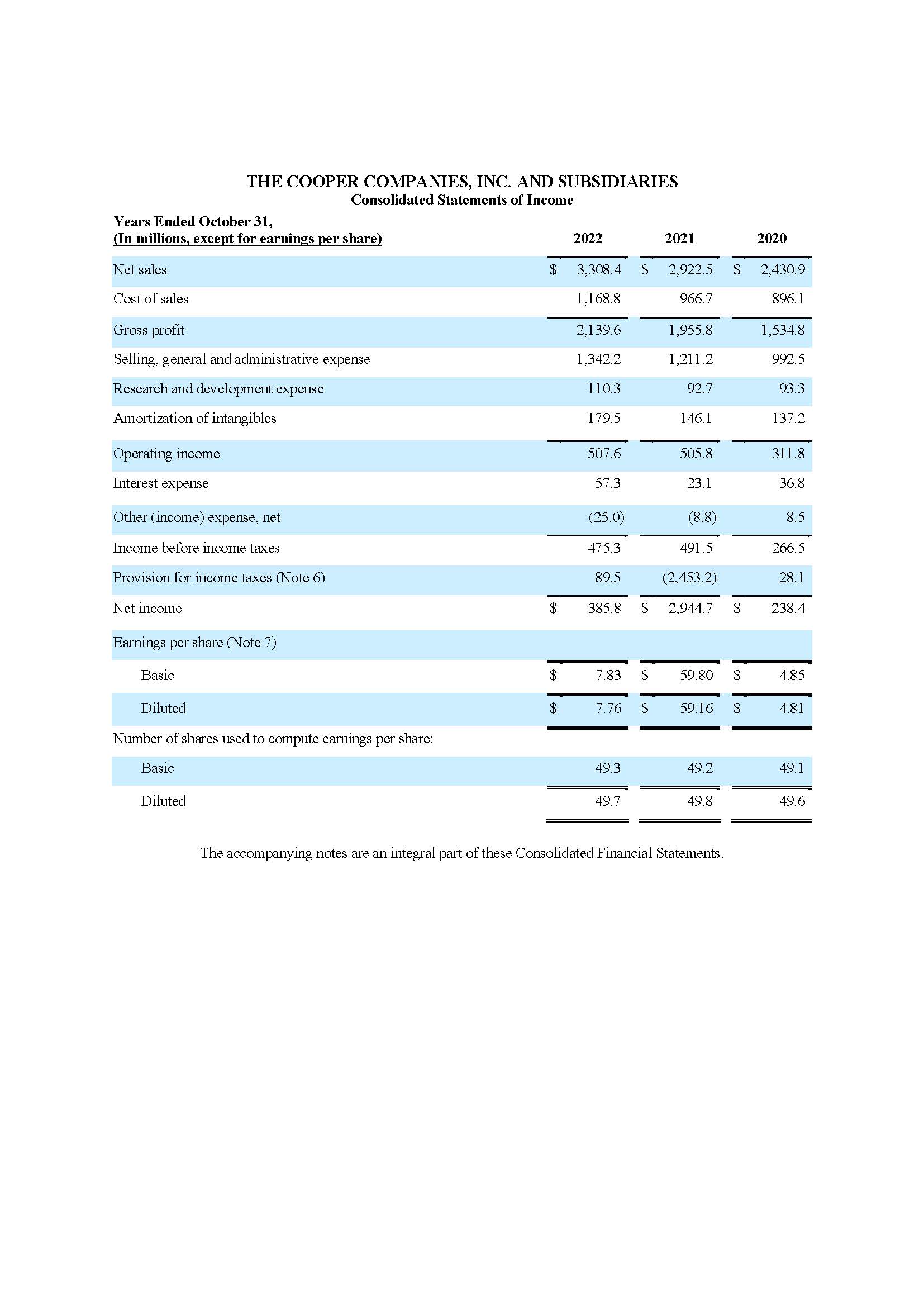

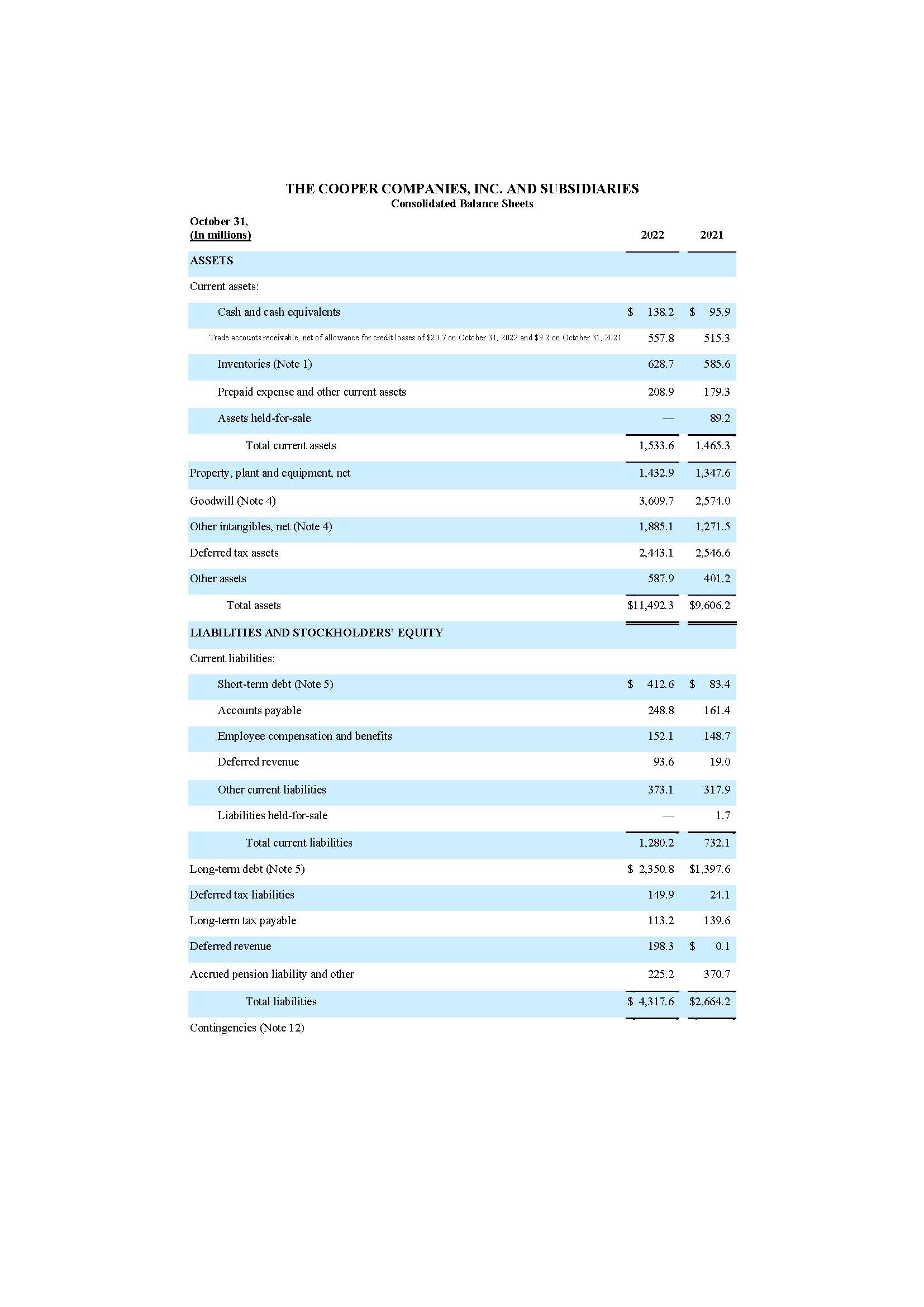

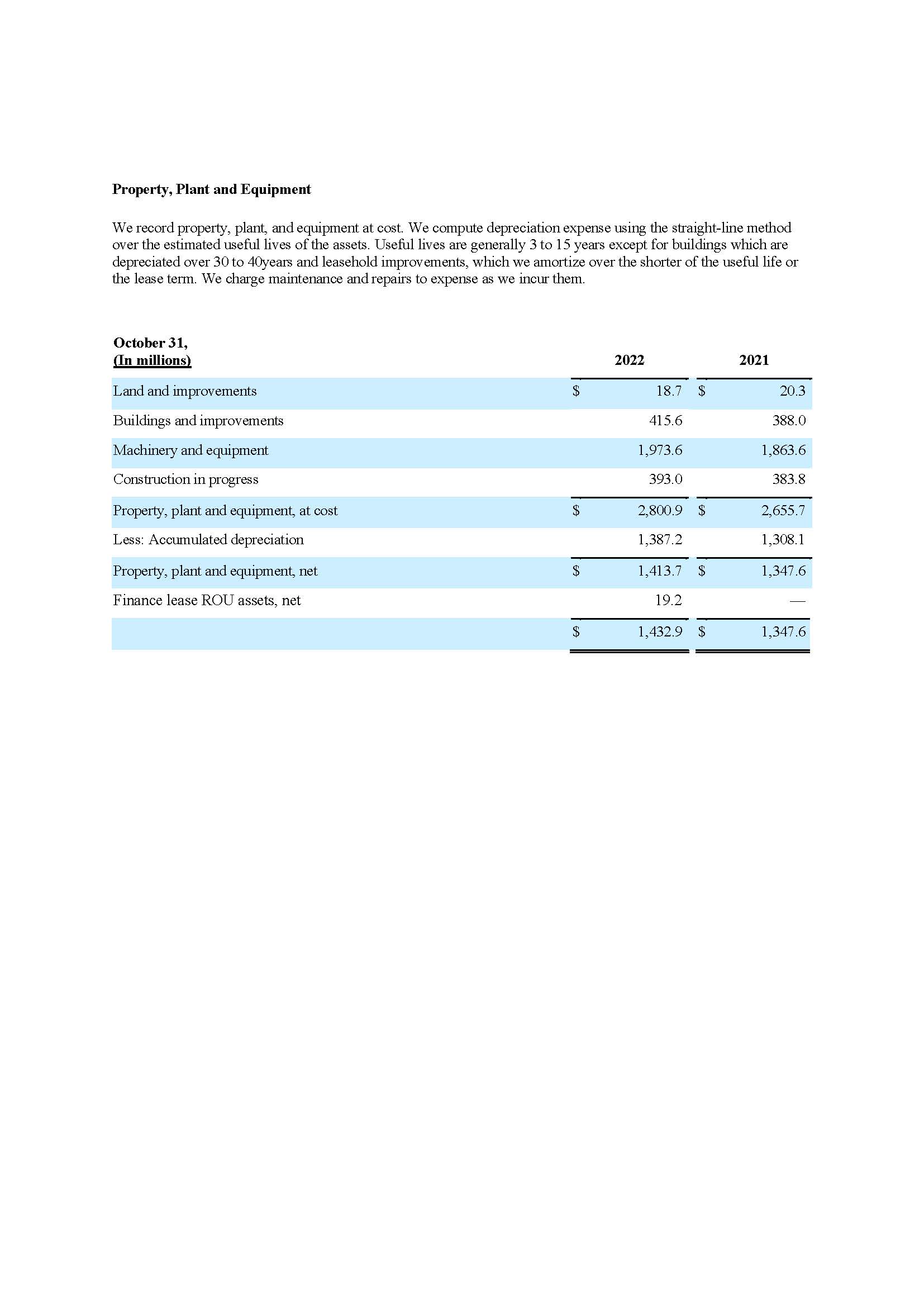

Estimate the after tax interest rate on debt. The effective tax rate for Cooper for the year ended October 31, 2022 was 18.8%. Use average

Estimate the after tax interest rate on debt. The effective tax rate for Cooper for the year ended October 31, 2022 was 18.8%. Use average debt in your calculation

THE COOPER COMPANIES, INC. AND SUBSIDIARIES Consolidated Statements of Income Years Ended October 31, (In millions, except for earnings per share) 2022 2021 2020 Net sales Cost of sales $ 3,308.4 $ 2,922.5 $ 2,430.9 1,168.8 966.7 896.1 Gross profit Selling, general and administrative expense Research and development expense Amortization of intangibles 2,139.6 1,955.8 1,534.8 1,342.2 1,211.2 992.5 110.3 92.7 93.3 179.5 146.1 137.2 Operating income Interest expense 507.6 505.8 311.8 57.3 23.1 36.8 Other (income) expense, net (25.0) (8.8) 8.5 Income before income taxes 475.3 491.5 266.5 Provision for income taxes (Note 6) 89.5 (2,453.2) 28.1 Net income $ 385.8 $ 2,944.7 $ 238.4 Earnings per share (Note 7) Basic $ 7.83 $ EA 59.80 $ 4.85 Diluted $ 7.76 $ 59.16 $ 4.81 Number of shares used to compute earnings per share: Basic Diluted 49.3 49.2 49.1 49.7 49.8 49.6 The accompanying notes are an integral part of these Consolidated Financial Statements.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer Gather Information Effective Tax Rate 188 provided Average Debt This information is not provi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started