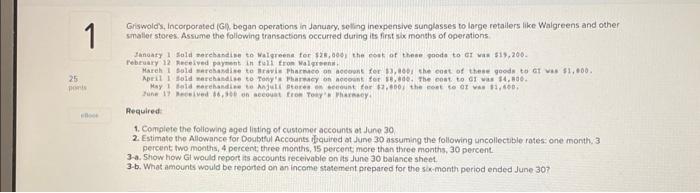

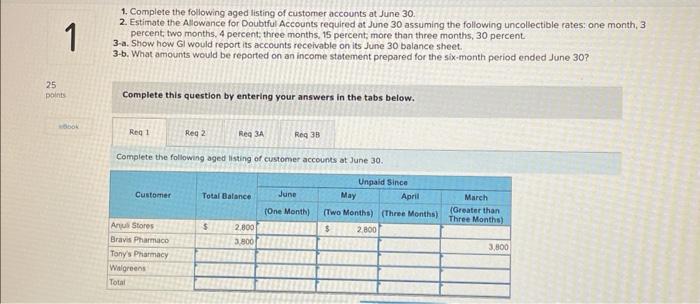

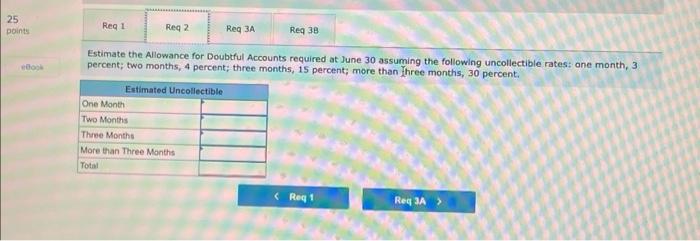

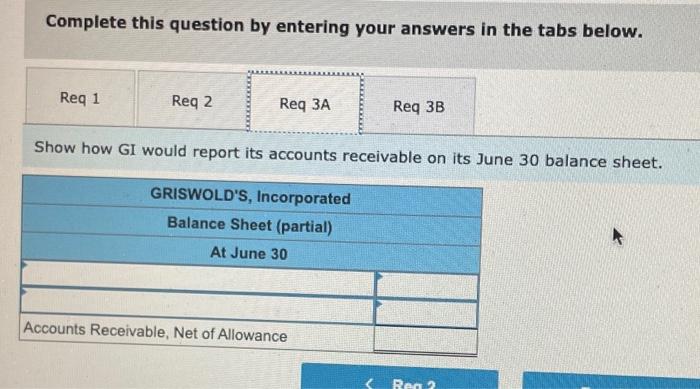

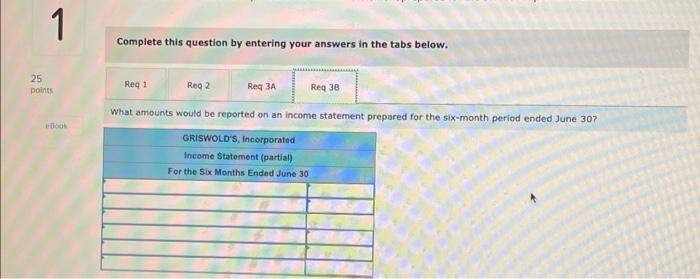

Estimate the Allowance for Doubtful Accounts required at June 30 assuming the following uncollectible rates: one month, 3 percent; two months, 4 percent; three months, 15 percent; more than Ihree months, 30 percent. Complete this question by entering your answers in the tabs below. What amounts would be reported on an income statement prepared for the six-month period ended June 30 ? 1. Complete the following aged listing of customer accounts at June 30 . 2. Estimate the Allowance for Doubtful Accounts required at June 30 assuming the following uncollectible rates: one month, 3 percent, two months, 4 percent; three months, 15 percent, more than three months, 30 percent. 3-a. Stiow how Gl would report its accounts receivable on its June 30 balance sheet. 3-b. What amounts would be reported on an income statement prepared for the six-month period ended June 30 ? Complete this question by entering your answers in the tabs below. Complete the following aged listing of customer accounts at June 30 . Complete this question by entering your answers in the tabs below. Show how GI would report its accounts receivable on its June 30 balance sheet. Griswolds, Incorporated (G), began operations in January, selling inexpensive sunglasses to large retailers like Walgreens and other smatlet stores. Assume the following transactions occurred during its first six months of operations February 12 meceived payment in tili fron Walqreenit. Aequired: 1. Complete the following aged listing of customer accounts of June 30 2. Estimate the Allowance for Doubtul Accounts if quired of June 30 assuming the following uncollectible rates one month.3 percent two months, 4 percent, three months, 15 percent more than three months, 30 percent. 3a. Show how Gl would report its accounts receivable on its June 30 balance sheet. 3-b. What amounts would be reported on an income statement prepared for the sa-month period ended June 30 ? Estimate the Allowance for Doubtful Accounts required at June 30 assuming the following uncollectible rates: one month, 3 percent; two months, 4 percent; three months, 15 percent; more than Ihree months, 30 percent. Complete this question by entering your answers in the tabs below. What amounts would be reported on an income statement prepared for the six-month period ended June 30 ? 1. Complete the following aged listing of customer accounts at June 30 . 2. Estimate the Allowance for Doubtful Accounts required at June 30 assuming the following uncollectible rates: one month, 3 percent, two months, 4 percent; three months, 15 percent, more than three months, 30 percent. 3-a. Stiow how Gl would report its accounts receivable on its June 30 balance sheet. 3-b. What amounts would be reported on an income statement prepared for the six-month period ended June 30 ? Complete this question by entering your answers in the tabs below. Complete the following aged listing of customer accounts at June 30 . Complete this question by entering your answers in the tabs below. Show how GI would report its accounts receivable on its June 30 balance sheet. Griswolds, Incorporated (G), began operations in January, selling inexpensive sunglasses to large retailers like Walgreens and other smatlet stores. Assume the following transactions occurred during its first six months of operations February 12 meceived payment in tili fron Walqreenit. Aequired: 1. Complete the following aged listing of customer accounts of June 30 2. Estimate the Allowance for Doubtul Accounts if quired of June 30 assuming the following uncollectible rates one month.3 percent two months, 4 percent, three months, 15 percent more than three months, 30 percent. 3a. Show how Gl would report its accounts receivable on its June 30 balance sheet. 3-b. What amounts would be reported on an income statement prepared for the sa-month period ended June 30