Answered step by step

Verified Expert Solution

Question

1 Approved Answer

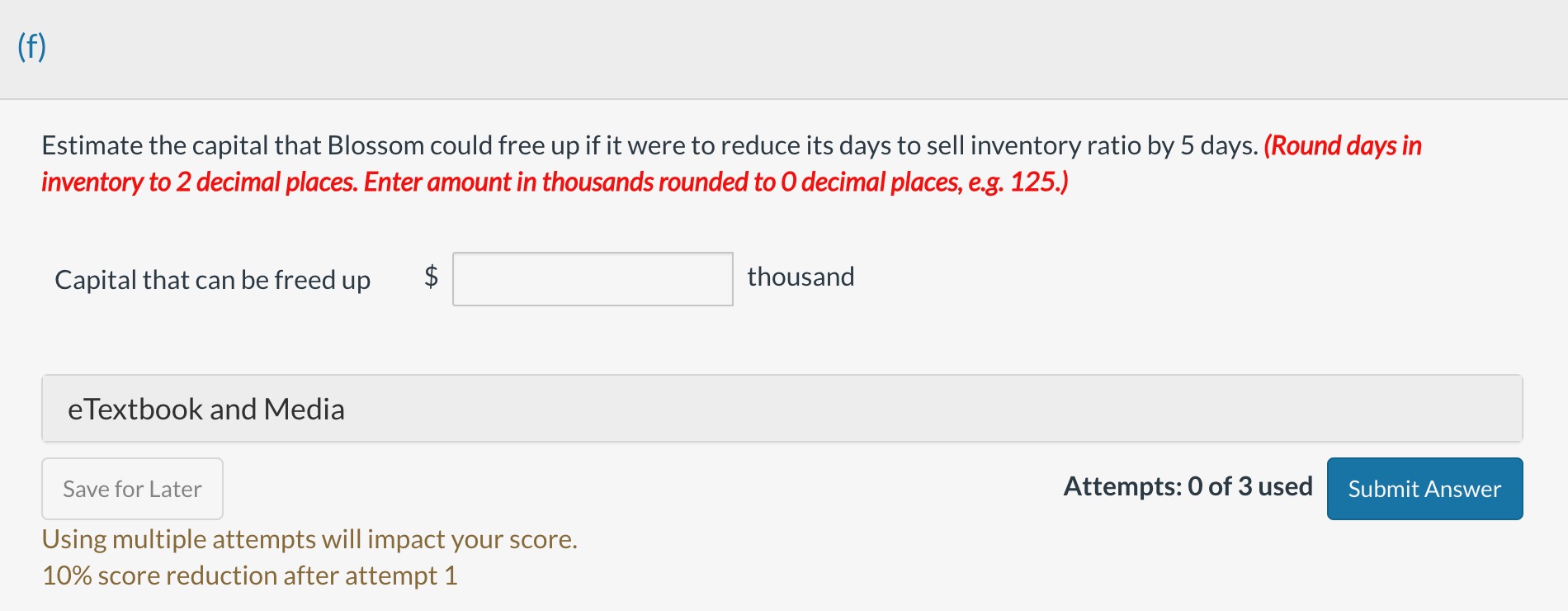

Estimate the capital that Blossom could free up if it were to reduce its days to sell inventory ratio by 5 days. (Round days in

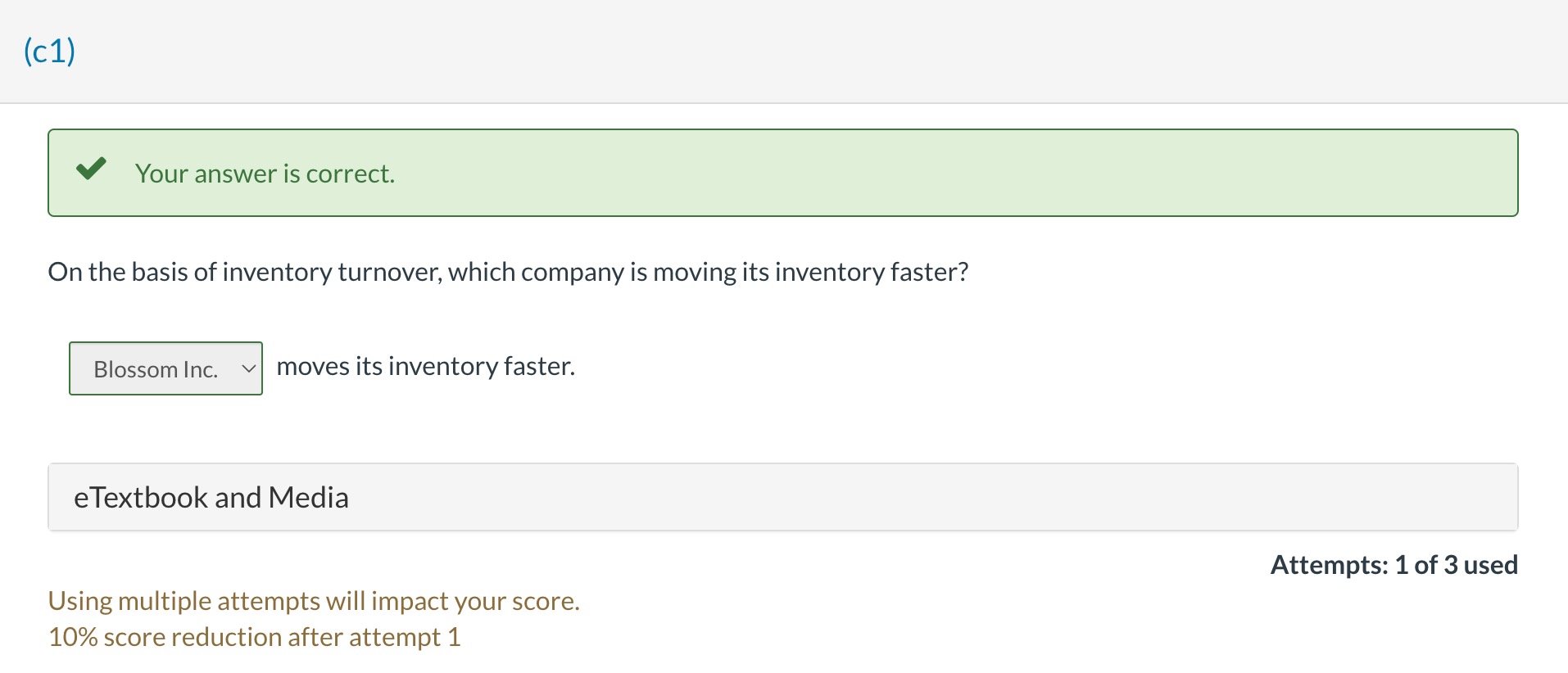

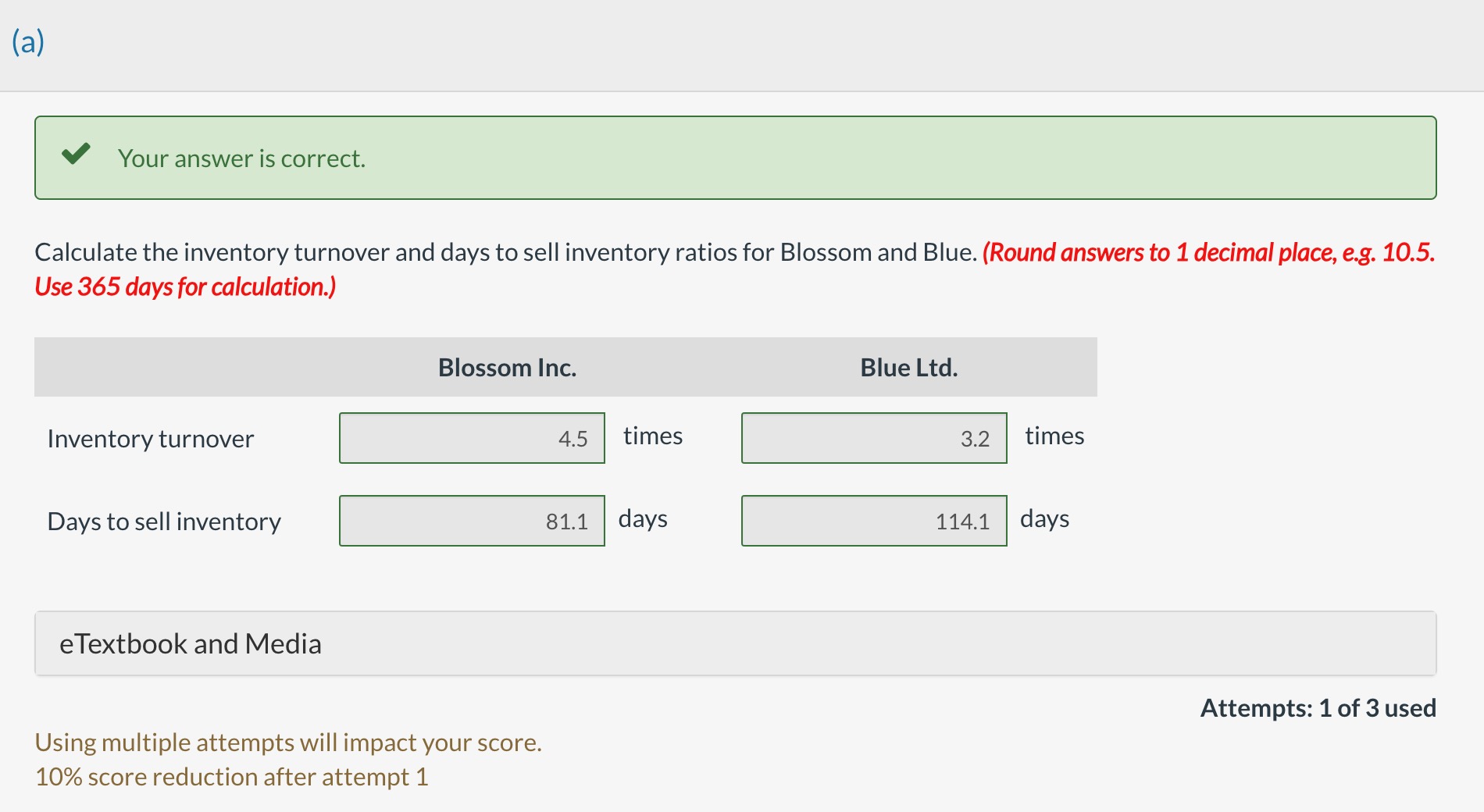

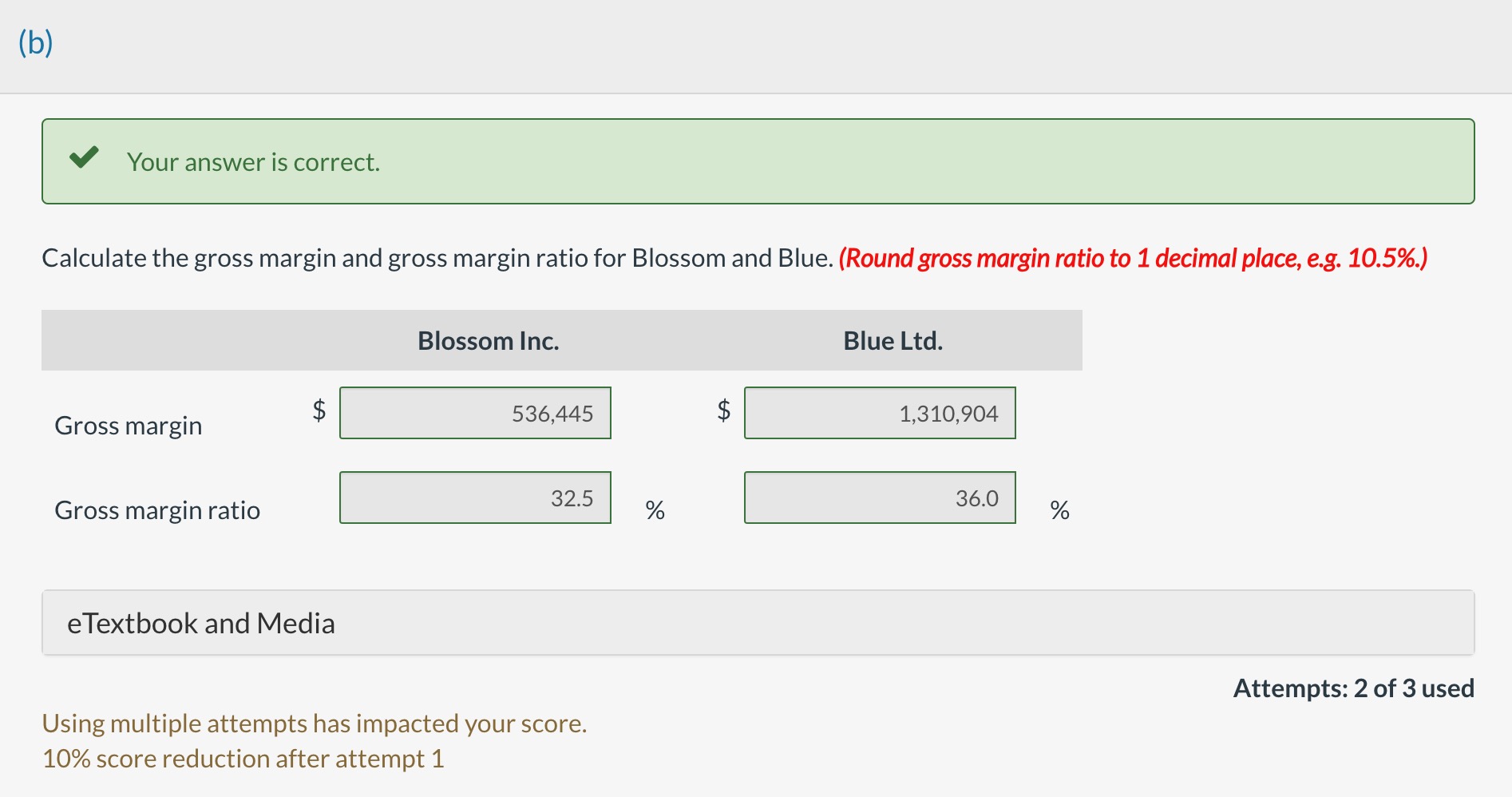

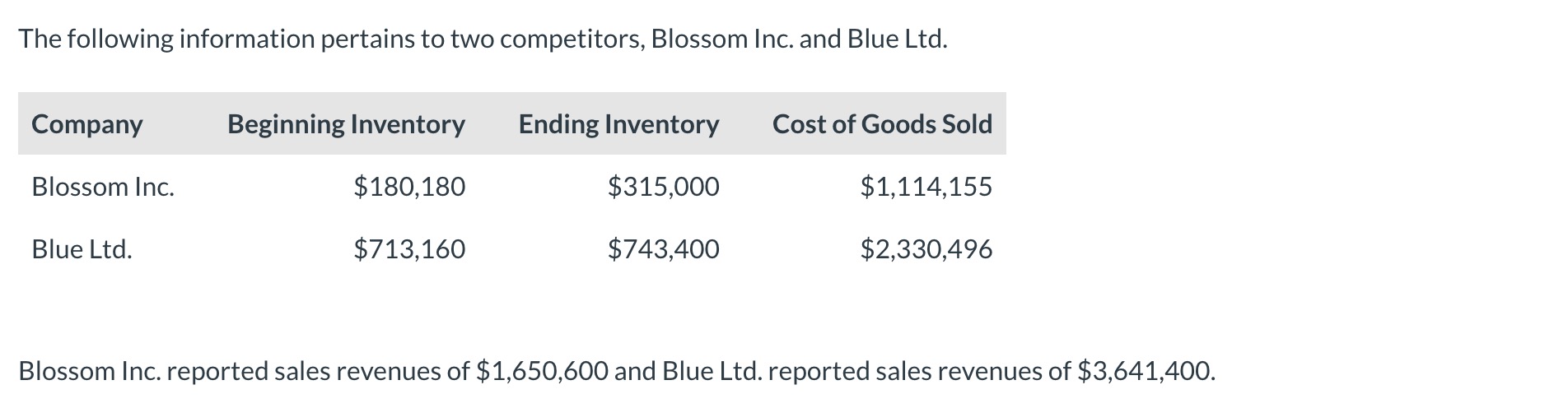

Estimate the capital that Blossom could free up if it were to reduce its days to sell inventory ratio by 5 days. (Round days in inventory to 2 decimal places. Enter amount in thousands rounded to 0 decimal places, e.g. 125.) Capital that can be freed up $ thousand eTextbook and Media Attempts: 0 of 3 used Using multiple attempts will impact your score. 10% score reduction after attempt 1 (b) Your answer is correct. Calculate the gross margin and gross margin ratio for Blossom and Blue. (Round gross margin ratio to 1 decimal place, e.g. 10.5\%.) eTextbook and Media Using multiple attempts has impacted your score. Attempts: 2 of 3 used 10% score reduction after attempt 1 The following information pertains to two competitors, Blossom Inc. and Blue Ltd. Blossom Inc. reported sales revenues of $1,650,600 and Blue Ltd. reported sales revenues of $3,641,400. Your answer is correct. On the basis of inventory turnover, which company is moving its inventory faster? moves its inventory faster. eTextbook and Media Using multiple attempts will impact your score. Attempts: 1 of 3 used 10% score reduction after attempt 1 (a) Your answer is correct. Calculate the inventory turnover and days to sell inventory ratios for Blossom and Blue. (Round answers to 1 decimal place, e.g. 10.5. Use 365 days for calculation.) eTextbook and Media Using multiple attempts will impact your score. Attempts: 1 of 3 used 10% score reduction after attempt 1

Estimate the capital that Blossom could free up if it were to reduce its days to sell inventory ratio by 5 days. (Round days in inventory to 2 decimal places. Enter amount in thousands rounded to 0 decimal places, e.g. 125.) Capital that can be freed up $ thousand eTextbook and Media Attempts: 0 of 3 used Using multiple attempts will impact your score. 10% score reduction after attempt 1 (b) Your answer is correct. Calculate the gross margin and gross margin ratio for Blossom and Blue. (Round gross margin ratio to 1 decimal place, e.g. 10.5\%.) eTextbook and Media Using multiple attempts has impacted your score. Attempts: 2 of 3 used 10% score reduction after attempt 1 The following information pertains to two competitors, Blossom Inc. and Blue Ltd. Blossom Inc. reported sales revenues of $1,650,600 and Blue Ltd. reported sales revenues of $3,641,400. Your answer is correct. On the basis of inventory turnover, which company is moving its inventory faster? moves its inventory faster. eTextbook and Media Using multiple attempts will impact your score. Attempts: 1 of 3 used 10% score reduction after attempt 1 (a) Your answer is correct. Calculate the inventory turnover and days to sell inventory ratios for Blossom and Blue. (Round answers to 1 decimal place, e.g. 10.5. Use 365 days for calculation.) eTextbook and Media Using multiple attempts will impact your score. Attempts: 1 of 3 used 10% score reduction after attempt 1 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started