Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Estimate the cash flows and calculate NPV and profitability ratios of the project? What do you recommend? Calculate the IRR of the project. Based on

- Estimate the cash flows and calculate NPV and profitability ratios of the project? What do you recommend?

- Calculate the IRR of the project. Based on your calculations, what would you recommend? Why?

- Calculate the payback period and discounted payback period. If the companys expected payback period is 4 years, what do you recommend? Why?

- What could the maximum value of cost of capital that makes the company still to accept the project?

- How should the annual interest expense of $250,000 be treated? Explain

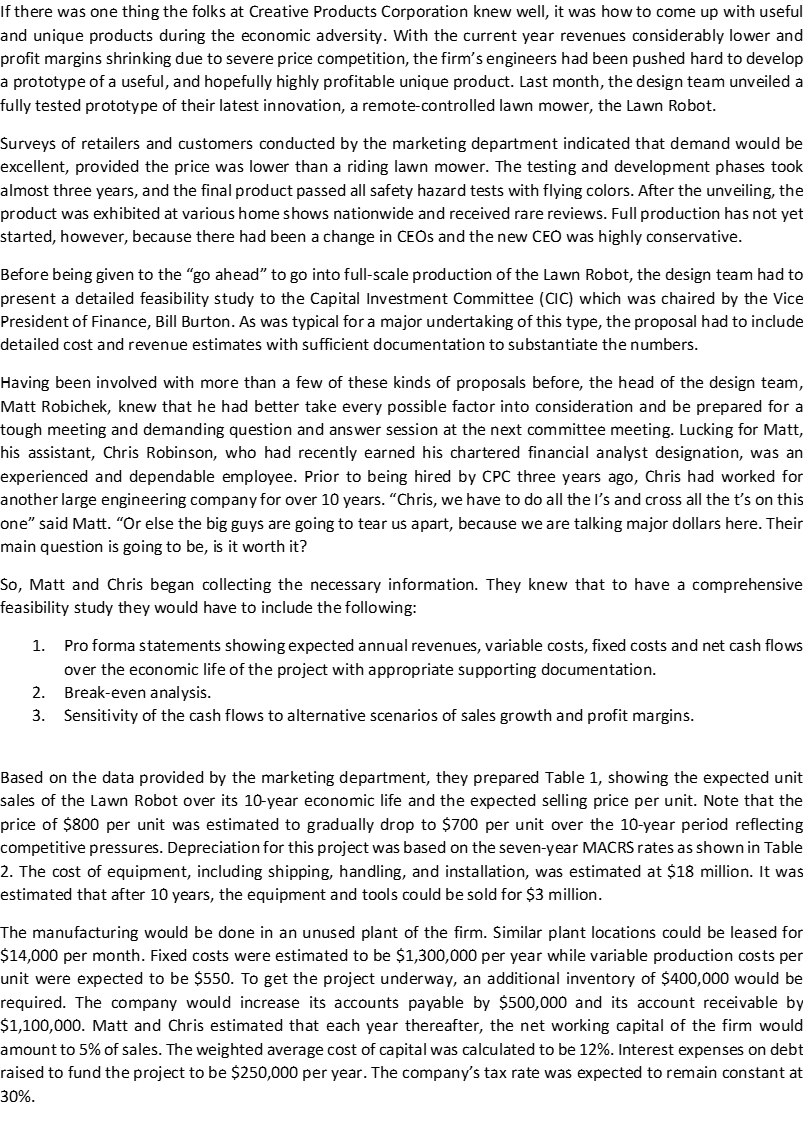

| Projected Unit Sales and Price for Lawn Robot | ||

| Year | Unit Sales | Unit Price |

| 1 | 30,000 | 800 |

| 2 | 34,000 | 800 |

| 3 | 38,800 | 775 |

| 4 | 38,000 | 750 |

| 5 | 36,000 | 725 |

| 6 | 36,000 | 700 |

| 7 | 35,500 | 700 |

| 8 | 35,000 | 700 |

| 9 | 34,500 | 700 |

| 10 | 34,000 | 700 |

| Modified ACRS Depreciation Allowances | ||||

| Year | 3-Year | 5-Year | 7-Year | |

| 1 | 33.33% | 20.00% | 14.29% | |

| 2 | 44.44 | 32 | 24.49% | |

| 3 | 14.82 | 19.2 | 17.49% | |

| 4 | 7.41 | 11.52 | 12.49% | |

| 5 | 11.52 | 8.93% | ||

| 6 | 5.76 | 8.93% | ||

| 7 | 8.93% | |||

| 8 | 4.45% |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started