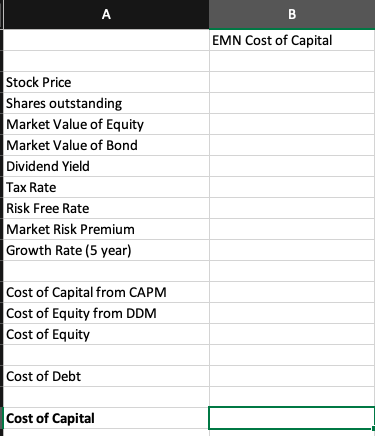

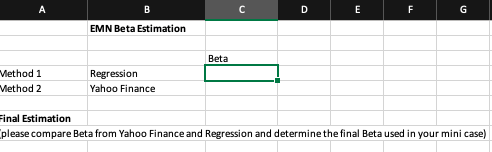

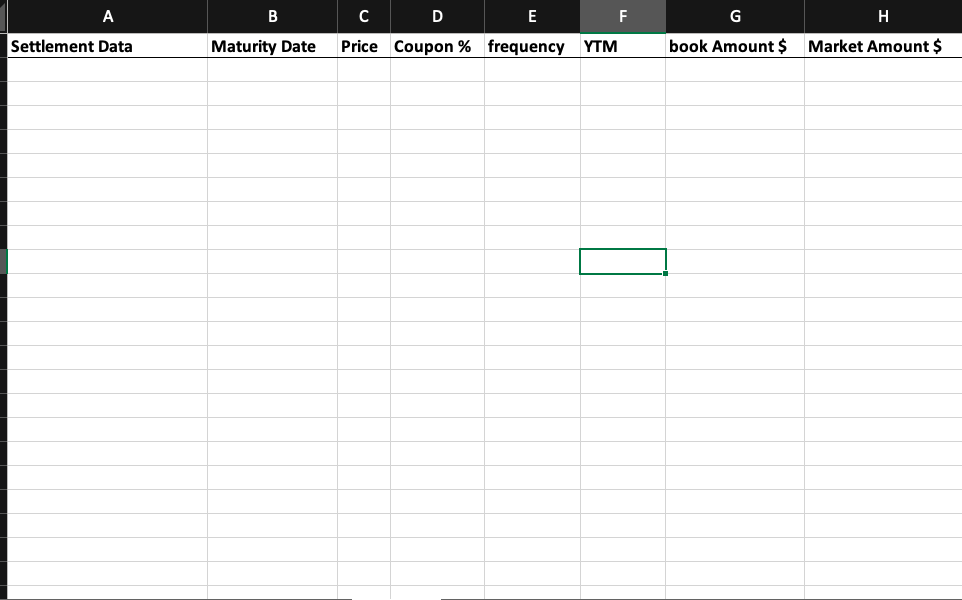

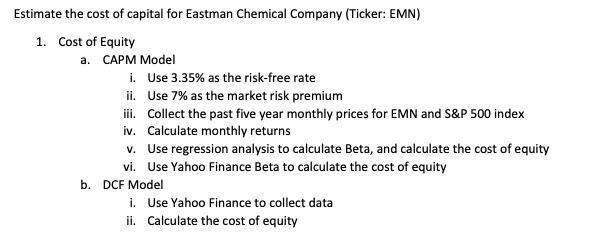

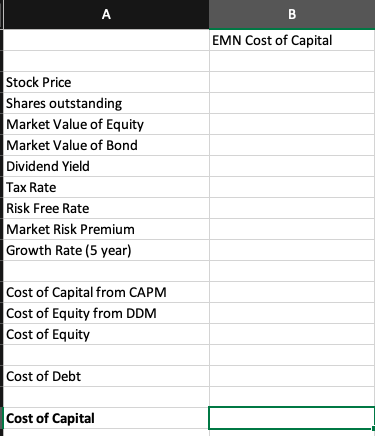

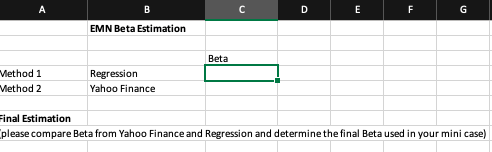

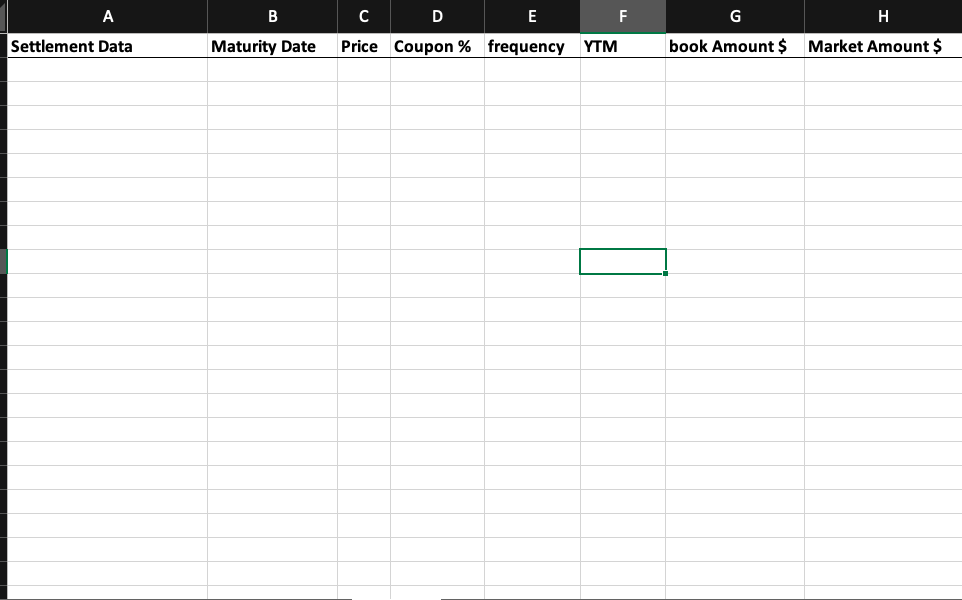

Estimate the cost of capital for Eastman Chemical Company (Ticker: EMN) 1. Cost of Equity a. CAPM Model i. Use 3.35% as the risk-free rate ii. Use 7% as the market risk premium iii. Collect the past five year monthly prices for EMN and S&P 500 index iv. Calculate monthly returns v. Use regression analysis to calculate Beta, and calculate the cost of equity vi. Use Yahoo Finance Beta to calculate the cost of equity b. DCF Model i. Use Yahoo Finance to collect data ii. Calculate the cost of equity A B EMN Cost of Capital Stock Price Shares outstanding Market Value of Equity Market Value of Bond Dividend Yield Tax Rate Risk Free Rate Market Risk Premium Growth Rate (5 year) Cost of Capital from CAPM Cost of Equity from DDM Cost of Equity Cost of Debt Cost of Capital B D E F G EMN Beta Estimation Beta Method 1 Method 2 Regression Yahoo Finance Final Estimation please compare Beta from Yahoo Finance and Regression and determine the final Beta used in your mini case) B C D E F G Settlement Data Maturity Date Price Coupon % frequency YTM book Amount $ Market Amount $ Estimate the cost of capital for Eastman Chemical Company (Ticker: EMN) 1. Cost of Equity a. CAPM Model i. Use 3.35% as the risk-free rate ii. Use 7% as the market risk premium iii. Collect the past five year monthly prices for EMN and S&P 500 index iv. Calculate monthly returns v. Use regression analysis to calculate Beta, and calculate the cost of equity vi. Use Yahoo Finance Beta to calculate the cost of equity b. DCF Model i. Use Yahoo Finance to collect data ii. Calculate the cost of equity A B EMN Cost of Capital Stock Price Shares outstanding Market Value of Equity Market Value of Bond Dividend Yield Tax Rate Risk Free Rate Market Risk Premium Growth Rate (5 year) Cost of Capital from CAPM Cost of Equity from DDM Cost of Equity Cost of Debt Cost of Capital B D E F G EMN Beta Estimation Beta Method 1 Method 2 Regression Yahoo Finance Final Estimation please compare Beta from Yahoo Finance and Regression and determine the final Beta used in your mini case) B C D E F G Settlement Data Maturity Date Price Coupon % frequency YTM book Amount $ Market Amount $