Question

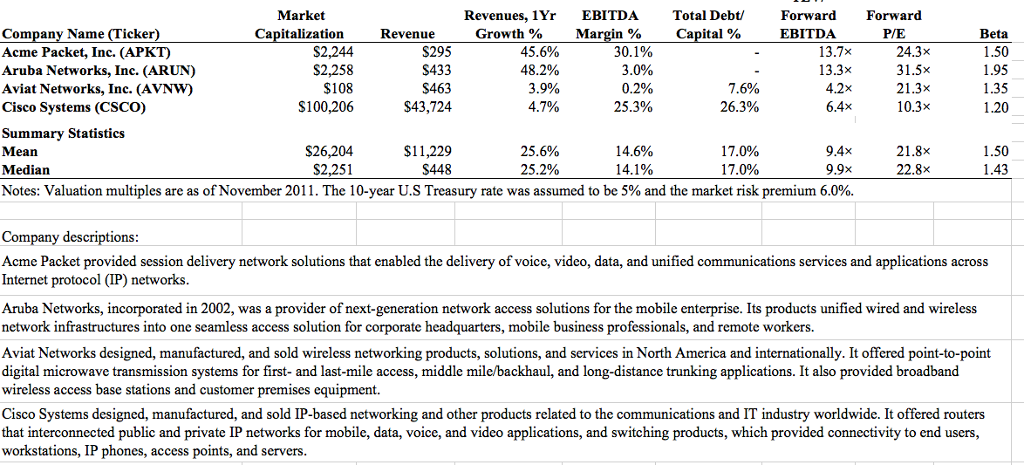

Estimate the cost of equity capital for the DCF valuation using the following assumptions: o Beta: average of the betas for Acme and Aruba o

Estimate the cost of equity capital for the DCF valuation using the following assumptions:

o Beta: average of the betas for Acme and Aruba o Market risk premium: 7.00% (this is an historical average)

o Treasury bill rates:

? Six month: 0.10%

? One year: 0.20%

? Three year: 0.80%

? Five year: 1.50%

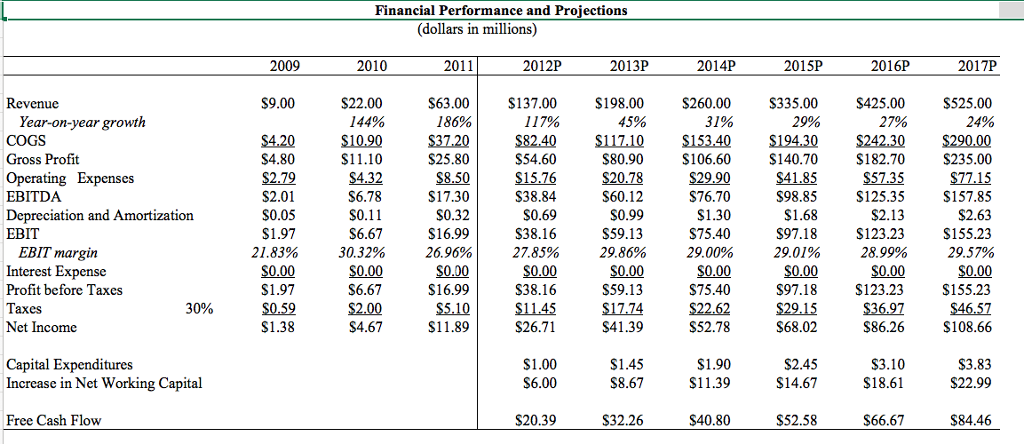

Conduct a valuation of the company and estimate the percentage of shares that the owners would need to offer venture capital investors in exchange for an investment of $30,000,000. Use the net cash flow forecasts provided in the case material and the following assumptions in your analysis:

o Discounted cash flow valuation

? Weighted average cost of capital: cost of equity capital from above calculation

? Horizon growth rate of 5.0%

? Probability of success: 50%

o Venture capital model valuation

? EBITDA multiples: 9.90 (median value) and 9.40 (mean value)

? Venture capital required rate of return of 50%

? ? Liquidity discount of 30%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started