Answered step by step

Verified Expert Solution

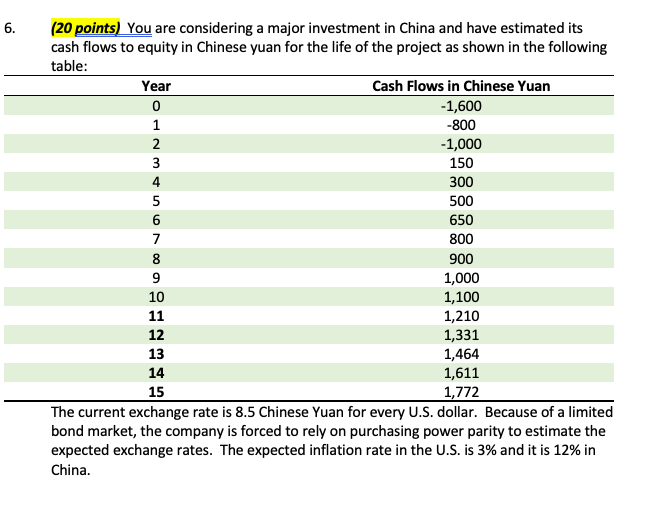

Question

1 Approved Answer

Estimate the expected cash flows in U.S. dollars Assume the cost of capital is 10% for U.S. projects. China is rated BBB by the rating

- Estimate the expected cash flows in U.S. dollars

- Assume the cost of capital is 10% for U.S. projects. China is rated BBB by the rating agencies and BBB bonds trade at 3.5% above U.S. treasury bonds. Chinese equities are twice as volatile as Chinese bonds. What would you use as the discount rate for the Chinese project? (Assume that you cannot diversify the Chinese risk.)

- Calculate the net present value of the project

- An analyst looks at your analysis and argues that it should be done entirely in the foreign currency rather than U.S. dollars. How would you respond?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started