Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Estimate the income elasticity of revenue for the motor vehicle fuel tax and evaluate the long run growth potential of the tax. Examine the years

Estimate the income elasticity of revenue for the motor vehicle fuel tax and evaluate the long run growth potential of the tax.

Examine the years when the motor vehicle fuel tax rate was increased and estimate the tax rate elasticity of motor fuel tax revenue. Provide an interpretation the tax rate elasticities you compute.

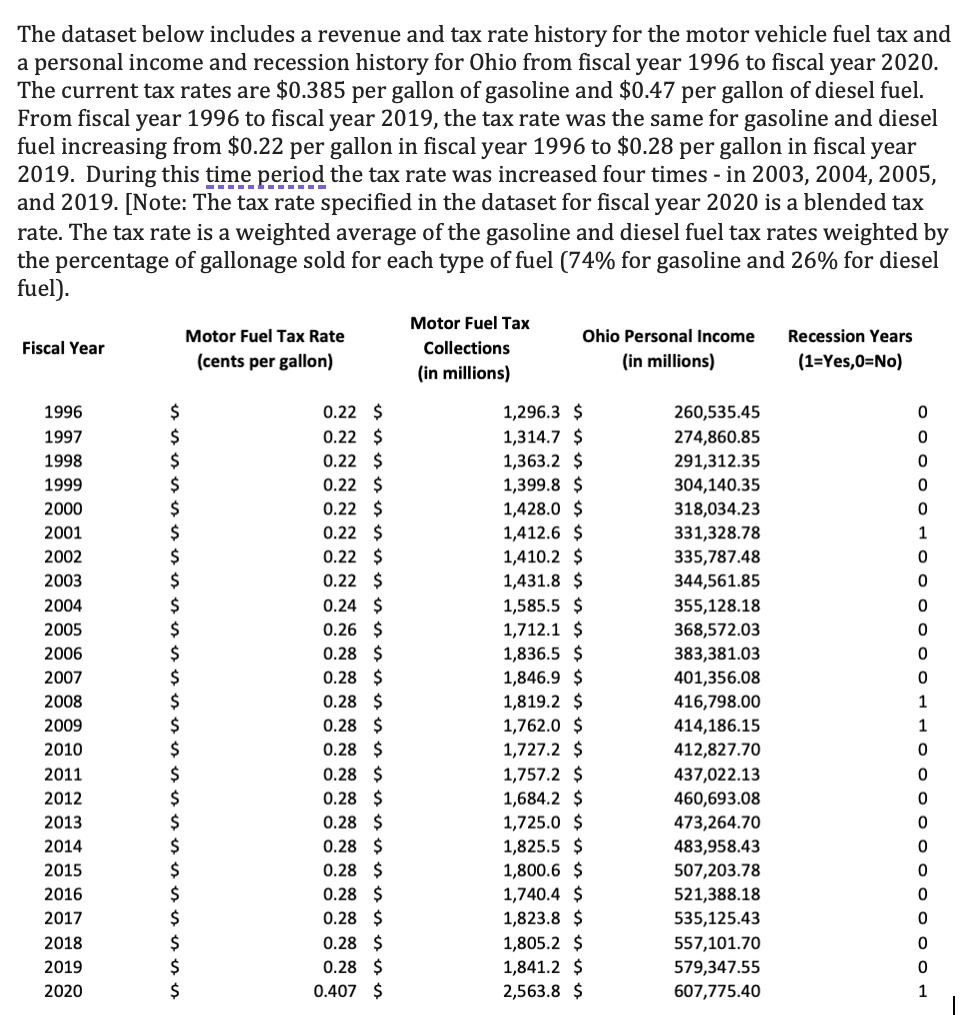

The dataset below includes a revenue and tax rate history for the motor vehicle fuel tax and a personal income and recession history for Ohio from fiscal year 1996 to fiscal year 2020. The current tax rates are $0.385 per gallon of gasoline and $0.47 per gallon of diesel fuel. From fiscal year 1996 to fiscal year 2019, the tax rate was the same for gasoline and diesel fuel increasing from $0.22 per gallon in fiscal year 1996 to $0.28 per gallon in fiscal year 2019. During this time period the tax rate was increased four times - in 2003, 2004, 2005, and 2019. [Note: The tax rate specified in the dataset for fiscal year 2020 is a blended tax rate. The tax rate is a weighted average of the gasoline and diesel fuel tax rates weighted by the percentage of gallonage sold for each type of fuel (74% for gasoline and 26% for diesel fuel). Fiscal Year 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ Motor Fuel Tax Rate (cents per gallon) 0.22 $ 0.22 $ 0.22 $ 0.22 $ 0.22 $ 0.22 $ 0.22 $ 0.22 $ 0.24 $ 0.26 $ 0.28 $ 0.28 $ 0.28 $ 0.28 $ 0.28 $ 0.28 $ 0.28 $ 0.28 $ 0.28 $ 0.28 $ 0.28 $ 0.28 $ 0.28 $ 0.28 $ 0.407 $ Motor Fuel Tax Collections (in millions) 1,296.3 $ 1,314.7 $ 1,363.2 $ 1,399.8 $ 1,428.0 $ Ohio Personal Income Recession Years (in millions) (1=Yes,0=No) 1,412.6 $ 1,410.2 $ 1,431.8 $ 1,585.5 $ 1,712.1 $ 1,836.5 $ 1,846.9 $ 1,819.2 $ 1,762.0 $ 1,727.2 $ 1,757.2 $ 1,684.2 $ 1,725.0 $ 1,825.5 $ 1,800.6 $ 1,740.4 $ 1,823.8 $ 1,805.2 $ 1,841.2 $ 2,563.8 $ 260,535.45 274,860.85 291,312.35 304,140.35 318,034.23 331,328.78 335,787.48 344,561.85 355,128.18 368,572.03 383,381.03 401,356.08 416,798.00 414,186.15 412,827.70 437,022.13 460,693.08 473,264.70 483,958.43 507,203.78 521,388.18 535,125.43 557,101.70 579,347.55 607,775.40 0 0 0 0 0 1 0 0 0 0 0 0 1 1 0 0 0 0 0 0 0 0 0 0 1 I

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Here are the steps to analyze the longrun growth potential of Ohios motor vehicle fuel tax 1 Estimat...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started