Answered step by step

Verified Expert Solution

Question

1 Approved Answer

How much debt does the issuer have? Has the debt level changed over the past three years? Can the increase/decrease in debt level affect their

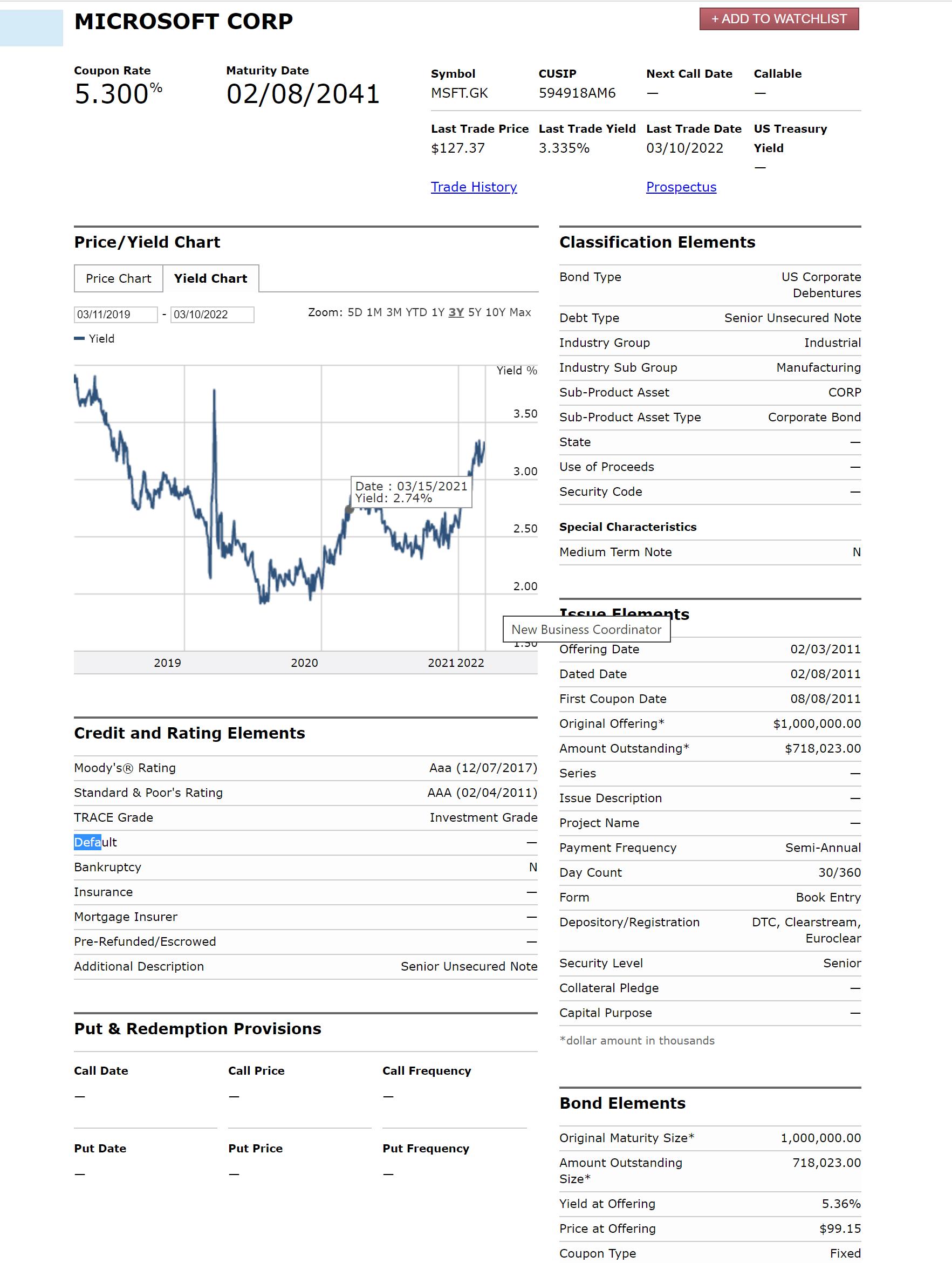

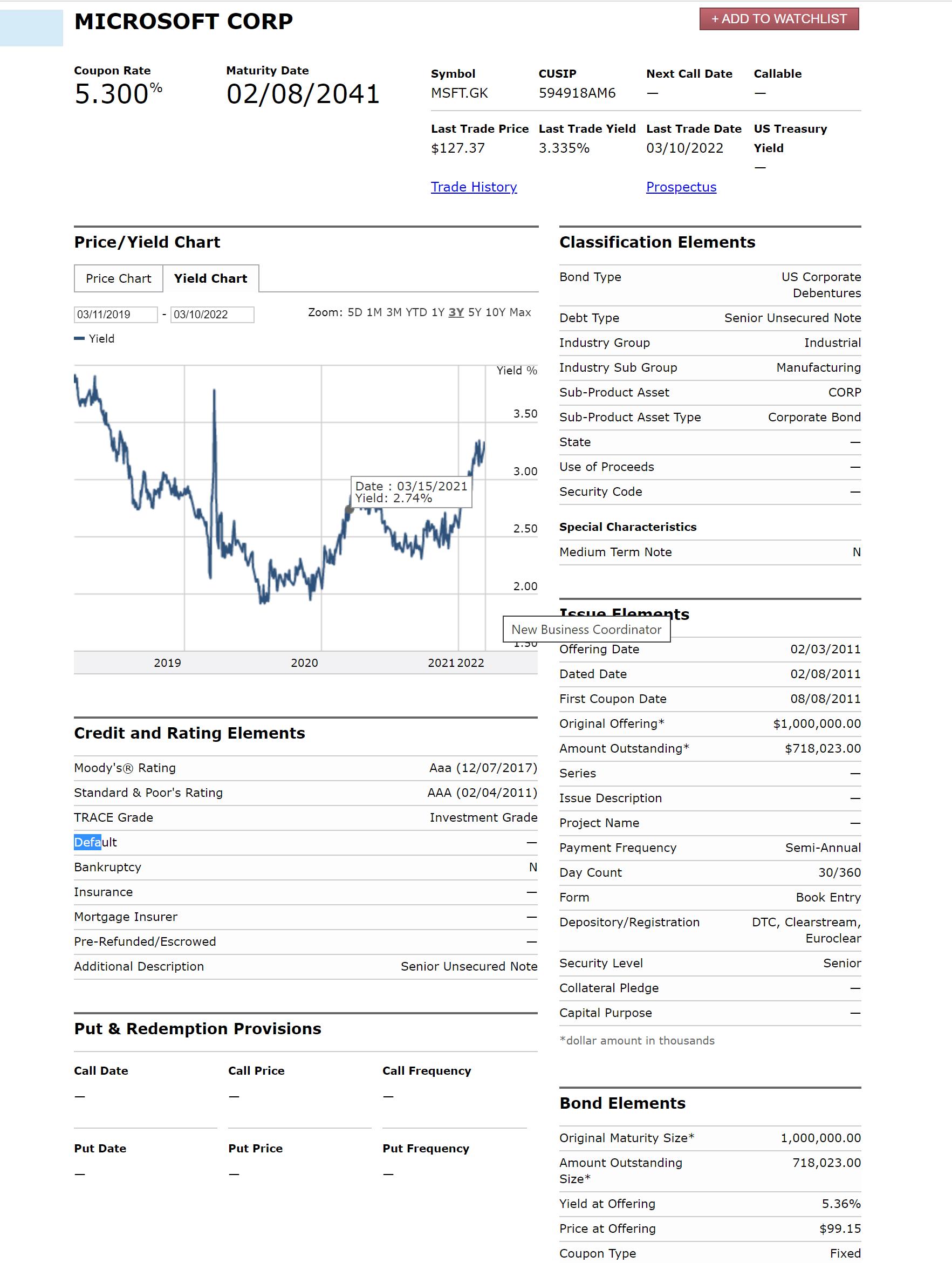

How much debt does the issuer have? Has the debt level changed over the past three years? Can the increase/decrease in debt level affect their credit rating? Provide a graph that shows the debt level over the past three years.

b. What is the bond's ratings? What does the rating indicate about default risk?

2) a. What is the coupon payment frequency and how much interest (in dollar amount) does the bond pay each period?

b. Why is the bond a good investment based on group risk profile? Include following points: Issuers debt ratio relative to their industry, Price risk, Reinvestment risk.

MICROSOFT CORP Coupon Rate 5.300% Price/Yield Chart Price Chart Yield Chart 03/11/2019 - Yield Maturity Date 02/08/2041 - 03/10/2022 2019 Additional Description Call Date Credit and Rating Elements Moody's Rating Standard & Poor's Rating TRACE Grade Default Bankruptcy Insurance Mortgage Insurer Pre-Refunded/Escrowed Put Date Put & Redemption Provisions Call Price 2020 Put Price Symbol MSFT.GK Zoom: 5D 1M 3M YTD 1Y 3Y 5Y 10Y Max Trade History. Date : 03/15/2021 Yield: 2.74% Last Trade Price Last Trade Yield Last Trade Date $127.37 3.335% 03/10/2022 2021 2022 Yield % 3.50 Call Frequency 3.00 Put Frequency 2.50 2.00 Aaa (12/07/2017) AAA (02/04/2011) Investment Grade Senior Unsecured Note CUSIP N 594918AM6 Bond Type Next Call Date Issue Elements New Business Coordinator Offering Date Dated Date 1.50 First Coupon Date Original Offering* Amount Outstanding* Series Issue Description Project Name Payment Frequency Prospectus Debt Type Industry Group Industry Sub Group Sub-Product Asset Sub-Product Asset Type Classification Elements State Use of Proceeds Security Code Special Characteristics Medium Term Note Day Count Form + ADD TO WATCHLIST Depository/Registration Security Level Collateral Pledge Capital Purpose *dollar amount in thousands Bond Elements Original Maturity Size* Amount Outstanding Size* Yield at Offering Price at Offering Coupon Type Callable US Treasury Yield US Corporate Debentures Senior Unsecured Note Industrial Manufacturing CORP Corporate Bond N 02/03/2011 02/08/2011 08/08/2011 $1,000,000.00 $718,023.00 Semi-Annual 30/360 Book Entry DTC, Clearstream, Euroclear Senior 1,000,000.00 718,023.00 5.36% $99.15 Fixed

Step by Step Solution

★★★★★

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Debt Level Analysis a Debt Level and Changes Based on the information provided it is not possible to determine the issuers debt level and how it has changed over the past three years The available dat...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started