Question

Estimate the incremental after-tax operating cash flows each year for the life of the project. Show your calculations. If using Excel, post an image of

Estimate the incremental after-tax operating cash flows each year for the life of the project. Show your calculations. If using Excel, post an image of the spreadsheet section used to make your calculations.

Question 11

What is the Net Present Value (NPV) of this toy business investment? Show your calculations. If using Excel, post an image of your spreadsheet that shows your calculations.

Question 12

Assume that the new toy business will generate side benefits for the television business, increasing after-tax cash flows from that business by $7.5 million/year, each year for the next 3 years. What effect does this have on your Net Present Value (NPV)? Show your calculations.

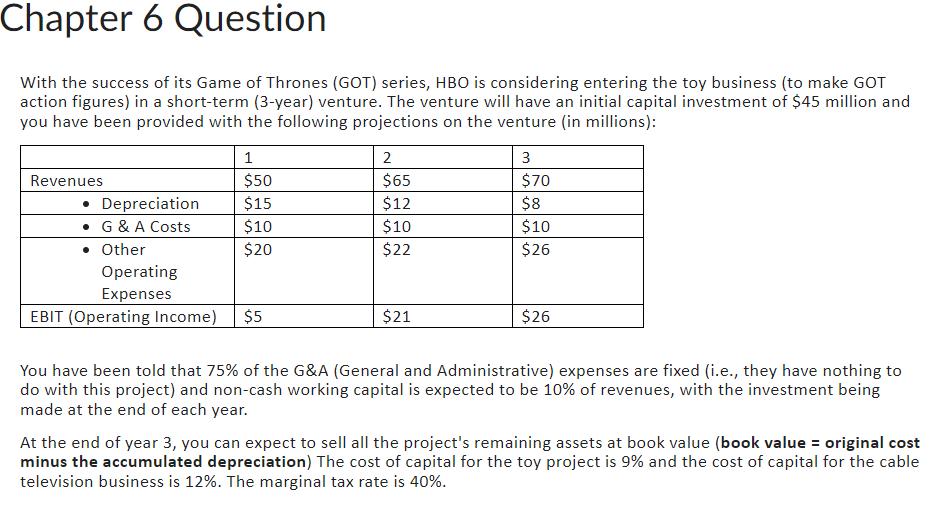

Chapter 6 Question With the success of its Game of Thrones (GOT) series, HBO is considering entering the toy business (to make GOT action figures) in a short-term (3-year) venture. The venture will have an initial capital investment of $45 million and you have been provided with the following projections on the venture (in millions): Revenues Depreciation . G & A Costs Other 1 $50 $15 $10 $20 Operating Expenses EBIT (Operating Income) $5 2 $65 $12 $10 $22 $21 3 $70 $8 $10 $26 $26 You have been told that 75% of the G&A (General and Administrative) expenses are fixed (i.e., they have nothing to do with this project) and non-cash working capital is expected to be 10% of revenues, with the investment being made at the end of each year. At the end of year 3, you can expect to sell all the project's remaining assets at book value (book value = original cost minus the accumulated depreciation) The cost of capital for the toy project is 9% and the cost of capital for the cable television business is 12%. The marginal tax rate is 40%.

Step by Step Solution

3.37 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started