Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Estimate the most current Cost of Debt and Total Market Value of Debt of Walmart Inc (ticker: WMT). Suggested sources of the data: 1. SEC's

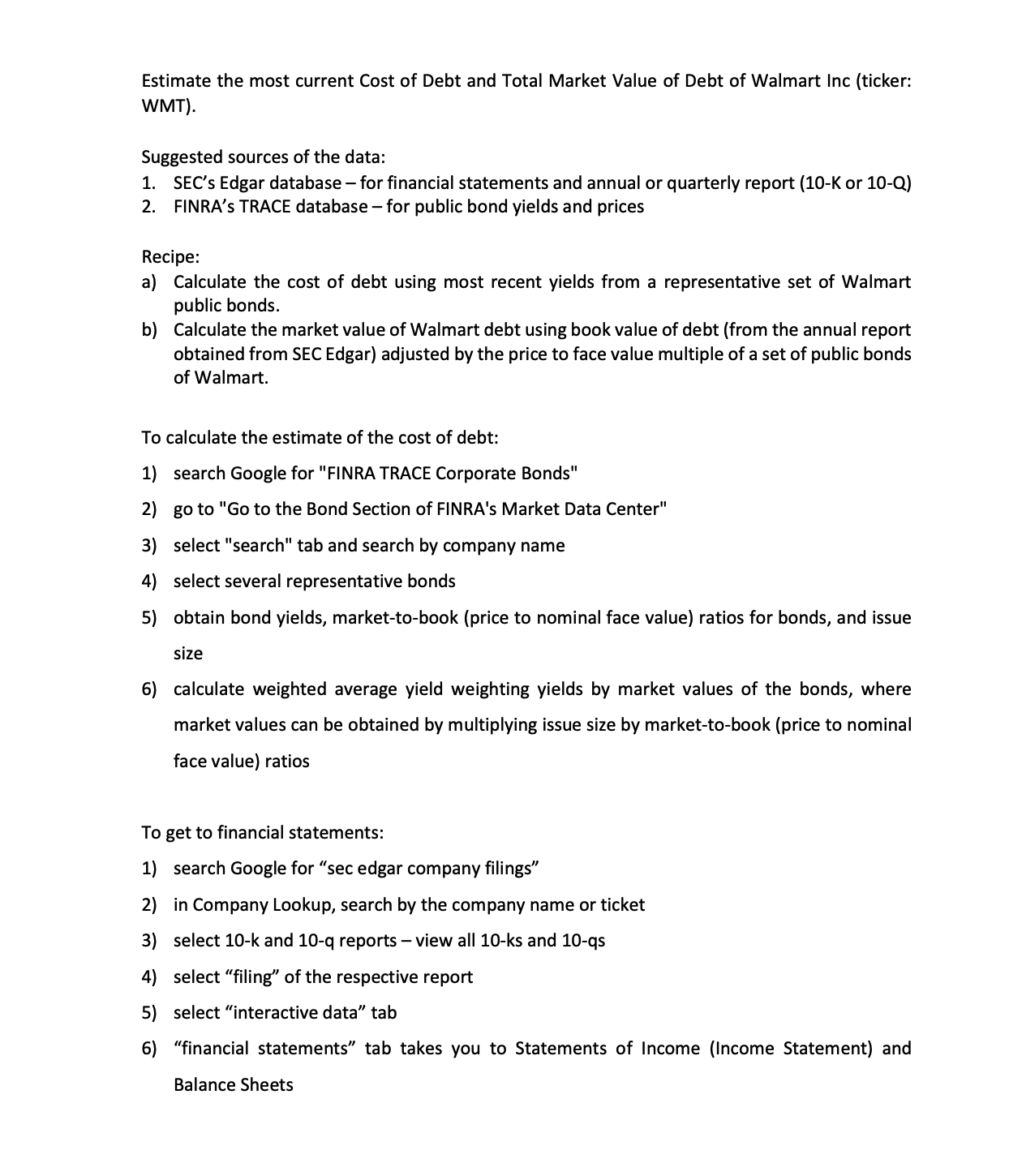

Estimate the most current Cost of Debt and Total Market Value of Debt of Walmart Inc (ticker: WMT). Suggested sources of the data: 1. SEC's Edgar database - for financial statements and annual or quarterly report (10-K or 10-Q) 2. FINRA's TRACE database - for public bond yields and prices Recipe: a) Calculate the cost of debt using most recent yields from a representative set of Walmart public bonds. b) Calculate the market value of Walmart debt using book value of debt (from the annual report obtained from SEC Edgar) adjusted by the price to face value multiple of a set of public bonds of Walmart. To calculate the estimate of the cost of debt: 1) search Google for "FINRA TRACE Corporate Bonds" 2) go to "Go to the Bond Section of FINRA's Market Data Center" 3) select "search" tab and search by company name 4) select several representative bonds 5) obtain bond yields, market-to-book (price to nominal face value) ratios for bonds, and issue size 6) calculate weighted average yield weighting yields by market values of the bonds, where market values can be obtained by multiplying issue size by market-to-book (price to nominal face value) ratios To get to financial statements: 1) search Google for "sec edgar company filings" 2) in Company Lookup, search by the company name or ticket 3) select 10-k and 10-q reports - view all 10-ks and 10-qs 4) select "filing" of the respective report 5) select "interactive data" tab 6) "financial statements" tab takes you to Statements of Income (Income Statement) and Balance Sheets

Estimate the most current Cost of Debt and Total Market Value of Debt of Walmart Inc (ticker: WMT). Suggested sources of the data: 1. SEC's Edgar database - for financial statements and annual or quarterly report (10-K or 10-Q) 2. FINRA's TRACE database - for public bond yields and prices Recipe: a) Calculate the cost of debt using most recent yields from a representative set of Walmart public bonds. b) Calculate the market value of Walmart debt using book value of debt (from the annual report obtained from SEC Edgar) adjusted by the price to face value multiple of a set of public bonds of Walmart. To calculate the estimate of the cost of debt: 1) search Google for "FINRA TRACE Corporate Bonds" 2) go to "Go to the Bond Section of FINRA's Market Data Center" 3) select "search" tab and search by company name 4) select several representative bonds 5) obtain bond yields, market-to-book (price to nominal face value) ratios for bonds, and issue size 6) calculate weighted average yield weighting yields by market values of the bonds, where market values can be obtained by multiplying issue size by market-to-book (price to nominal face value) ratios To get to financial statements: 1) search Google for "sec edgar company filings" 2) in Company Lookup, search by the company name or ticket 3) select 10-k and 10-q reports - view all 10-ks and 10-qs 4) select "filing" of the respective report 5) select "interactive data" tab 6) "financial statements" tab takes you to Statements of Income (Income Statement) and Balance Sheets Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started