Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Homemade Delight (Pty) Ltd is a bakery that sells a variety of baked goods. The company has a December year-end. Mr. Baker started the

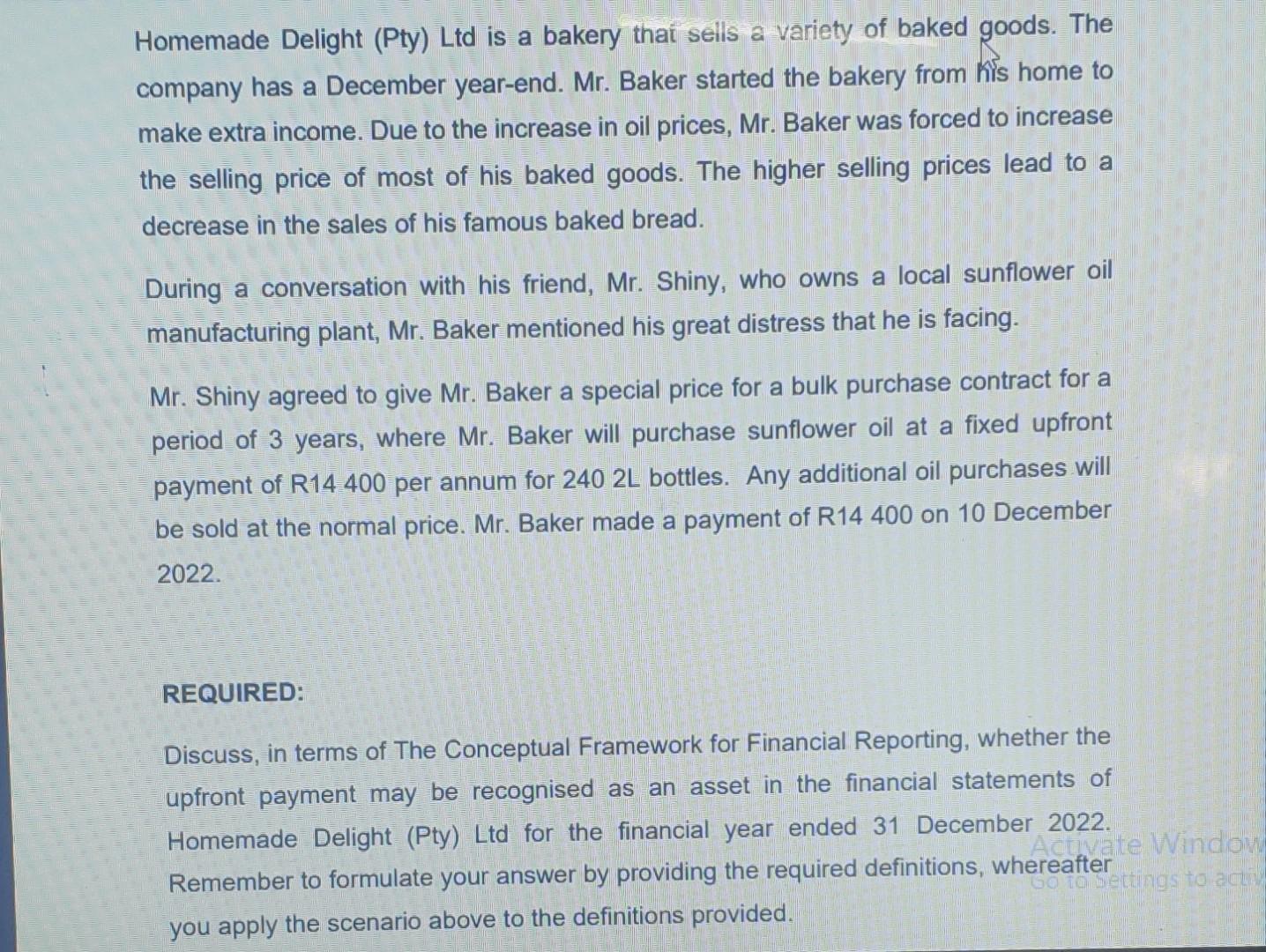

Homemade Delight (Pty) Ltd is a bakery that sells a variety of baked goods. The company has a December year-end. Mr. Baker started the bakery from his home to make extra income. Due to the increase in oil prices, Mr. Baker was forced to increase the selling price of most of his baked goods. The higher selling prices lead to a decrease in the sales of his famous baked bread. During a conversation with his friend, Mr. Shiny, who owns a local sunflower oil manufacturing plant, Mr. Baker mentioned his great distress that he is facing. Mr. Shiny agreed to give Mr. Baker a special price for a bulk purchase contract for a period of 3 years, where Mr. Baker will purchase sunflower oil at a fixed upfront payment of R14 400 per annum for 240 2L bottles. Any additional oil purchases will be sold at the normal price. Mr. Baker made a payment of R14 400 on 10 December 2022. REQUIRED: Discuss, in terms of The Conceptual Framework for Financial Reporting, whether the upfront payment may be recognised as an asset in the financial statements of Homemade Delight (Pty) Ltd for the financial year ended 31 December 2022. Remember to formulate your answer by providing the required definitions, whereafter you apply the scenario above to the definitions provided. Activate Window Go to bettings to activ

Step by Step Solution

★★★★★

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

The Conceptual Framework for Financial Reporting provides guidance on the recognition measurement and disclosure of assets in the financial statements ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started