Question

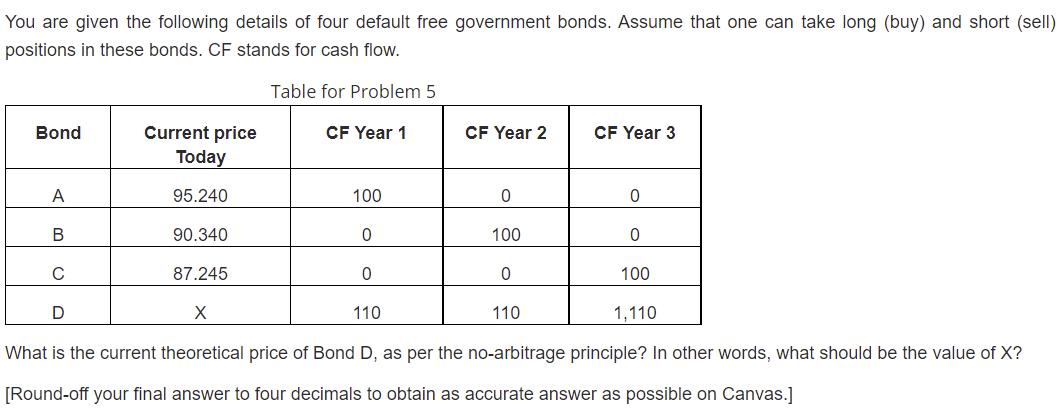

You are given the following details of four default free government bonds. Assume that one can take long (buy) and short (sell) positions in

You are given the following details of four default free government bonds. Assume that one can take long (buy) and short (sell) positions in these bonds. CF stands for cash flow. Bond Current price Today 95.240 90.340 87.245 X 110 What is the current theoretical price of Bond D, as per the no-arbitrage principle? In other words, what should be the value of X? [Round-off your final answer to four decimals to obtain as accurate answer as possible on Canvas.] A B C Table for Problem 5 D CF Year 1 100 0 0 110 CF Year 2 0 100 0 CF Year 3 0 0 100 1,110

Step by Step Solution

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Price of Bond D Bond D has Bond D Cf si...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Physics

Authors: Jearl Walker, Halliday Resnick

8th Extended edition

471758019, 978-0471758013

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App