Answered step by step

Verified Expert Solution

Question

1 Approved Answer

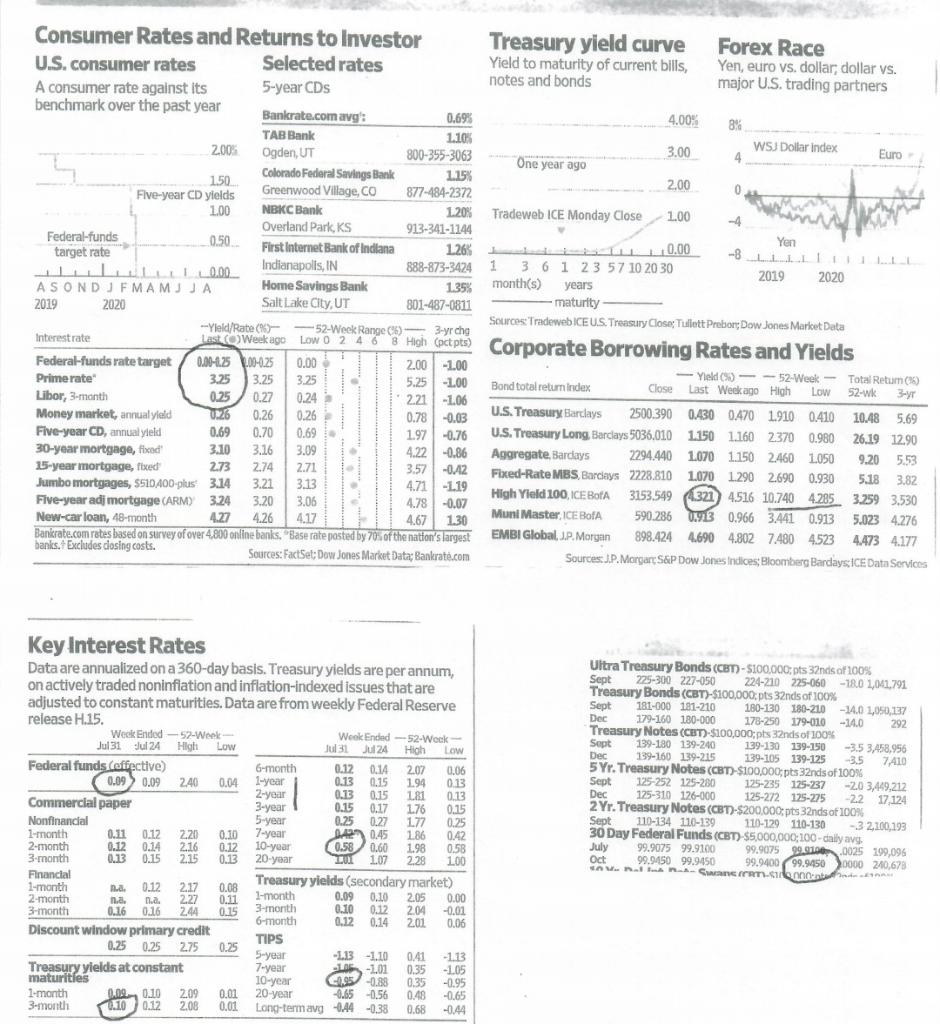

Estimate the probability the U.S. will remain in a recession next year by application of a model developed by researchers at the Federal Reserve. The

Estimate the probability the U.S. will remain in a recession next year by application of a model developed by researchers at the Federal Reserve. The formula follows: p = NORMSDIST (-.6045 - .7374* Spread). The spread is the percentage difference in yield between 10-year U.S. Treasury notes @ 1.57% and 3-month U.S. Treasury bills @ 0.04%.

0 0.00 2020 Consumer Rates and Returns to Investor Treasury yield curve Forex Race U.S. consumer rates Selected rates Yield to maturity of current bills, Yen, euro vs. dollar, dollar vs. notes and bonds A consumer rate against its 5-year CDs major U.S. trading partners benchmark over the past year Bankrate.com avg': 0.69% 4.00% 8% TAB Bank 1.105 2.00% WSJ Dollar index Ogden, UT 800-355-3063 3.00 4 Euro "One year ago 1.50 Colorado Federal Savings Bank 1.15% 2.00 Five-year CD yields Greenwood Village, CO 877-484-2372 1.00 NBKC Bank 120% Tradeweb ICE Monday Close 1.00 -4 Overland Park, KS 913-341-1144 Federal-funds 0.50 Yen First Internet Bank of Indiana target rate 1266 LLLLLLL 0.00 Indianapolis, IN 888-873-3424 1 3 6 1 23 57 10 20 30 2019 AS ONDJ FMAMJJA Home Savings Bank 1.35% month(s) years 2019 2020 Salt Lake City, UT 801-487-0811 - maturity Sources Tradeweb ICEUS Treasury Close; Tullett Prebon: Dow Jones Market Data -Yield/Rate (6) -52-Week Range (6) - 3-yr cho : Interestrate Le Wek ago Low O 2 4 6 8 High (pict pts) Corporate Borrowing Rates and Yields Federal-funds rate target 0.00-6.35 0.00-0.25 0.00 2.00 -1.00 Prime rate 3.25 3.25 Yield() -- 52-Week - Total Return (6) 3.25 5.25 -1.00 Bond total return Index Close Last Week ago High Low 52-wk 3-yr Libor, 3-month 0.25 0.27 0.24 221 -1.06 Money market, annual yold 0.26 0.26 0.26 0.78 -0.03 U.S. Treasury Barclays 2500.390 0430 0470 1.910 0410 1048 5.69 Five-year CD, annual yield 0.69 0.70 0.69 1.97 -0.76 U.S. Treasury Long, Barclays 5036.010 1150 1.160 2370 0.980 26.19 12.90 30-year mortgage, fired! 3.10 3.16 3.09 4.22 -0.86 Aggregate Bardays 2294.440 1070 1.150 2460 1.050 9.20 5.53 35-year mortgage, fixed 2.73 2.74 2.71 3.57 -042 Fixed-Rate MBS, Barclays 2228.810 1.070 1.290 2.690 0.930 5.18 3.82 Jumbo mortgages, 5510400-plus! 3.14 3.21 3.13 4.71 1.19 High Yield 100, ICE BoA 3153549 321 4516 10.740 4285 3.259 3.530 Five-year adj mortgage (ARM) 3.24 3.20 3.06 4.78 -0.07 New-car loan, 48-month 4.27 4.26 4.17 4.67 1.30 Muni Master ICE BofA 590.286 093 0.966 3.441 0.913 5.023 4.276 Bankrate.com rates based on survey of over 4,800 online banks. "Base rate posted by 705 of the nation's largest EMBI Global, J.P. Morgan 898.424 4.690 4.802 7.480 45234473 4.177 banks. Excludes closing costs. Sources: FactSet: Dow Jones Market Data: Bankrate.com Sources: J.P. Margar S&P Dow Jones Indices Bloomberg Bardays ICE Data Services Key Interest Rates Data are annualized on a 360-day basis. Treasury yields are per annum, on actively traded noninflation and inflation-indexed issues that are adjusted to constant maturities. Data are from weekly Federal Reserve release H.15. WeekEnded --- 52-Week WeekEnded-52-Week- Jul 31 Jul 24 Hight Low Jul 31 Jul 24 High Low Federal funds (effective) 6-month 0.12 0.14 2.07 0,06 0.09 0.09 240 0.04 1-year 0.13 0.15 194 0.13 2-year Commercial paper 0.13 015 181 0.13 3-year 0.15 0.17 176 0.15 Nonfinancial 5-year 0.25 0.22 177 0.25 1-month 0.11 0.12 2220 0.10 7-year DAP045 186 0.42 0.12 0.14 216 0.12 10-year 0.58 0.60 1.98 0.58 3 month 0.13 0.15 2215 0.13 20-year 21 1.07 2.29 100 Financial 1-month Treasury yields (secondary market) ma 0.12 217 0.08 2-month na. na. 2.27 0.11 1-month 0.09 0.10 2.05 0.00 3-month 3 0.16 0.16 244 0.15 3-month 0.10 0.12 2.04 -0.01 6-month 0.12 0.14 Discount window primary credit 201 0.06 TIPS 0.25 0.25 2.75 0.25 5-year -2.13 -1.10 0.41 -113 Treasury yields at constant 7-year 0.35 -105 maturities 10-year C095 -0.88 0.35 -0.95 1-month 0.09 0.10 2.09 0.01 20 year -9.65 -0.56 0.48 -0.65 3- month 0.100.12 2.08 0.01 Long-term avg -0,44 -0.38 0.68 -0.44 Ultra Treasury Bonds (CBT)-$100,000: pts 32nds of 100% Sept 225-300 227-050 224-210 225-060-18.0 1,041.791 Treasury Bonds (CBT)-$100,000: pts 32nds of 100% Sept 181-000 181-210 180-130 180-210-14.0 1,050,137 Dec 179-160 180-000 178-250 179-010-14.0 292 Treasury Notes (CBT)-$100,000;pts 32nds of 100% Sept 139-180 139-240 139-130 139-150 -3.5 3,458,956 Dec 139-160 139-215 139-105 139-125 -3.5 7.410 5 Yr. Treasury Notes (CBT)-$100,000; pts 32nds of 100% Sept 125-252 125-280 125-235125-237 -20 3,449,212 Dec 125-310 126-000 125-272 125-275 -22 17.124 2 Yr. Treasury Notes (CBT)-$200,000:pts 32nds of 100% Sept 110-134 110-139 110-120 110-130 -3 2,200,193 30 Day Federal Funds (CBT)-$5,000,000;100-cally avs July 99.9075 99.9100 99.9075 99.9.190.0025 199,096 Oct 99.9450 99.9450 99.9400 99.94500000 240,678 CARA CRT.com 2-month 10-201Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started