Estimate the project's operating cash flows. Assume the sales price will increase by a 4.0% annual inflation rate beginning after year 1, and cash operating costs (variable per unit and fixed) will increase by a 3.0% annual inflation rate, also beginning after year 1. Assume no other cash flows (net working capital, or salvage values) are affected by inflation. Of course, lease payments are impacted by inflation but only to the extent of the previously mentioned contractual escalation clause. What is the project's NPV, IRR, and MIRR? Use 15% for the required rate of return. (20 points) A spreadsheet should be used and included to answer this question

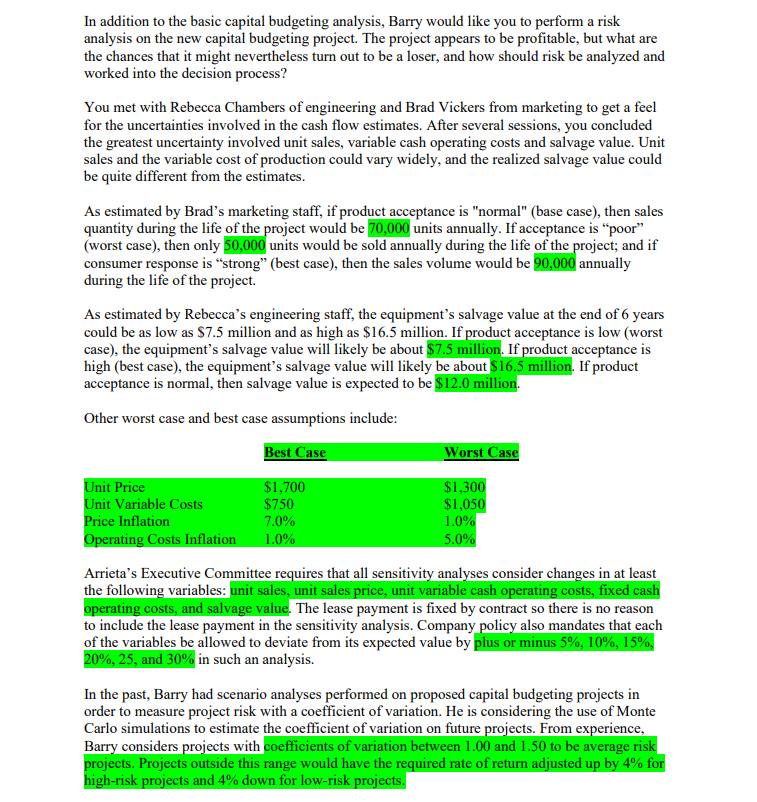

Arrieta Natural Ecological Solutions, Inc. is a successful technology, supply, and equipment company. Arrieta provides technical, software and equipment solutions to a wide variety of companies. The firm has benefited from the swift growth in the globalization of supply chains and the world economy. although the Covid-19 pandemic and the Ukraine-Russia conflict has caused concern about the dependability of supply chains. Albert Wesker, the corporate founder, is considering a push to manufacture its first product intended for the consumer market. The R\&D arm of the company, led by Jill Valentine, has recently developed a portable solar generator. This is not a new breakthrough product, as other companies are already producing solar generators. However, Arrieta's new solar generator produces significantly more electricity more efficiently than any other portable solar generator currently on the market. If the company decides to go forward with this project, an assembly facility will be located in buildings leased for $1.0 million annually. This lease payment is tax-deductible, paid at the beginning of each year, and has an escalation clause causing the lease payment to increase 3.0% annually over the life of the project. Thus, the lease payment at the beginning of Year 1 (at time zero) will be $1.0 million, and it will increase by 3.0% annually thereafter. Equipment for the facility will cost $75 million, including delivery and installation. An initial Net Working Capital investment will be $7.0 million immediately to support the facility. Assume the Net Working Capital investment will be returned at the end of the project's six-year life, as it will no longer be needed. Equipment depreciation will be according to MACRS 5-year asset class (20.00\%, 32.00\%, 19.20%,11.52%,11.52%, and 5.76% respectively for years one through six). The equipment is expected to have a salvage value of $12.0 million after 6 years of use. Arrieta expects to produce and sell each solar generator at an initial price of $1,500 per unit. The facility's annual maximum production capacity is expected to be 100,000 units during the 6-year economic life of the facility. The forecast is for actual production and sales to be 70,000 units annually. Fixed cash operating costs (not including depreciation and lease payment) are estimated to be $18.0 million annually, and variable cash operating costs are estimated at $900 per unit. Arrieta's federal-plus-state effective tax rate is 30%. Assume that the company is able to take advantage of all tax shields (tax-deductions). Your task is to analyze this project. You must recommend acceptance or rejection and evaluate the project's acceptability using the net present value (NPV), internal rate of return (IRR), and modified internal rate of return (MIRR) criteria. Arrieta's weighted average cost of capital (WACC), and thus the project's required rate of return, is 15%. Barry Burton, the CFO, wondered whether it would be appropriate to assume neutral inflation equal to the 4.0% expected general rate of inflation, and if not, how sensitive the results would be to alternative assumptions of differential inflation impacts on revenues and costs. Barry expects these and other questions to be raised when you present your recommendations to the Executive Committee. In addition to the basic capital budgeting analysis, Barry would like you to perform a risk analysis on the new capital budgeting project. The project appears to be profitable, but what are the chances that it might nevertheless turn out to be a loser, and how should risk be analyzed and worked into the decision process? You met with Rebecca Chambers of engineering and Brad Vickers from marketing to get a feel for the uncertainties involved in the cash flow estimates. After several sessions, you concluded the greatest uncertainty involved unit sales, variable cash operating costs and salvage value. Unit sales and the variable cost of production could vary widely, and the realized salvage value could be quite different from the estimates. As estimated by Brad's marketing staff, if product acceptance is "normal" (base case), then sales quantity during the life of the project would be 70,000 units annually. If acceptance is "poor" (worst case), then only 50,000 units would be sold annually during the life of the project; and if consumer response is "strong" (best case), then the sales volume would be 90,000 annually during the life of the project. As estimated by Rebecca's engineering staff, the equipment's salvage value at the end of 6 years could be as low as $7.5 million and as high as $16.5 million. If product acceptance is low (worst case), the equipment's salvage value will likely be about $7.5 million. If product acceptance is high (best case), the equipment's salvage value will likely be about $16.5 million. If product acceptance is normal, then salvage value is expected to be $12.0 million. Other worst case and best case assumptions include: Arrieta's Executive Committee requires that all sensitivity analyses consider changes in at least the following variables: unit sales, unit sales price, unit variable cash operating costs, fixed cash operating costs, and salvage value. The lease payment is fixed by contract so there is no reason to include the lease payment in the sensitivity analysis. Company policy also mandates that each of the variables be allowed to deviate from its expected value by plus or minus 5%,10%,15%, 20%,25, and 30% in such an analysis. In the past, Barry had scenario analyses performed on proposed capital budgeting projects in order to measure project risk with a coefficient of variation. He is considering the use of Monte Carlo simulations to estimate the coefficient of variation on future projects. From experience, Barry considers projects with coefficients of variation between 1.00 and 1.50 to be average risk projects. Projects outside this range would have the required rate of return adjusted up by 4% for high-risk projects and 4% down for low-risk projects