Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Estimate Unaudited Accounts Receivable end year 2 (discuss briefly) Estimate actual accounts Receivable end year 2 (discuss briefly) Expected discrepancy in Accounts Receivable _____________ Unaudited

Estimate Unaudited Accounts Receivable end year 2 (discuss briefly)

Estimate actual accounts Receivable end year 2 (discuss briefly)

Expected discrepancy in Accounts Receivable _____________

Unaudited Accounts Receivable Estimated Actual Accounts Receivable

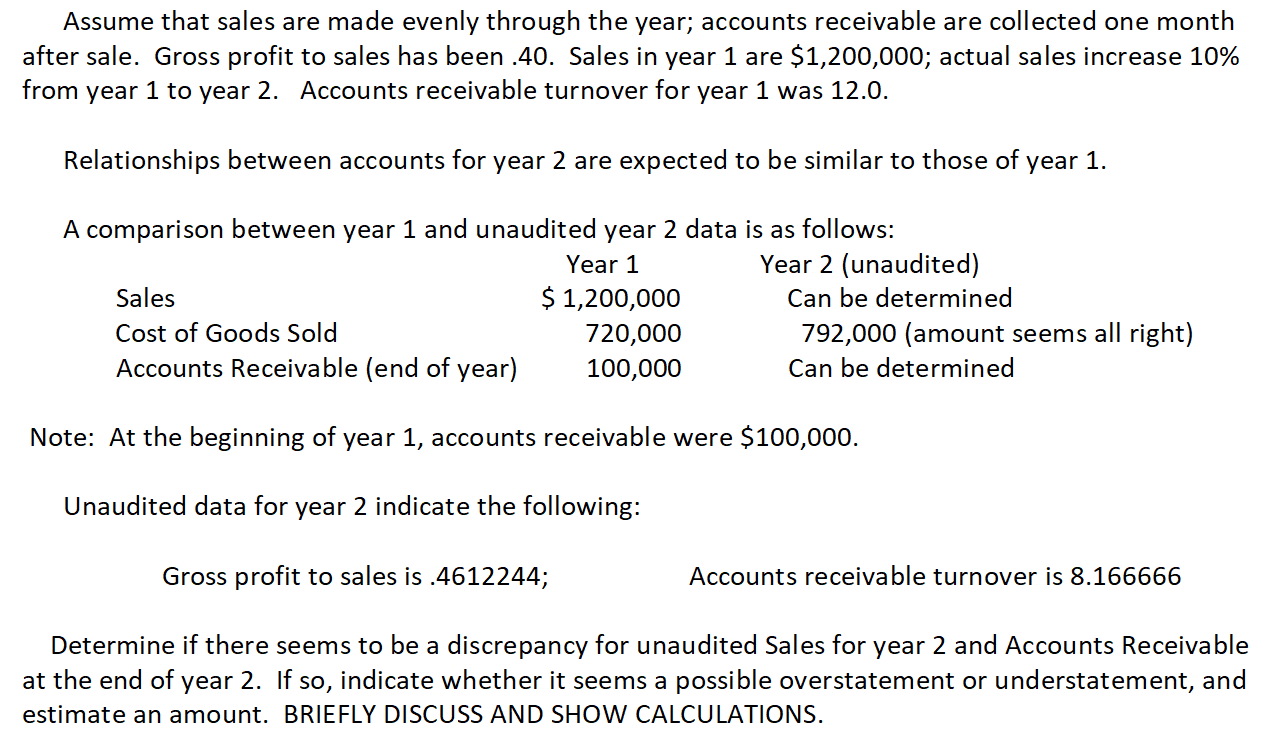

Assume that sales are made evenly through the year; accounts receivable are collected one month after sale. Gross profit to sales has been .40. Sales in year 1 are $1,200,000; actual sales increase 10% from year 1 to year 2. Accounts receivable turnover for year 1 was 12.0. Relationships between accounts for year 2 are expected to be similar to those of year 1. A comparison between year 1 and unaudited year 2 data is as follows: Year 1 Year 2 (unaudited) Sales $ 1,200,000 Can be determined Cost of Goods Sold 720,000 792,000 (amount seems all right) Accounts Receivable (end of year) 100,000 Can be determined Note: At the beginning of year 1, accounts receivable were $100,000. Unaudited data for year 2 indicate the following: Gross profit to sales is .4612244; Accounts receivable turnover is 8.166666 Determine if there seems to be a discrepancy for unaudited Sales for year 2 and Accounts Receivable at the end of year 2. If so, indicate whether it seems a possible overstatement or understatement, and estimate an amount. BRIEFLY DISCUSS AND SHOW CALCULATIONSStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started