Answered step by step

Verified Expert Solution

Question

1 Approved Answer

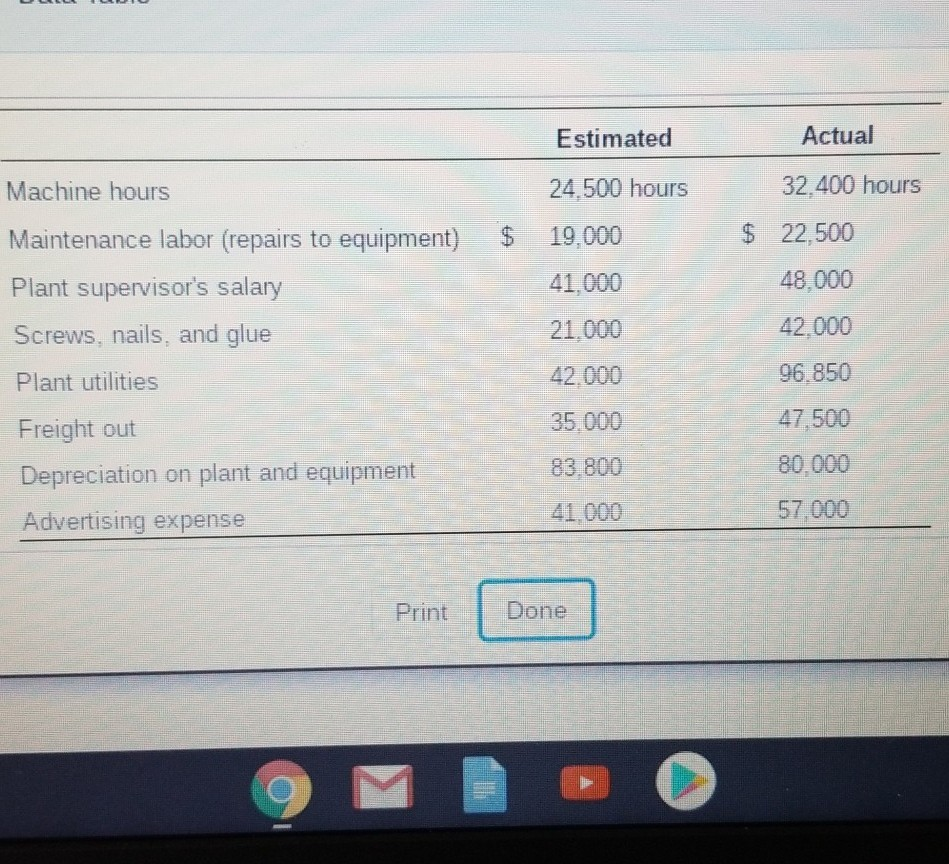

Estimated Actual 24.500 hours 32,400 hours 19.000 $ 22.500 Machine hours Maintenance labor (repairs to equipment) Plant supervisor's salary Screws, nails, and glue 41,000 48.000

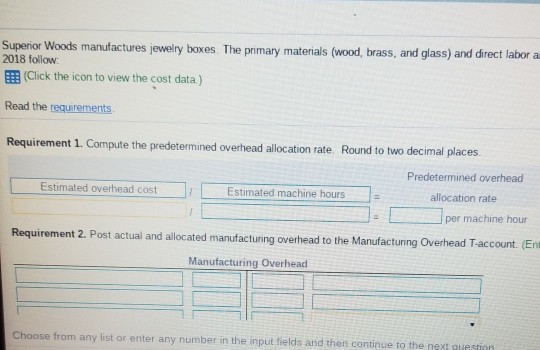

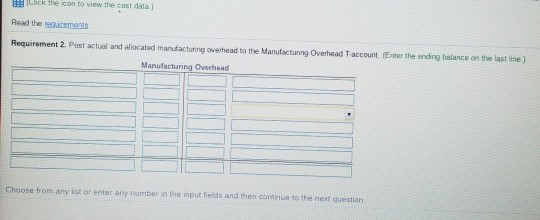

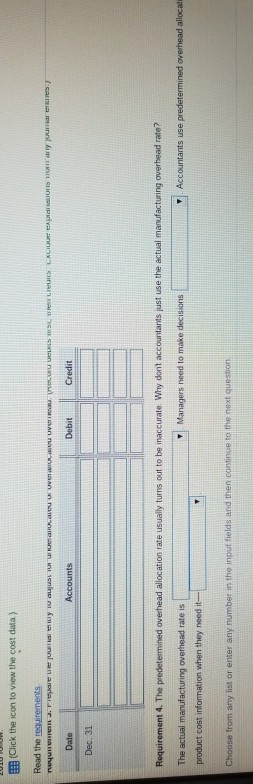

Estimated Actual 24.500 hours 32,400 hours 19.000 $ 22.500 Machine hours Maintenance labor (repairs to equipment) Plant supervisor's salary Screws, nails, and glue 41,000 48.000 21.000 42.000 Plant utilities 42.000 96.850 35.000 47,500 83.800 80.000 Freight out Depreciation on plant and equipment Advertising expense 57 000 Done Superior Woods manufactures jewelry boxes. The primary materials (wood, brass, and glass) and direct labor a 2018 follow Click the icon to view the cost data) Read the requirements Requirement 1. Compute the predetermined overhead allocation rate. Round to two decimal places Predetermined overhead Estimated overhead cost Estimated machine hours allocation rate per machine hour Requirement 2. Post actual and allocated manufacturing overhead to the Manufacturing Overhead T-account. (En Manufacturing Overhead Choose from any list or enter any number in the input fields and then continue to the next question Chick the con to view the cost data) Read the requirements Requirement 2. Post actual and allocated manufacturing overhead to the Manufacturing Overhead T-account. Er the ending balance on the lastine) Manufacturing Overhead Choose from any list of enter any number in the input fields and then continue to the next Question (Click the icon to view the cost data) Read the requirements WIR File urla y caut . KUVERTU VESSELS LACUT ALIULIS TURTY a res Date Accounts Debit Credit Dec. 31 Requirement 4. The predetermined overhead allocation rate usually turns out to be inaccurate Why dont accountants just use the actual manufacturing overhead rate? Managers need to make decisions Accountants use predetermined overhead allocat The actual manufacturing overhead rate is product cost information when they need it Choose from any list or enter any number in the input fields and then continue to the next

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started