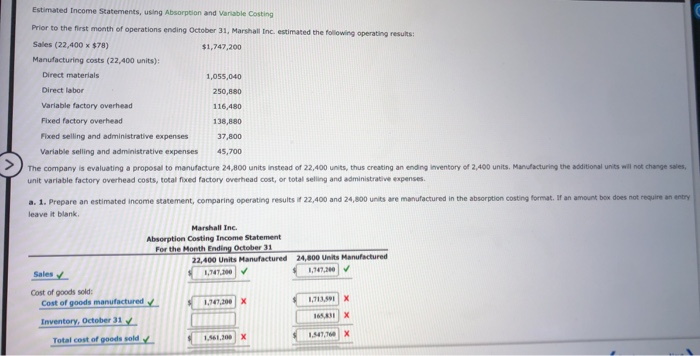

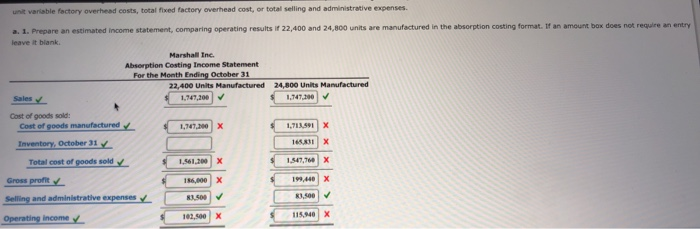

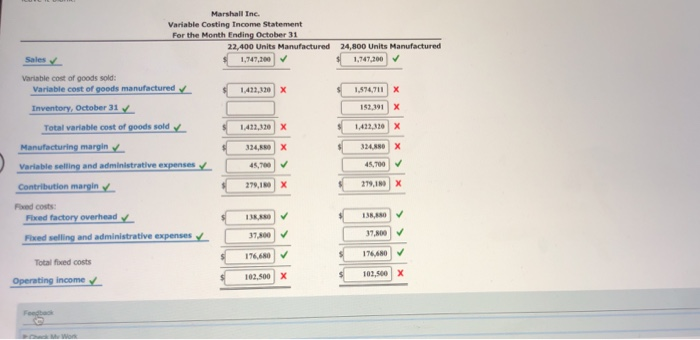

Estimated Income Statements, using Absorption and Variable Costing Prior to the first month of operations ending October 31, Marshall Inc. estimated the following operating results: Sales (22,400 x $78) $1,747,200 Manufacturing costs (22,400 units): Direct materials 1,055,040 Direct labor 250,880 Variable factory overhead 116,480 Fixed factory overhead 138,880 Fixed selling and administrative expenses 37,800 Variable selling and administrative expenses 45,700 The company is evaluating a proposal to manufacture 24,800 units instead of 22,400 units, thus creating an ending Inventory of 2,400 units, Manufacturing the additional units will not change sales, unit variable factory overhead costs, total fed factory overhead cost, or total selling and administrative expenses a. 1. Prepare an estimated Income statement, comparing operating results it 22,400 and 24,000 units are manufactured in the absorption costing format. If an amount box does not require an entry leave it blank Marshall Inc Absorption Costing Income Statement For the Month Ending October 31 22.400 Units Manufactured 24,000 Units Manufactured 1,147.100 Cost of goods sold: Cost of goods manufactured 1.3.200 x 1111.1 x Inventory, October 31 1. X Total cost of goods sold 1.561,300 x 1.547,700X Sales unit variable factory overhead costs, total fixed factory overhead cost, or total selling and administrative expenses. a. 1. Prepare an estimated Income statement, comparing operating results if 22,400 and 24,800 units are manufactured in the absorption costing format. If an amount box does not require an entry leave it blank Marshall Inc. Absorption Costing Income Statement For the Month Ending October 31 22,400 Units Manufactured 24,800 Units Manufactured Sales 1.747.2007 1.17.200 Cost of goods sold: Cost of goods manufactured 1,747.100 x 1,713.591 X Inventory, October 31 168.831X Total cost of goods sold 1.561,200 X 1.547,700X 186,000 X 199.440 X Gross profit Selling and administrative expenses 3.500 3.500 Operating income 102,500 x 115,940 X Marshall Inc. Variable Costing Income Statement For the Month Ending October 31 22,400 Units Manufactured 24,500 Units Manufactured Sales 1,747.2007 1,747,200 Variable cost of goods sold: Variable cost of goods manufactured 1,422,320 X 1.574,711 x Inventory, October 31 153,391 x Total variable cost of goods sold 1:43.320 X 1,412,310 X Manufacturing margin v 334, X 324.80 x Variable selling and administrative expenses 45,00 Contribution margin 279,180 X 279,180 X Fred costs Fixed factory overhead 138.180 Fixed selling and administrative expenses 37.800 37,800 Total foed costs 176.680 176.680 Operating income 102.500 X 103.500 X Feed W