Answered step by step

Verified Expert Solution

Question

1 Approved Answer

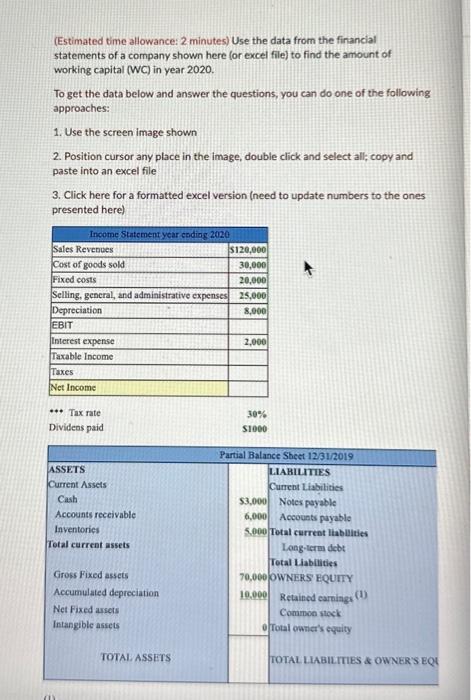

(Estimated time allowance: 2 minutes) Use the data from the financial statements of a company shown here (or excel file) to find the amount

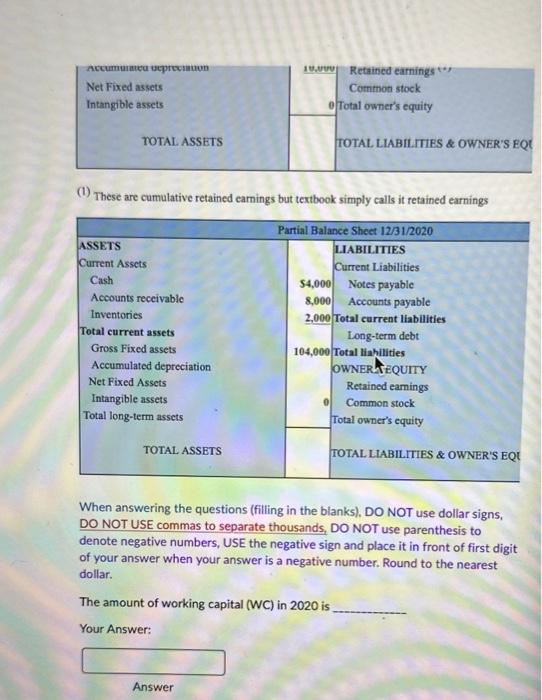

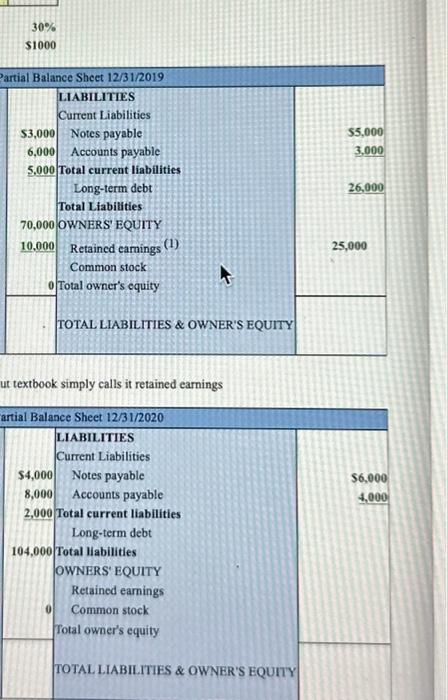

(Estimated time allowance: 2 minutes) Use the data from the financial statements of a company shown here (or excel file) to find the amount of working capital (WC) in year 2020. To get the data below and answer the questions, you can do one of the following approaches: 1. Use the screen image shown 2. Position cursor any place in the image, double click and select all; copy and paste into an excel file 3. Click here for a formatted excel version (need to update numbers to the ones presented here) Income Statement year ending 2020 Sales Revenues Cost of goods sold Fixed costs $120,000 30,000 20,000 Selling, general, and administrative expenses 25,000 Depreciation EBIT Interest expense 8,000 2,000 Taxable Income Taxes Net Income ***Tax rate Dividens paid ASSETS Current Assets Cash Accounts receivable Inventories Total current assets Gross Fixed assets Accumulated depreciation Net Fixed assets Intangible assets TOTAL ASSETS 30% $1000 Partial Balance Sheet 12/31/2019 LIABILITIES Current Liabilities $3,000 Notes payable 6,000 Accounts payable 5,000 Total current liabilities Long-term debt Total Liabilities 70,000 OWNERS' EQUITY 10.000 Retained earnings (1) Common stock offotal owner's equity TOTAL LIABILITIES & OWNER'S EQU

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started