Answered step by step

Verified Expert Solution

Question

1 Approved Answer

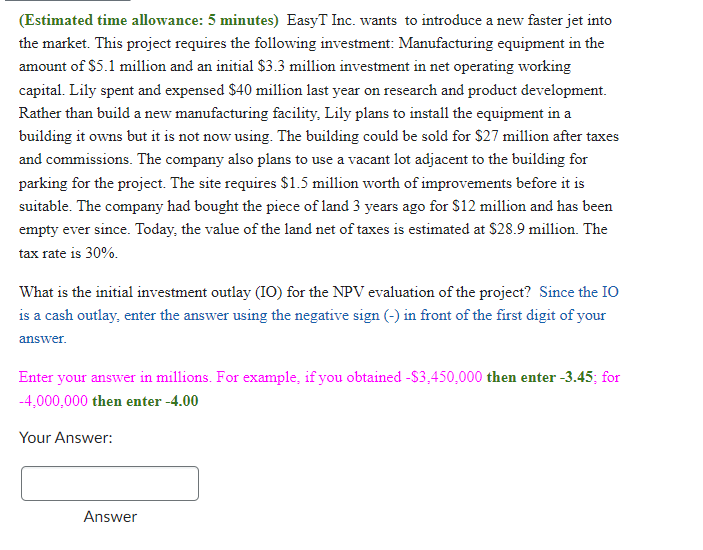

( Estimated time allowance: 5 minutes ) EasyT Inc. wants to introduce a new faster jet into the market. This project requires the following investment:

Estimated time allowance: minutes EasyT Inc. wants to introduce a new faster jet into

the market. This project requires the following investment: Manufacturing equipment in the

amount of $ million and an initial $ million investment in net operating working

capital. Lily spent and expensed $ million last year on research and product development.

Rather than build a new manufacturing facility, Lily plans to install the equipment in a

building it owns but it is not now using. The building could be sold for $ million after taxes

and commissions. The company also plans to use a vacant lot adjacent to the building for

parking for the project. The site requires $ million worth of improvements before it is

suitable. The company had bought the piece of land years ago for $ million and has been

empty ever since. Today, the value of the land net of taxes is estimated at $ million. The

tax rate is

What is the initial investment outlay IO for the NPV evaluation of the project? Since the IO

is a cash outlay, enter the answer using the negative sign in front of the first digit of your

answer.

Enter your answer in millions. For example, if you obtained $ then enter ; for

then enter

Your Answer:

Answer

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started