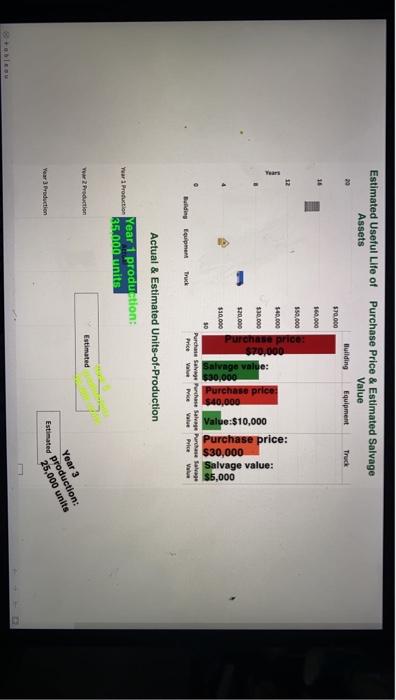

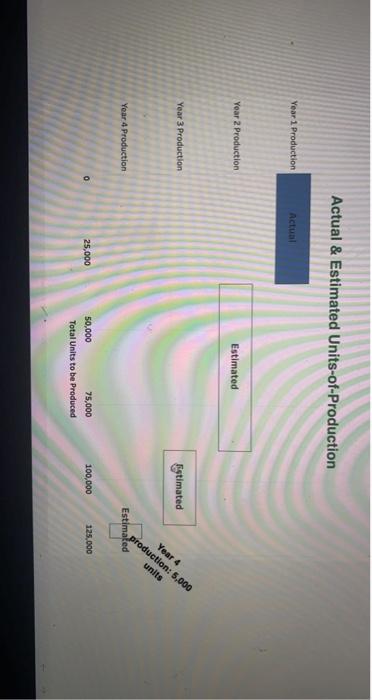

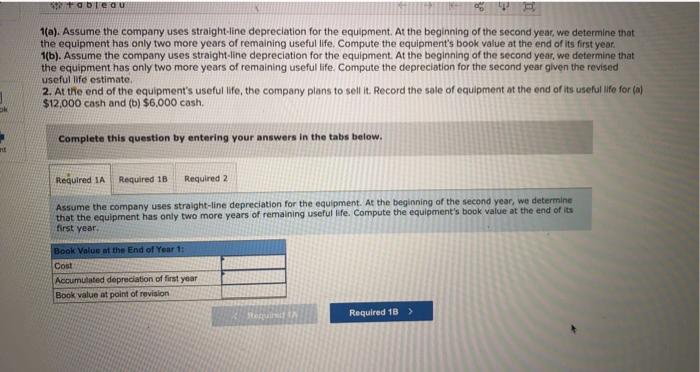

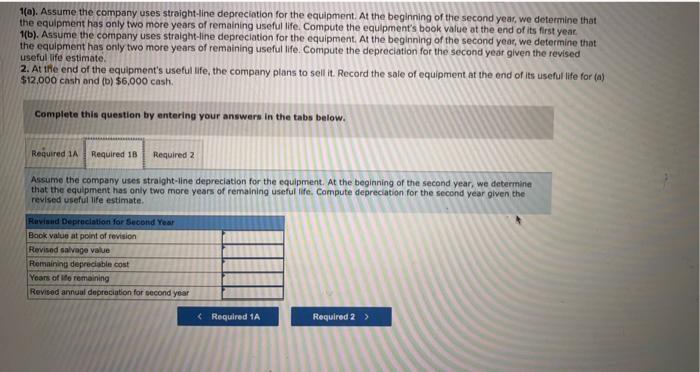

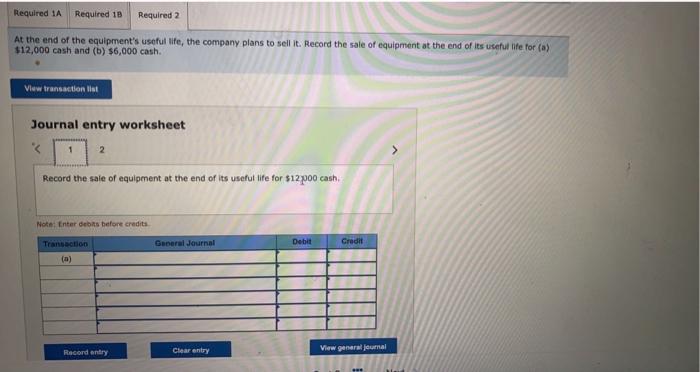

Estimated Useful Life of Purchase Price & Estimated Salvage Assets Value Building Equipment 29 Truck 370.000 11 160.000 5.000 140.000 520.000 Salvage value: Purchase price $40,000 Value:$10,000 Purchase price: $30,000 Il Salvage value: $10.000 $5,000 50 Purchase Salvage Purchase Salvage Purchase Sale Price Value Pieve Price Building fant Actual & Estimated Units-of-Production Year 1 production: 65.000 units ww2 Production Estimated Year 3 production: 25,000 units Year 3 Production Estimated Actual & Estimated Units-of-Production Year 1 Production Actual Yoar 2 Production Estimated Year 3 Production Estimated Year 4 5.000 Year 4 Production Estimated 25,000 100,000 125.000 50,000 75,000 Total Units to be produced Tableau 1(a). Assume the company uses straight-line depreciation for the equipment. At the beginning of the second year, we determine that the equipment has only two more years of remaining useful life. Compute the equipment's book value at the end of its first year. 1(b). Assume the company uses straight-line depreciation for the equipment. At the beginning of the second year, we determine that the equipment has only two more years of remaining useful life. Compute the depreciation for the second year given the revised useful life estimate 2. At the end of the equipment's useful life, the company plans to sell it. Record the sale of equipment at the end of its useful life for (a) $12,000 cash and (b) $6,000 cash. Complete this question by entering your answers in the tabs below. Required 1A Required 18 Required 2 Assume the company uses straight-line depreciation for the equipment. At the beginning of the second year, we determine that the equipment has only two more years of remaining useful life. Compute the equipment's book value at the end of its first year Book Value at the End of Year 1: Cost Accumulated depreciation of first year Book value at point of revision Required 13 > 1(a). Assume the company uses straight-line depreciation for the equipment. At the beginning of the second year, we determine that the equipment has only two more years of remaining useful life. Compute the equipment's book value at the end of its first year 1(b). Assume the company uses straight-line depreciation for the equipment. At the beginning of the second year, we determine that the equipment has only two more years of remaining useful life. Compute the depreciation for the second year given the revised useful life estimate. 2. At the end of the equipment's useful life, the company plans to sell it. Record the sale of equipment at the end of its useful life for (a) $12,000 cash and (b) $6,000 cash. Complete this question by entering your answers in the tabs below. Required 1A Required 1B Required 2 Assume the company uses straight-line depreciation for the equipment. At the beginning of the second year, we determine that the equipment has only two more years of remaining useful life. Compute depreciation for the second year given the revised useful life estimate Ravinud Depreciation for Second Year Book value at point of revision Revised salvage value Remaining depreciable cost Years of to remaining Revised annual depreciation for second year Required 1A Required 10 Required 2 At the end of the equipment's useful life, the company plans to sell it. Record the sale of equipment at the end of its useful life for (a) $12,000 cash and (b) $6,000 cash. View transaction list Journal entry worksheet 1 2 Record the sale of equipment at the end of its useful life for $12 poo cash. Note: Enter debits before credits General Journal Debit Credit Transaction (a) Record entry Clear entry View general Journal Estimated Useful Life of Purchase Price & Estimated Salvage Assets Value Building Equipment 29 Truck 370.000 11 160.000 5.000 140.000 520.000 Salvage value: Purchase price $40,000 Value:$10,000 Purchase price: $30,000 Il Salvage value: $10.000 $5,000 50 Purchase Salvage Purchase Salvage Purchase Sale Price Value Pieve Price Building fant Actual & Estimated Units-of-Production Year 1 production: 65.000 units ww2 Production Estimated Year 3 production: 25,000 units Year 3 Production Estimated Actual & Estimated Units-of-Production Year 1 Production Actual Yoar 2 Production Estimated Year 3 Production Estimated Year 4 5.000 Year 4 Production Estimated 25,000 100,000 125.000 50,000 75,000 Total Units to be produced Tableau 1(a). Assume the company uses straight-line depreciation for the equipment. At the beginning of the second year, we determine that the equipment has only two more years of remaining useful life. Compute the equipment's book value at the end of its first year. 1(b). Assume the company uses straight-line depreciation for the equipment. At the beginning of the second year, we determine that the equipment has only two more years of remaining useful life. Compute the depreciation for the second year given the revised useful life estimate 2. At the end of the equipment's useful life, the company plans to sell it. Record the sale of equipment at the end of its useful life for (a) $12,000 cash and (b) $6,000 cash. Complete this question by entering your answers in the tabs below. Required 1A Required 18 Required 2 Assume the company uses straight-line depreciation for the equipment. At the beginning of the second year, we determine that the equipment has only two more years of remaining useful life. Compute the equipment's book value at the end of its first year Book Value at the End of Year 1: Cost Accumulated depreciation of first year Book value at point of revision Required 13 > 1(a). Assume the company uses straight-line depreciation for the equipment. At the beginning of the second year, we determine that the equipment has only two more years of remaining useful life. Compute the equipment's book value at the end of its first year 1(b). Assume the company uses straight-line depreciation for the equipment. At the beginning of the second year, we determine that the equipment has only two more years of remaining useful life. Compute the depreciation for the second year given the revised useful life estimate. 2. At the end of the equipment's useful life, the company plans to sell it. Record the sale of equipment at the end of its useful life for (a) $12,000 cash and (b) $6,000 cash. Complete this question by entering your answers in the tabs below. Required 1A Required 1B Required 2 Assume the company uses straight-line depreciation for the equipment. At the beginning of the second year, we determine that the equipment has only two more years of remaining useful life. Compute depreciation for the second year given the revised useful life estimate Ravinud Depreciation for Second Year Book value at point of revision Revised salvage value Remaining depreciable cost Years of to remaining Revised annual depreciation for second year Required 1A Required 10 Required 2 At the end of the equipment's useful life, the company plans to sell it. Record the sale of equipment at the end of its useful life for (a) $12,000 cash and (b) $6,000 cash. View transaction list Journal entry worksheet 1 2 Record the sale of equipment at the end of its useful life for $12 poo cash. Note: Enter debits before credits General Journal Debit Credit Transaction (a) Record entry Clear entry View general Journal