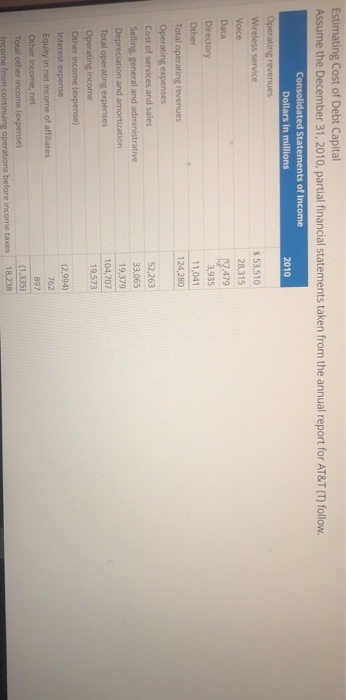

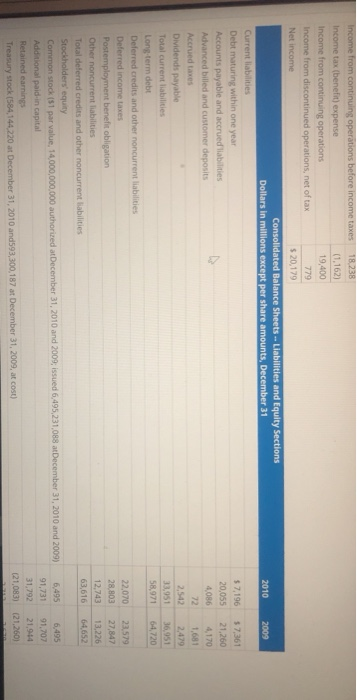

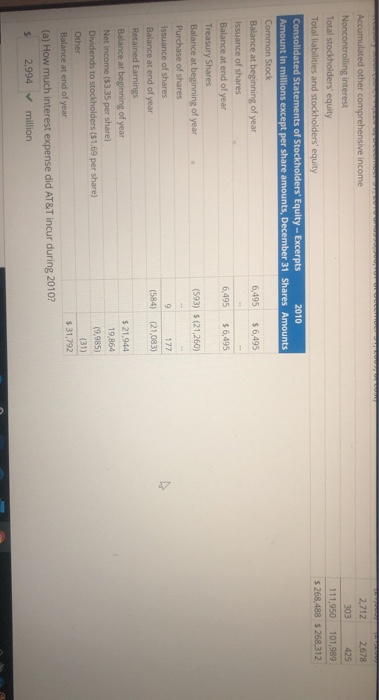

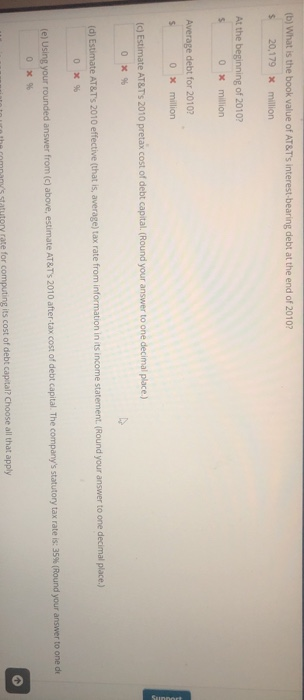

Estimating Cost of Debt Capital Assume the December 31, 2010, partial financial statements taken from the annual report for AT&T (T) follow. Consolidated Statements of Income Dollars in millions 2010 Operating revenues Wireless service $53,510 Voice 28,315 Data N 479 Directory 3,935 Other 11,041 Total operating revenues 124,280 Operating expenses Cost of services and sales 52,263 Selling general and administrative 33,065 Depreciation and amortization 19.379 Total operating expenses 104,707 Operating income 19.573 Other income (expense) Interest expense 12,994) Equity in net income of affiliates 762 Other income, net 897 Total other income (expense) (1,335) Income from continuing operations before income taxes 18.238 2010 2009 $7.196 20,055 4,086 72 Income from continuing operations before income taxes 18238 Income tax (benefit) expense (1.162) Income from continuing operations 19,400 Income from discontinued operations, net of tax 779 Net income $ 20,179 Consolidated Balance Sheets - Liabilities and Equity Sections Dollars in millions except per share amounts, December 31 Current liabilities Debt maturing within one year Accounts payable and accrued liabilities Advanced billed and customer deposits Accrued taxes Dividends payable Total current liabilities Long-term debt Deferred credits and other noncurrent liabilities Deferred income taxes Postemployment benefit obligation Other noncurrent liabilities Total deferred credits and other noncurrent liabilities Stockholders' equity Common stock (51 par value, 14,000,000,000 authorized at December 31, 2010 and 2009, issued 6,495,231,088 at December 31, 2010 and 2009) Additional paid in capital Retained earnings Treasury stock (584,144 220 at December 31, 2010 and593,300,187 at December 31, 2009, at cost) 57,361 21,260 4,170 1,681 2,479 36,951 64.720 2,542 33,951 58.971 22,070 28.803 12,743 63,616 23.579 27,847 13.226 64,652 6,495 91,731 31,792 (21,083) 91,707 21,944 (21,260) OGGETNYCH GODDECODE 2,712 2678 303 425 111,950 101,989 $ 268,488 $268.312 Accumulated other comprehensive income Noncontrolling interest Total stockholders' equity Total liabilities and stockholders' equity Consolidated Statements of Stockholders' Equity - Excerpts 2010 Amount in millions except per share amounts, December 31 Shares Amounts Common Stock Balance at beginning of year 6,495 $ 6,495 Issuance of shares Balance at end of year 6,495 $ 6,495 Treasury Shares Balance at beginning of year (593) $ (21,260) Purchase of shares Issuance of shares 9 177 Balance at end of year (584) 121,083) Retained Earnings Balance at beginning of year $21.944 Net income (53.35 per share) 19,864 Dividends to stockholders ($1.69 per share) (9,985) Other (31) Balance at end of year $ 31,792 (a) How much interest expense did AT&T incur during 2010? s 2,994 million (b) What is the book value of AT&T's interest-bearing debt at the end of 2010? $ 20,179 x million At the beginning of 20107 $ 0 x million Average debt for 2010? 5 0 x million (c) Estimate AT&T's 2010 pretax cost of debt capital. (Round your answer to one decimal place.) 0 X 96 (d) Estimate AT&T's 2010 effective (that is, average) tax rate from information in its income statement. (Round your answer to one decimal place.) 0 X 96 (e) Using your rounded answer from (c) above, estimate AT&T's 2010 after-tax cost of debt capital. The company's statutory tax rate is: 35% (Round your answer to one de 0 x rate for computing its cost of debt capital? Choose all that apply