Question

Estimating Share Value Using the ROPI Model Assume following are forecasts of Abercrombie & Fitch's sales, net operating profit after tax (NOPAT), and net operating

Estimating Share Value Using the ROPI Model Assume following are forecasts of Abercrombie & Fitch's sales, net operating profit after tax (NOPAT), and net operating assets (NOA) as of January 29, 2011. Refer to the information in the table to answer the following requirements.

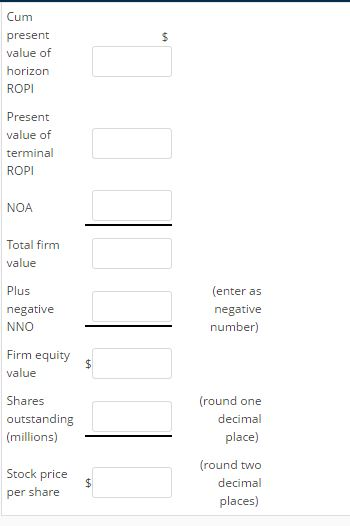

Answer the following requirements assuming a discount rate (WACC) of 13.3%, a terminal period growth rate of 1%, common shares outstanding of 86.2 million, and net nonoperating obligations (NNO) of $(255) million (negative NNO reflects net nonoperating assets such as investments rather than net obligations).

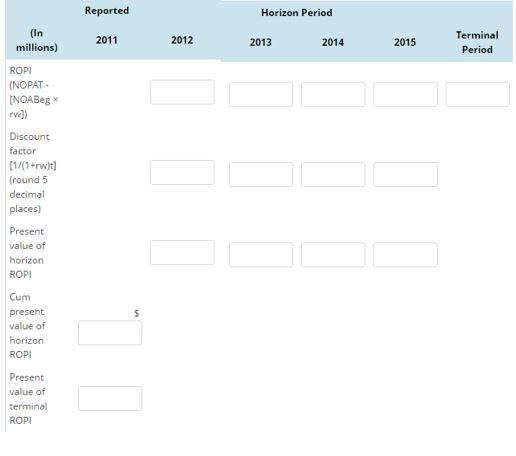

(a) Estimate the value of a share of Abercrombie & Fitch common stock using the residual operating income (ROPI) model as of January 29, 2011. Rounding Instructions: Round answers to the nearest whole number unless noted otherwise. Use your round answers for subsequent calculations.

**Please show all work

Reported Horizon Period (In Terminal 2011 2012 2013 2014 2015 millions) Period Sales 3,750 4,500 5,400 6,480 7,776 7,853 954 464 578 686 825 948 NOPAT NOA 1,333 1,612 1,944 2,289 2,780 2,806

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started