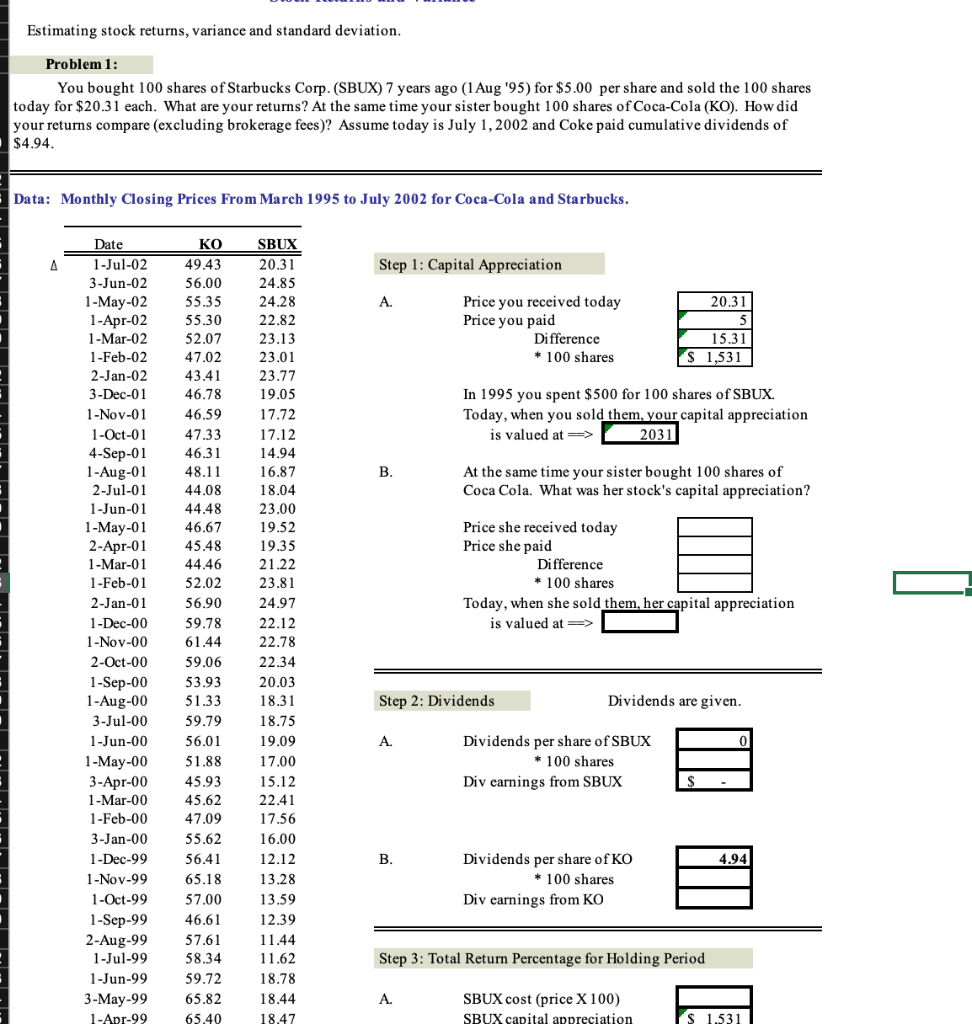

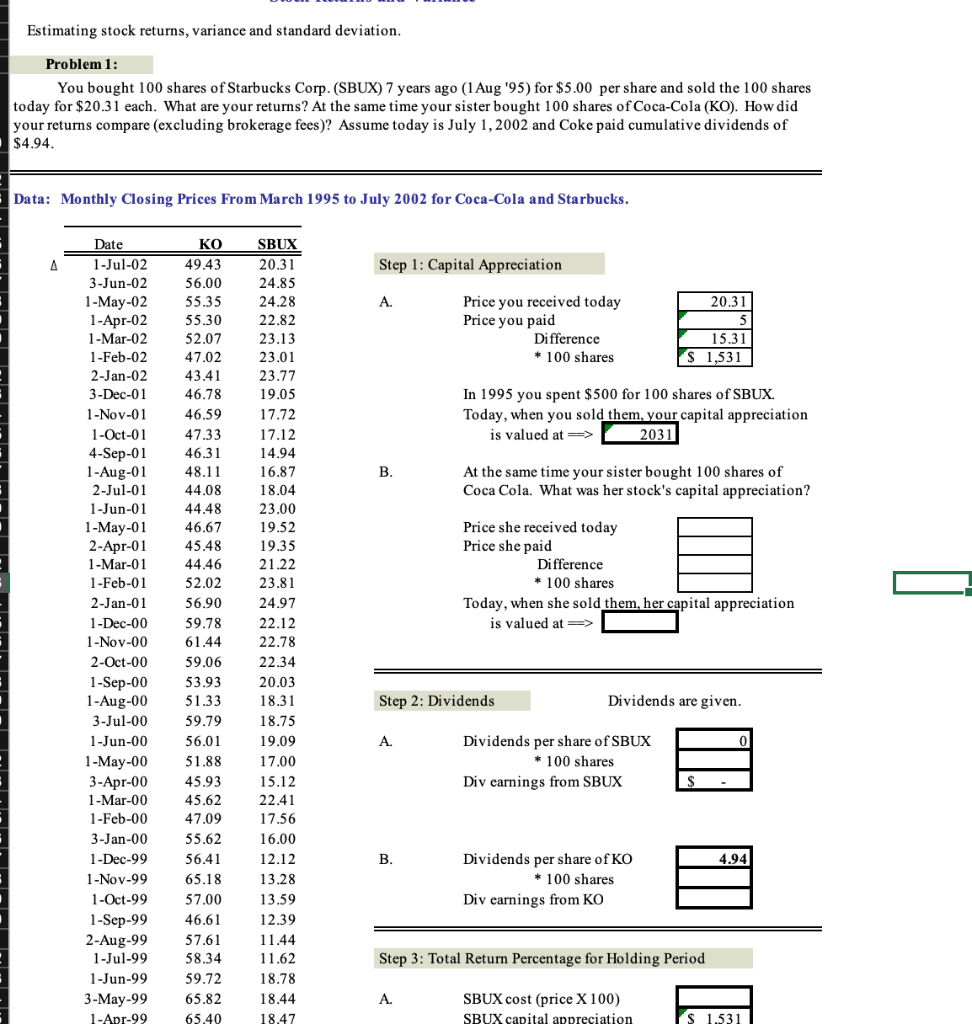

Estimating stock returns, variance and standard deviation. Problem 1: You bought 100 shares of Starbucks Corp. (SBUX) 7 years ago (1 Aug '95) for $5.00 per share and sold the 100 shares today for $20.31 each. What are your returns? At the same time your sister bought 100 shares of Coca-Cola (KO). How did your returns compare (excluding brokerage fees)? Assume today is July 1, 2002 and Coke paid cumulative dividends of $4.94. Data: Monthly Closing Prices From March 1995 to July 2002 for Coca-Cola and Starbucks. Step 1: Capital Appreciation A. 20.31 Price you received today Price you paid Difference * 100 shares 15.31 $ 1,531 In 1995 you spent $500 for 100 shares of SBUX. Today, when you sold them, your capital appreciation is valued at ==> 2031 B. At the same time your sister bought 100 shares of Coca Cola. What was her stock's capital appreciation? Price she received today Price she paid Difference * 100 shares Today, when she sold them, her capital appreciation is valued at => Date 1-Jul-02 3-Jun-02 1-May-02 1-Apr-02 1-Mar-02 1-Feb-02 2-Jan-02 3-Dec-01 1-Nov-01 1-Oct-01 4-Sep-01 1-Aug-01 2-Jul-01 1-Jun-01 1-May-01 2-Apr-01 1-Mar-01 1-Feb-01 2-Jan-01 1-Dec-00 1-Nov-00 2-Oct-00 1-Sep-00 1-Aug-00 3-Jul-00 1-Jun-00 1-May-00 3-Apr-00 1-Mar-00 1-Feb-00 3-Jan-00 1-Dec-99 1-Nov-99 1-Oct-99 1-Sep-99 2-Aug-99 1-Jul-99 1-Jun-99 3-May-99 1-Apr-99 KO 49.43 56.00 55.35 55.30 52.07 47.02 43.41 46.78 46.59 47.33 46.31 48.11 44.08 44.48 46.67 45.48 44.46 52.02 56.90 59.78 61.44 59.06 53.93 51.33 59.79 56.01 51.88 45.93 45.62 47.09 55.62 56.41 65.18 57.00 46.61 57.61 58.34 59.72 65.82 65.40 SBUX 20.31 24.85 24.28 22.82 23.13 23.01 23.77 19.05 17.72 17.12 14.94 16.87 18.04 23.00 19.52 19.35 21.22 23.81 24.97 22.12 22.78 22.34 20.03 18.31 18.75 19.09 17.00 15.12 22.41 17.56 16.00 12.12 13.28 13.59 12.39 11.44 11.62 18.78 18.44 18,47 Step 2: Dividends Dividends are given. A. Dividends per share of SBUX * 100 shares Div earnings from SBUX B. 4.94 Dividends per share of KO * 100 shares Div earnings from KO Step 3: Total Return Percentage for Holding Period A. SBUX cost (price X 100) SBUX capital appreciation 1 S 1.531 Estimating stock returns, variance and standard deviation. Problem 1: You bought 100 shares of Starbucks Corp. (SBUX) 7 years ago (1 Aug '95) for $5.00 per share and sold the 100 shares today for $20.31 each. What are your returns? At the same time your sister bought 100 shares of Coca-Cola (KO). How did your returns compare (excluding brokerage fees)? Assume today is July 1, 2002 and Coke paid cumulative dividends of $4.94. Data: Monthly Closing Prices From March 1995 to July 2002 for Coca-Cola and Starbucks. Step 1: Capital Appreciation A. 20.31 Price you received today Price you paid Difference * 100 shares 15.31 $ 1,531 In 1995 you spent $500 for 100 shares of SBUX. Today, when you sold them, your capital appreciation is valued at ==> 2031 B. At the same time your sister bought 100 shares of Coca Cola. What was her stock's capital appreciation? Price she received today Price she paid Difference * 100 shares Today, when she sold them, her capital appreciation is valued at => Date 1-Jul-02 3-Jun-02 1-May-02 1-Apr-02 1-Mar-02 1-Feb-02 2-Jan-02 3-Dec-01 1-Nov-01 1-Oct-01 4-Sep-01 1-Aug-01 2-Jul-01 1-Jun-01 1-May-01 2-Apr-01 1-Mar-01 1-Feb-01 2-Jan-01 1-Dec-00 1-Nov-00 2-Oct-00 1-Sep-00 1-Aug-00 3-Jul-00 1-Jun-00 1-May-00 3-Apr-00 1-Mar-00 1-Feb-00 3-Jan-00 1-Dec-99 1-Nov-99 1-Oct-99 1-Sep-99 2-Aug-99 1-Jul-99 1-Jun-99 3-May-99 1-Apr-99 KO 49.43 56.00 55.35 55.30 52.07 47.02 43.41 46.78 46.59 47.33 46.31 48.11 44.08 44.48 46.67 45.48 44.46 52.02 56.90 59.78 61.44 59.06 53.93 51.33 59.79 56.01 51.88 45.93 45.62 47.09 55.62 56.41 65.18 57.00 46.61 57.61 58.34 59.72 65.82 65.40 SBUX 20.31 24.85 24.28 22.82 23.13 23.01 23.77 19.05 17.72 17.12 14.94 16.87 18.04 23.00 19.52 19.35 21.22 23.81 24.97 22.12 22.78 22.34 20.03 18.31 18.75 19.09 17.00 15.12 22.41 17.56 16.00 12.12 13.28 13.59 12.39 11.44 11.62 18.78 18.44 18,47 Step 2: Dividends Dividends are given. A. Dividends per share of SBUX * 100 shares Div earnings from SBUX B. 4.94 Dividends per share of KO * 100 shares Div earnings from KO Step 3: Total Return Percentage for Holding Period A. SBUX cost (price X 100) SBUX capital appreciation 1 S 1.531