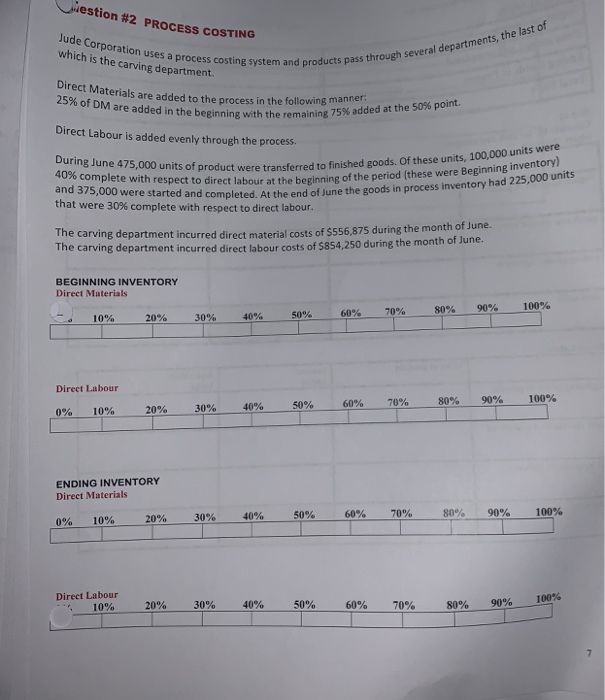

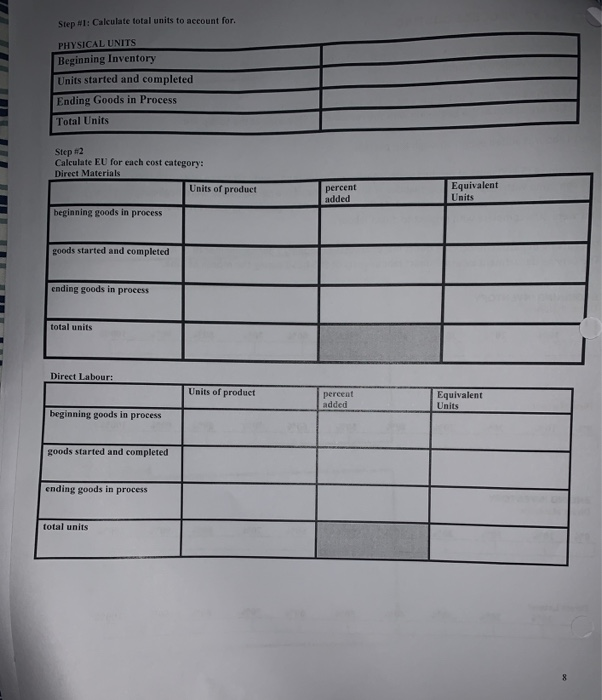

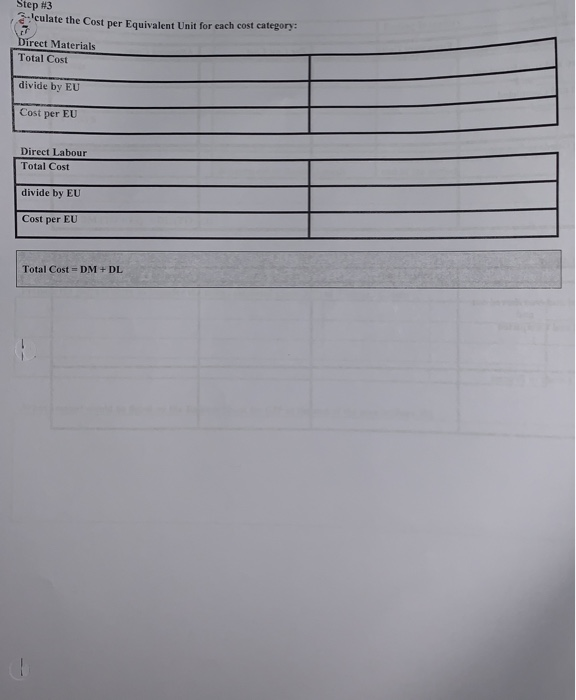

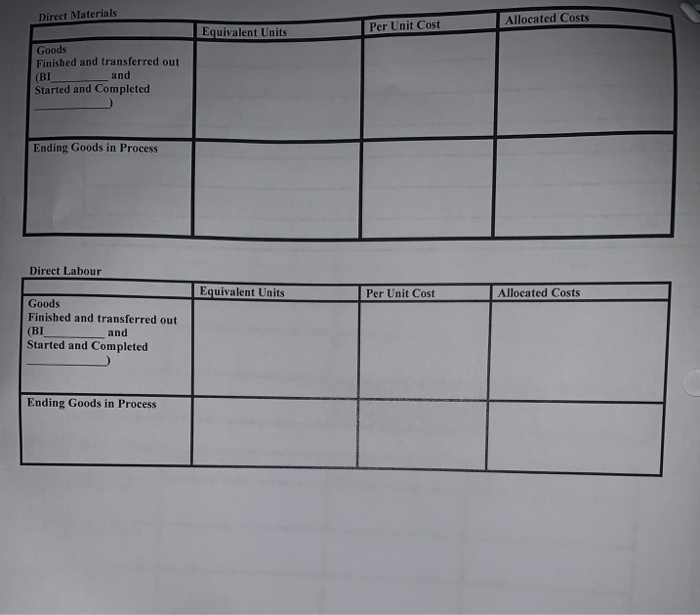

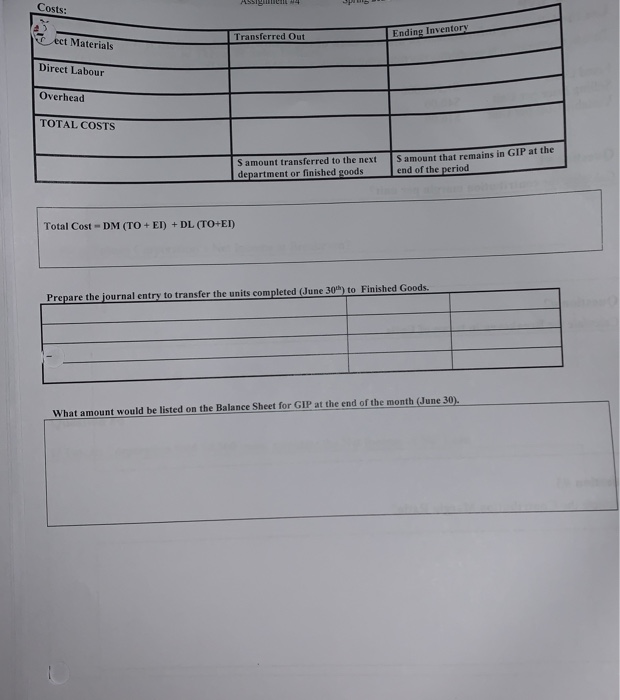

estion #2 PROCESS COSTING Jude Corporation de Corporation uses a process costing system which is the carving department. everal departments, the last of and products pass through several departments, Direct Materials are added 25% of DM are added in the beginnin erials are added to the process in the following manner the beginning with the remaining 75% added at the 50% point. Direct Labour is added evenly through the process. During June 475,000 units of product were tran 40% complete with respect to direct labour at the beginning of the p and 375,000 were started and completed. At that were 30% complete with respect to direct labour. shed goods. Of these units, 100,000 units were started and completed. At the end of June the goods in process inventory had 225,000 he beginning of the period (these were Beginning inventory) ne carving department incurred direct material costs of $556.875 during the month of June. The carving department incurred direct labour costs of $854,250 during the month of June. BEGINNING INVENTORY Direct Materials 70% 80% 90% 10% 100% 60% 20% 30% 40% 50% Direct Labour 60% 80% 70% 90% 100% 50% 10% 30% 40% 0% 20% ENDING INVENTORY Direct Materials 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Direct Labour 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Step 1: Calculate total units to account for. PHYSICAL UNITS Beginning Inventory Units started and completed Ending Goods in Process Total Units Step #2 Calculate EU for each cost category: Direct Materials Units of product sercent Equivalent Equi added Units beginning goods in process goods started and completed ending goods in process total units Direct Labour: Units of product Equivalent Units beginning goods in process goods started and completed ending goods in process total units Step #3 alculate the Cost per Equivalent Unit for each cost category: 17 Direct Materials Total Cost divide by EU le by EU Cost per EU EU Direct Labour Total Cost divide by EU Cost per EU Total Cost = DM + DL Direct Materials Allocated Costs Per Unit Cost Equivalent Units Goods Finished and transferred out (BI and Started and Completed Ending Goods in Process Direct Labour Equivalent Units Per Unit Cost Allocated Costs Goods Finished and transferred out (BI and Started and Completed Ending Goods in Process CUSLS: ect Materials Transferred Out Ending Inventory Direct Labour Overhead TOTAL COSTS Samount transferred to the next department or finished goods Samount that remains in GIP at the end of the period Total Cost - DM (TO + ET) + DL (TO+ET) Prepare the journal entry to transfer the units completed (June 30) to Finished Goods. What amount would be listed on the Balance Sheet for GIP at the end of the month (June 30). estion #2 PROCESS COSTING Jude Corporation de Corporation uses a process costing system which is the carving department. everal departments, the last of and products pass through several departments, Direct Materials are added 25% of DM are added in the beginnin erials are added to the process in the following manner the beginning with the remaining 75% added at the 50% point. Direct Labour is added evenly through the process. During June 475,000 units of product were tran 40% complete with respect to direct labour at the beginning of the p and 375,000 were started and completed. At that were 30% complete with respect to direct labour. shed goods. Of these units, 100,000 units were started and completed. At the end of June the goods in process inventory had 225,000 he beginning of the period (these were Beginning inventory) ne carving department incurred direct material costs of $556.875 during the month of June. The carving department incurred direct labour costs of $854,250 during the month of June. BEGINNING INVENTORY Direct Materials 70% 80% 90% 10% 100% 60% 20% 30% 40% 50% Direct Labour 60% 80% 70% 90% 100% 50% 10% 30% 40% 0% 20% ENDING INVENTORY Direct Materials 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Direct Labour 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Step 1: Calculate total units to account for. PHYSICAL UNITS Beginning Inventory Units started and completed Ending Goods in Process Total Units Step #2 Calculate EU for each cost category: Direct Materials Units of product sercent Equivalent Equi added Units beginning goods in process goods started and completed ending goods in process total units Direct Labour: Units of product Equivalent Units beginning goods in process goods started and completed ending goods in process total units Step #3 alculate the Cost per Equivalent Unit for each cost category: 17 Direct Materials Total Cost divide by EU le by EU Cost per EU EU Direct Labour Total Cost divide by EU Cost per EU Total Cost = DM + DL Direct Materials Allocated Costs Per Unit Cost Equivalent Units Goods Finished and transferred out (BI and Started and Completed Ending Goods in Process Direct Labour Equivalent Units Per Unit Cost Allocated Costs Goods Finished and transferred out (BI and Started and Completed Ending Goods in Process CUSLS: ect Materials Transferred Out Ending Inventory Direct Labour Overhead TOTAL COSTS Samount transferred to the next department or finished goods Samount that remains in GIP at the end of the period Total Cost - DM (TO + ET) + DL (TO+ET) Prepare the journal entry to transfer the units completed (June 30) to Finished Goods. What amount would be listed on the Balance Sheet for GIP at the end of the month (June 30)