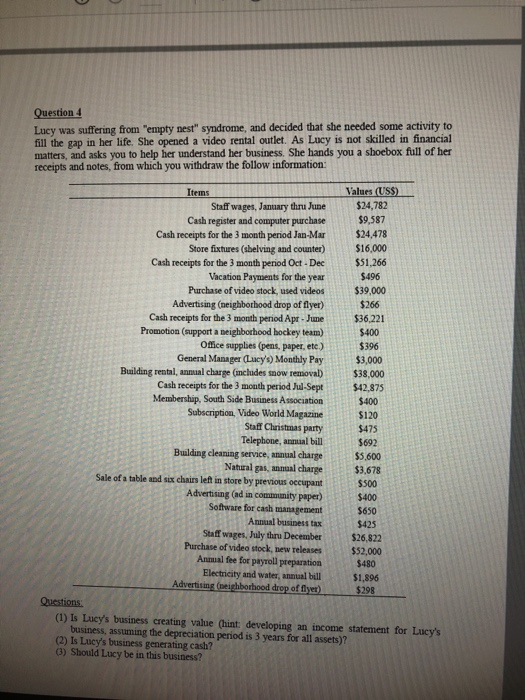

estion 4 Lucy was suffering from "empty nest" syndrome, and decided that she needed some activity to fill the gap in her life. She opened a video rental outlet. As Lucy is not skilled in financial matters, and asks you to help her understand her business. She hands you a shoebox full of her receipts and notes, from which you withdraw the follow information Values (USS) Items Staff wages, Jamuary thru June$24,782 Cash register and computer purchase$9,587 Cash receipts for the 3 month period Jan-Mar $24,478 Store fixtures (sbelving and counter $16,000 $51,266 Cash receipts for the 3 month period Oct-Dec $496 Vacation Payments for the year Advertising (neighbothood drop of flyer) Promotion (support a neighborhood bockey team) Purchase of video stock, used videos$39,000 $266 Cash receipts for the 3 month period Apr- June $36,221 $400 $396 Office supplies (pens, paper, ete.) General Manager (Lucy's) Monthly Pay $3,000 Building rental, annual charge (mcludes smow removal)$38,000 Cash receipts for the 3 month period Jul-Sept $42,875 Membership, South Side Business Association$400 Subscription. Video World Magazine Staff Christmas party 120 $475 Telephone, annual bill $692 Bulding cleaning service, annual charge$5.600 Natural gas, annual charge$3,678 Sale of a table and six chairs left in store by ptevious occupant $500 Advertising (ad in commumity paper)$400 Sofitware for cash management Annual business tax Staff wages, July thru December $650 $425 $26,822 Purchase of videa stock, new releases$$2,000 $480 Electricity and water, annual bill $1,896 Annual fee for payroll preparation Advertising (eighborhood drop of fyer) $298 (1) Is Lucy's business creating value (hint: developing an income statement for Lucy's business, assuming the depreciation period is 3 years for all assets)? (2) Is Lucy's business generating cash? (3) Should Lucy be in this business? estion 4 Lucy was suffering from "empty nest" syndrome, and decided that she needed some activity to fill the gap in her life. She opened a video rental outlet. As Lucy is not skilled in financial matters, and asks you to help her understand her business. She hands you a shoebox full of her receipts and notes, from which you withdraw the follow information Values (USS) Items Staff wages, Jamuary thru June$24,782 Cash register and computer purchase$9,587 Cash receipts for the 3 month period Jan-Mar $24,478 Store fixtures (sbelving and counter $16,000 $51,266 Cash receipts for the 3 month period Oct-Dec $496 Vacation Payments for the year Advertising (neighbothood drop of flyer) Promotion (support a neighborhood bockey team) Purchase of video stock, used videos$39,000 $266 Cash receipts for the 3 month period Apr- June $36,221 $400 $396 Office supplies (pens, paper, ete.) General Manager (Lucy's) Monthly Pay $3,000 Building rental, annual charge (mcludes smow removal)$38,000 Cash receipts for the 3 month period Jul-Sept $42,875 Membership, South Side Business Association$400 Subscription. Video World Magazine Staff Christmas party 120 $475 Telephone, annual bill $692 Bulding cleaning service, annual charge$5.600 Natural gas, annual charge$3,678 Sale of a table and six chairs left in store by ptevious occupant $500 Advertising (ad in commumity paper)$400 Sofitware for cash management Annual business tax Staff wages, July thru December $650 $425 $26,822 Purchase of videa stock, new releases$$2,000 $480 Electricity and water, annual bill $1,896 Annual fee for payroll preparation Advertising (eighborhood drop of fyer) $298 (1) Is Lucy's business creating value (hint: developing an income statement for Lucy's business, assuming the depreciation period is 3 years for all assets)? (2) Is Lucy's business generating cash? (3) Should Lucy be in this business