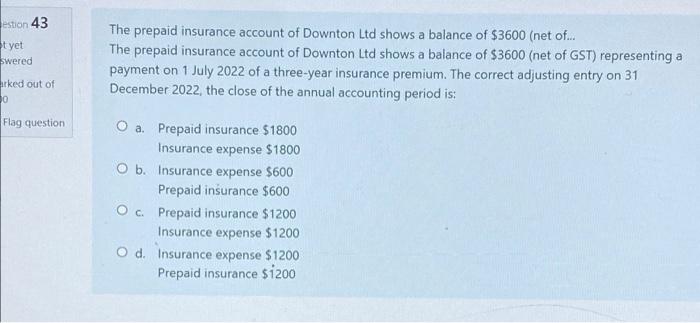

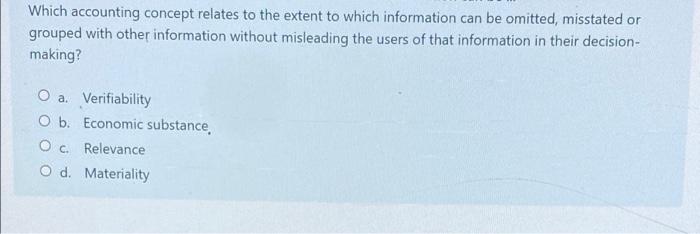

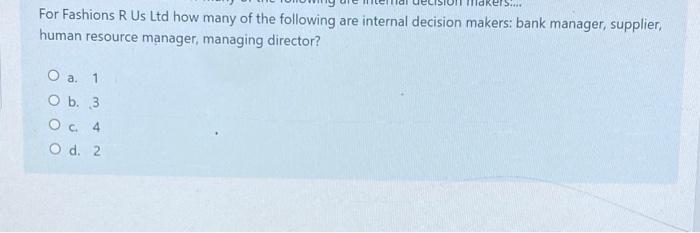

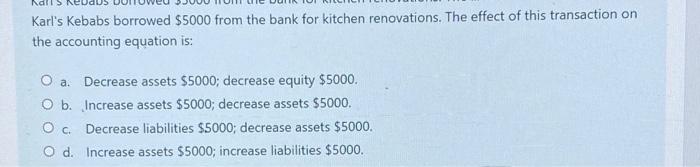

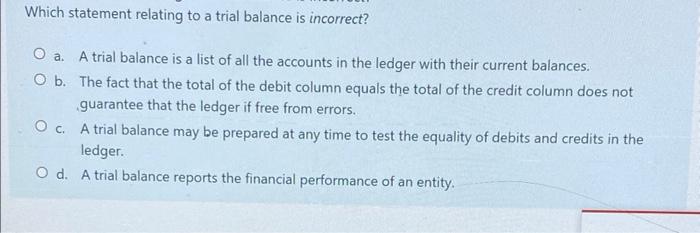

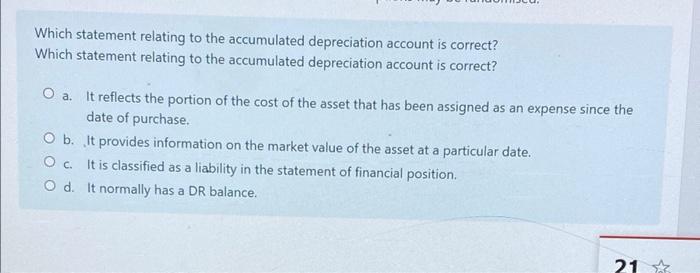

estion 43 t yet swered The prepaid insurance account of Downton Ltd shows a balance of $3600 (net of... The prepaid insurance account of Downton Ltd shows a balance of $3600 (net of GST) representing a payment on 1 July 2022 of a three-year insurance premium. The correct adjusting entry on 31 December 2022, the close of the annual accounting period is: ked out of 0 Flag question O a. Prepaid insurance $1800 Insurance expense $1800 O b. Insurance expense $600 Prepaid insurance $600 Oc Prepaid insurance $1200 Insurance expense $1200 Od Insurance expense $1200 Prepaid insurance siz00 Which accounting concept relates to the extent to which information can be omitted, misstated or grouped with other information without misleading the users of that information in their decision- making? O a Verifiability O b. Economic substance, Oc Relevance O d. Materiality Su For Fashions R Us Ltd how many of the following are internal decision makers: bank manager, supplier human resource manager, managing director? O a. 1 O b. 3 Oc 4 O d. 2 Karl's Kebabs borrowed $5000 from the bank for kitchen renovations. The effect of this transaction on the accounting equation is: a. Decrease assets $5000; decrease equity $5000. O b. Increase assets $5000; decrease assets $5000. Oc Decrease liabilities $5000; decrease assets $5000. O d. Increase assets $5000; increase liabilities $5000. Which statement relating to a trial balance is incorrect? O a. A trial balance is a list of all the accounts in the ledger with their current balances. O b. The fact that the total of the debit column equals the total of the credit column does not guarantee that the ledger if free from errors. . C. A trial balance may be prepared at any time to test the equality of debits and credits in the ledger O d. A trial balance reports the financial performance of an entity. Which statement relating to the accumulated depreciation account is correct? Which statement relating to the accumulated depreciation account is correct? O a. It reflects the portion of the cost of the asset that has been assigned as an expense since the date of purchase. O b. It provides information on the market value of the asset at a particular date. Oc. It is classified as a liability in the statement of financial position. O d. It normally has a DR balance. 21