Answered step by step

Verified Expert Solution

Question

1 Approved Answer

= estion 6 t yet swered Time left 1:07:17 SPG is a US MNC that has operations in Europe, the Middle East, and Africa. It

=

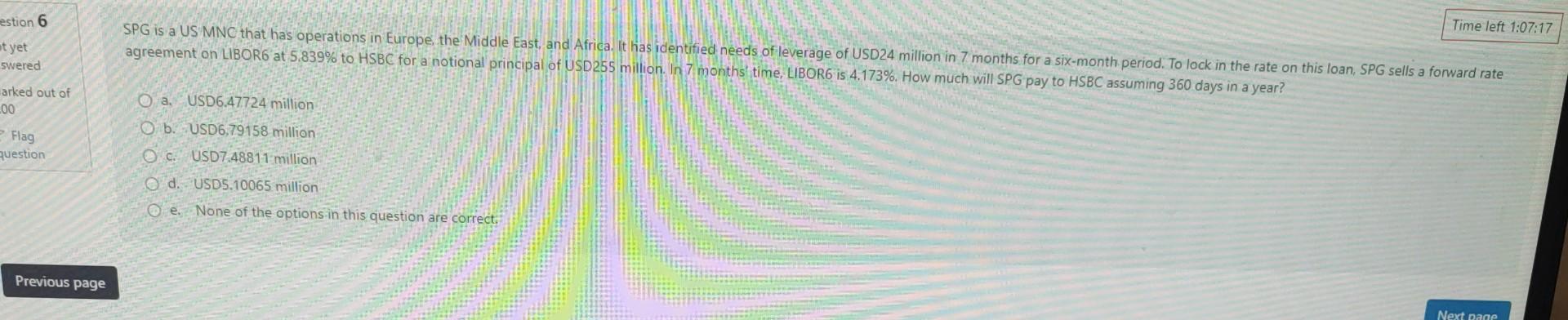

estion 6 t yet swered Time left 1:07:17 SPG is a US MNC that has operations in Europe, the Middle East, and Africa. It has identified needs of leverage of USD24 million in 7 months for a six-month period. To lock in the rate on this loan, SPG sells a forward rate agreement on LIBOR6 at 5.839% to HSBC for a notional principal of USD255 million. In 7 months' time, LIBOR6 is 4.173%. How much will SPG pay to HSBC assuming 360 days in a year? arked out of Oa. USD6.47724 million 200 Flag question Previous page Ob. USD6,79158 million Oc. USD7.48811 million Od. USD5.10065 million Oe. None of the options in this question are correct. Next page

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started