Answered step by step

Verified Expert Solution

Question

1 Approved Answer

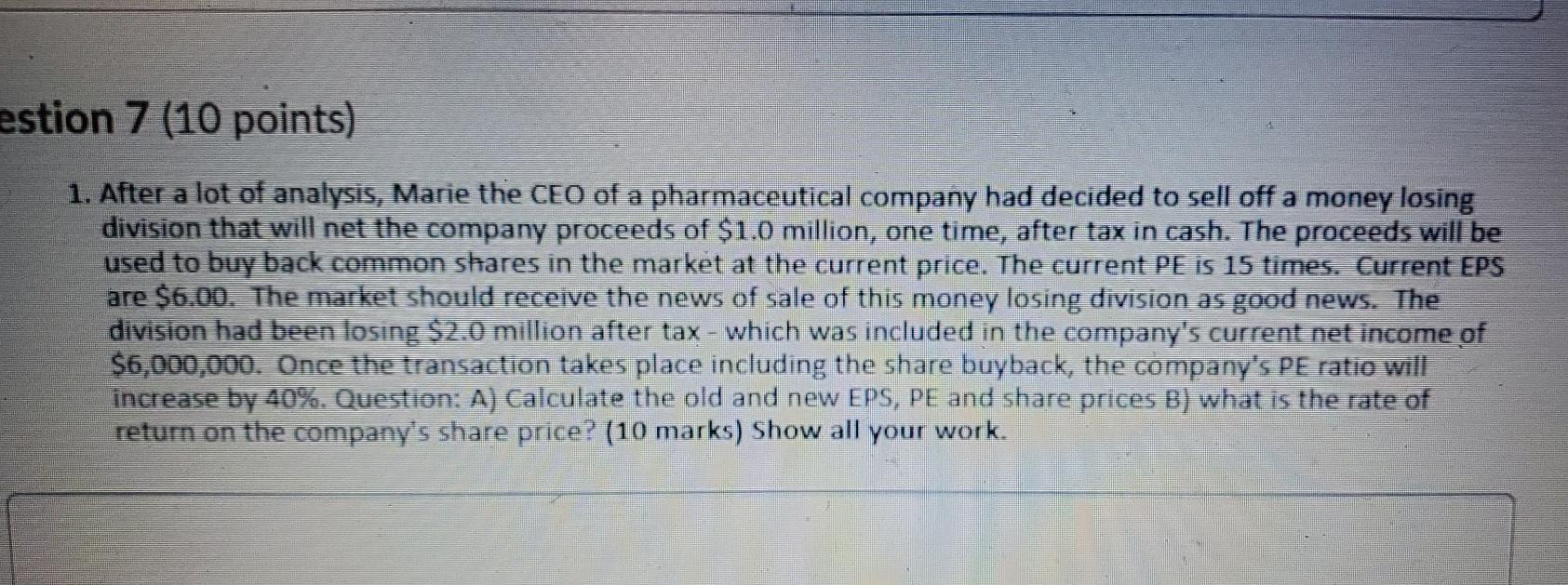

estion 7 (10 points) 1. After a lot of analysis, Marie the CEO of a pharmaceutical company had decided to sell off a money losing

estion 7 (10 points) 1. After a lot of analysis, Marie the CEO of a pharmaceutical company had decided to sell off a money losing division that will net the company proceeds of $1.0 million, one time, after tax in cash. The proceeds will be used to buy back common shares in the market at the current price. The current PE is 15 times. Current EPS are $6.00. The market should receive the news of sale of this money losing division as good news. The division had been losing $2.0 million after tax - which was included in the company's current net income of $6,000,000. Once the transaction takes place including the share buyback, the company's PE ratio will increase by 40%. Question: A) Calculate the old and new EPS, PE and share prices B) what is the rate of return on the company's share price? (10 marks) Show all your work

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started