Answered step by step

Verified Expert Solution

Question

1 Approved Answer

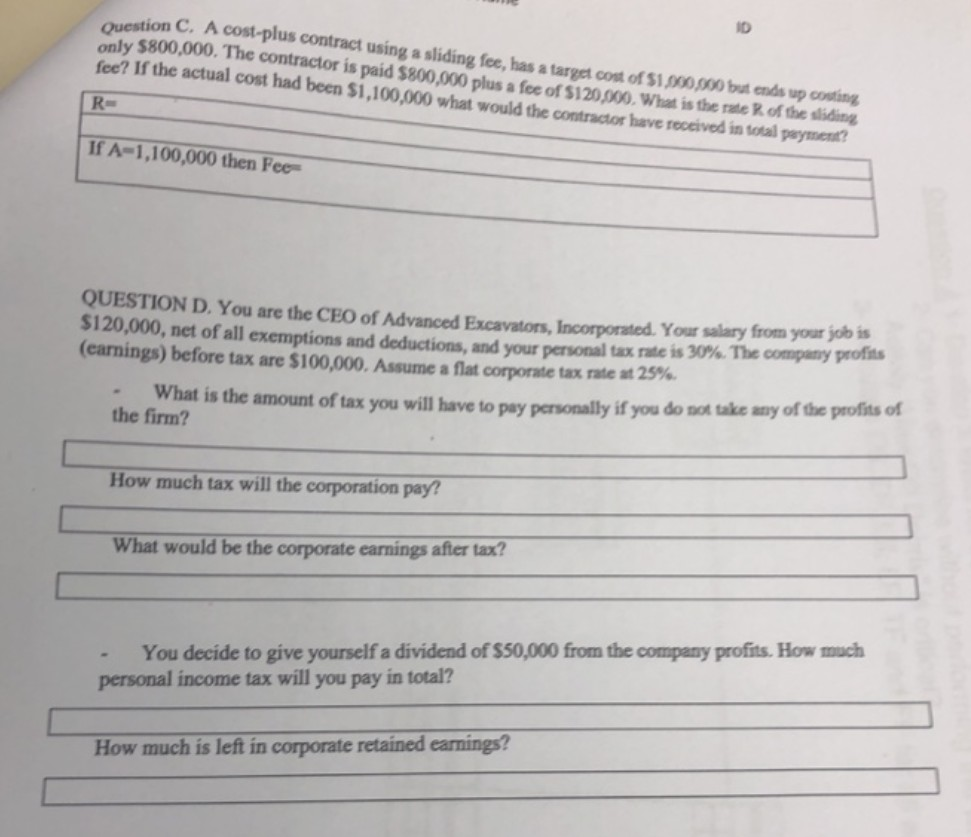

estion C. A cost-plus contract using a sliding fee, has a target cost of 51.900 5300 but ends up costing only $800,000. The contractor is

estion C. A cost-plus contract using a sliding fee, has a target cost of 51.900 5300 but ends up costing only $800,000. The contractor is paid $800,000 plus a fee of $120.000. What is the rate of the sliding fee? If the actual cost had been $1,100,000 what would the contractor have received in total payment? R- If A-1,100,000 then Fee QUESTION D. You are the CEO of Advanced Excavators, Incorporated. Your salary from you ww, net of all exemptions and deductions, and your personal tax rate is 30%. The company profits (earnings) before tax are $100,000. Assume a flat corporate tax rate at 23%. mat is the amount of tax you will have to pay personally if you do not take any of the prons or the firm? How much tax will the corporation pay?! What would be the corporate earnings after tax?! - You decide to give yourself a dividend of $50,000 from the company profits. How much personal income tax will you pay in total? How much is left in corporate retained earnings

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started