Answered step by step

Verified Expert Solution

Question

1 Approved Answer

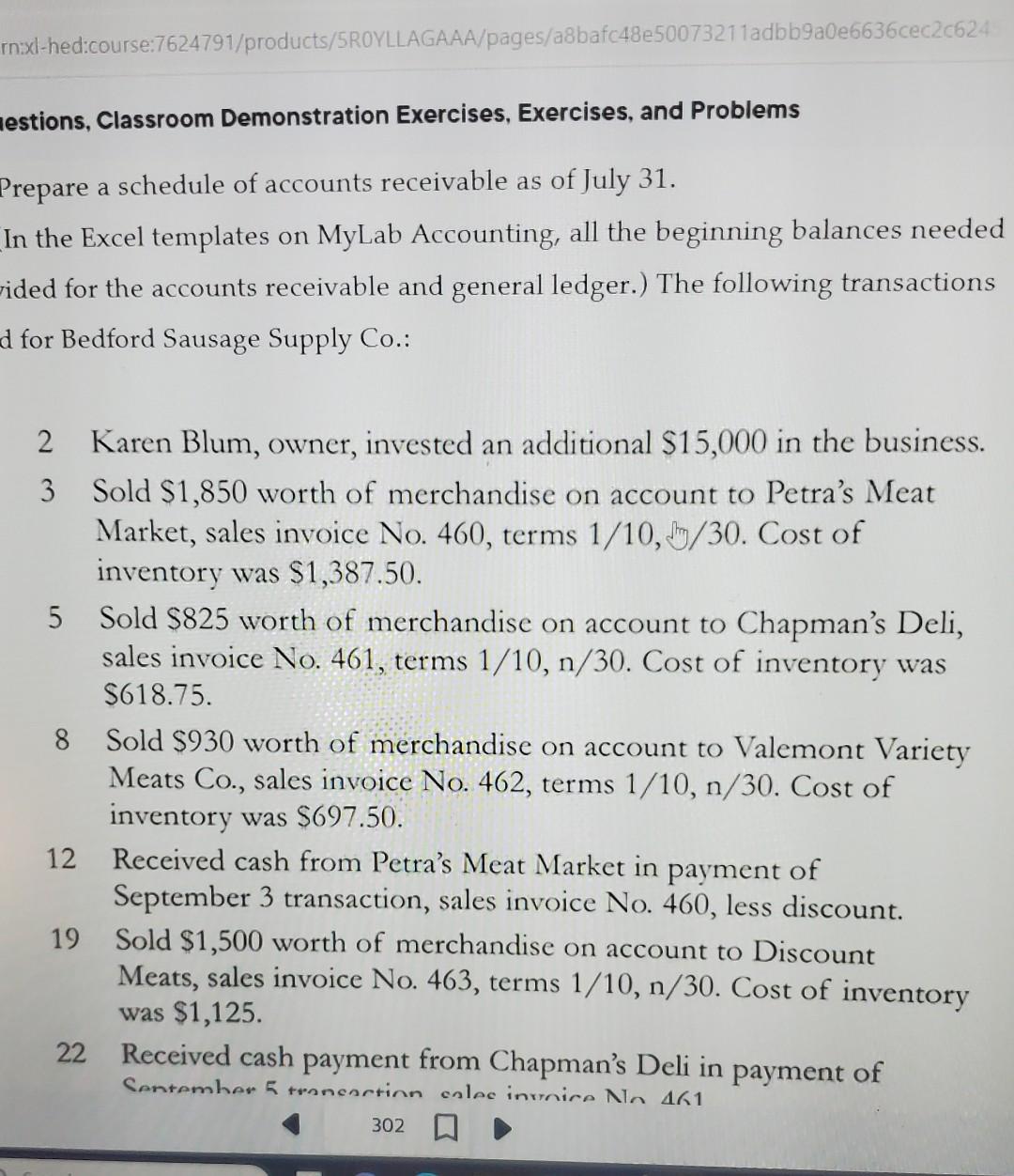

estions, Classroom Demonstration Exercises, Exercises, and Problems repare a schedule of accounts receivable as of July 31. In the Excel templates on MyLab Accounting, all

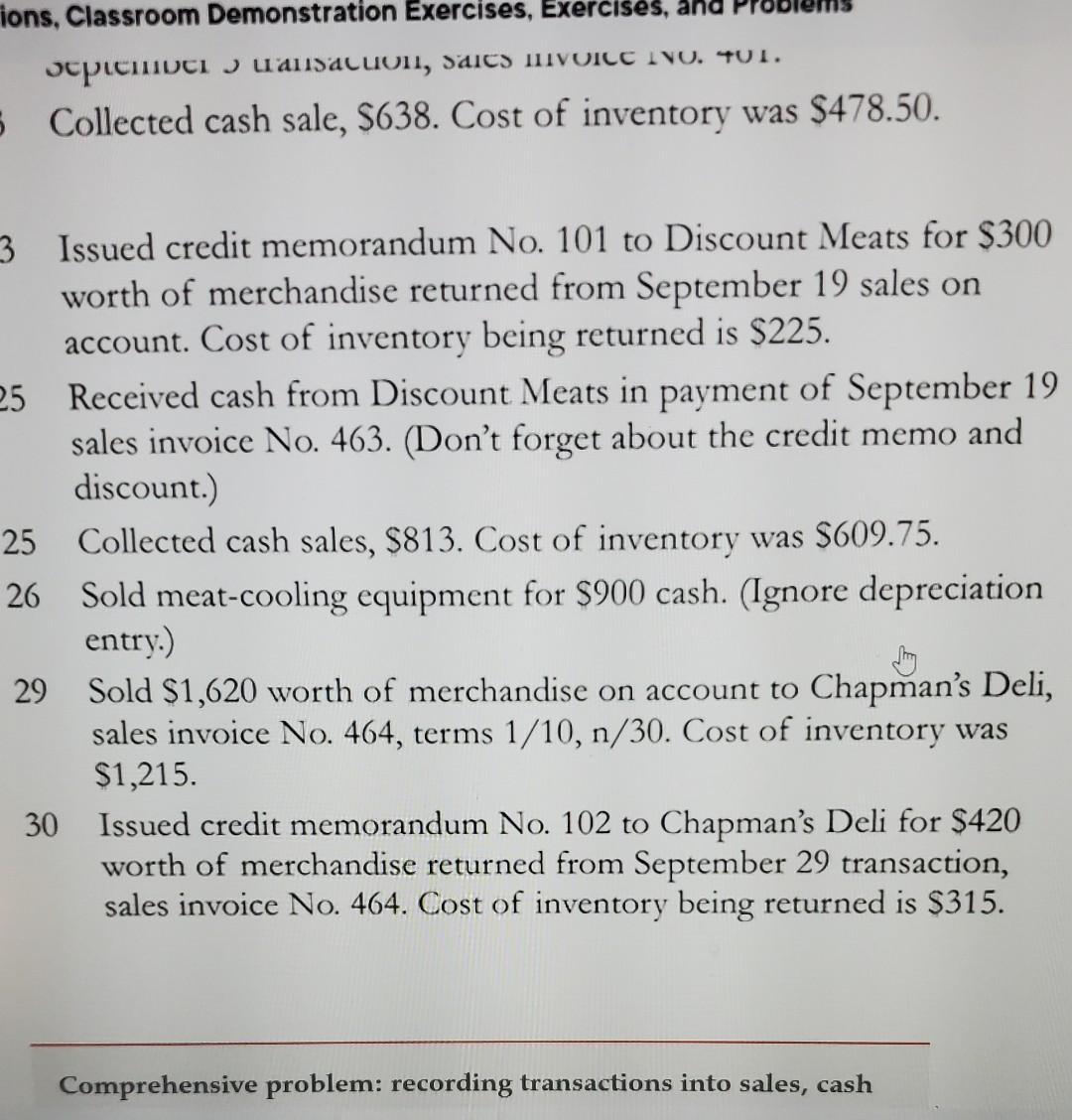

estions, Classroom Demonstration Exercises, Exercises, and Problems repare a schedule of accounts receivable as of July 31. In the Excel templates on MyLab Accounting, all the beginning balances needec ided for the accounts receivable and general ledger.) The following transactions for Bedford Sausage Supply Co.: 2 Karen Blum, owner, invested an additional \$15,000 in the business. 3 Sold \$1,850 worth of merchandise on account to Petra's Meat Market, sales invoice No. 460 , terms 1/10, ito /30. Cost of inventory was $1,387.50. 5 Sold $825 worth of merchandise on account to Chapman's Deli, sales invoice No. 461 , terms 1/10,n/30. Cost of inventory was $618.75. 8 Sold $930 worth of merchandise on account to Valemont Variety Meats Co., sales invoice No. 462, terms 1/10, n/30. Cost of inventory was $697.50. 12 Received cash from Petra's Meat Market in payment of September 3 transaction, sales invoice No. 460, less discount. 19 Sold $1,500 worth of merchandise on account to Discount Meats, sales invoice No. 463, terms 1/10,n/30. Cost of inventory was $1,125. 22 Received cash payment from Chapman's Deli in payment of 302 Comprehensive problem: recording transactions into sales, cash receipts, and general journals; recording to accounts receivable and posting to general ledger; preparing a schedule of accounts receivable 123(70min) Check Figure Schedule of Accounts Receivable $6,084.60 quired a. Journalize the transactions in the appropriate journals. b. Record and post as appropriate. c. Prepare a schedule of accounts receivable as of Sept. 30. Collected cash sale, $638. Cost of inventory was $478.50. 3 Issued credit memorandum No. 101 to Discount Meats for $300 worth of merchandise returned from September 19 sales on account. Cost of inventory being returned is $225. 25 Received cash from Discount Meats in payment of September 19 sales invoice No. 463. (Don't forget about the credit memo and discount.) 25 Collected cash sales, $813. Cost of inventory was $609.75. 26 Sold meat-cooling equipment for $900 cash. (Ignore depreciation entry.) 29 Sold \$1,620 worth of merchandise on account to Chapman's Deli, sales invoice No. 464 , terms 1/10,n/30. Cost of inventory was $1,215. 30 Issued credit memorandum No. 102 to Chapman's Deli for $420 worth of merchandise returned from September 29 transaction, sales invoice No. 464. Cost of inventory being returned is $315. Comprehensive problem: recording transactions into sales, cash

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started