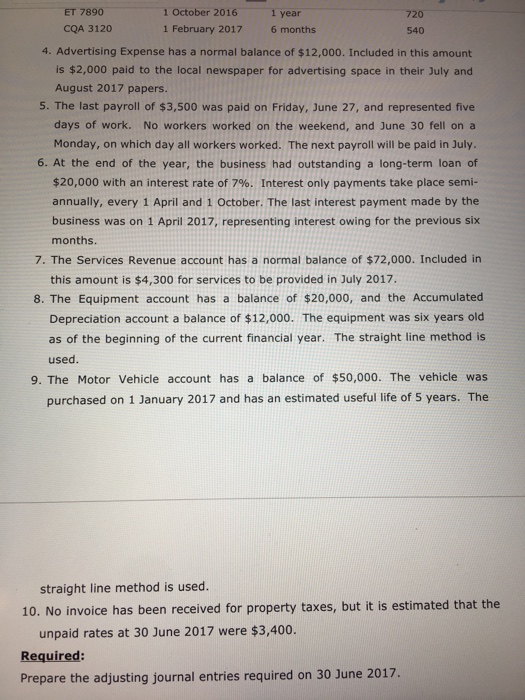

ET 7890 1 October 20161 year 1 February 2017 6 months 720 CQA 3120 540 4. Advertising Expense has a normal balance of $12,000. Included in this amount is $2,000 paid to the local newspaper for advertising space in their July and August 2017 papers. 5. The last payroll of $3,500 was paid on Friday, June 27, and represented five days of work. No workers worked on the weekend, and June 30 fell on a Monday, on which day all workers worked. The next payroll will be paid in July. 6. At the end of the year, the business had outstanding a long-term loan of $20,000 with an interest rate of 7%. Interest only payments take place semi- annually, every 1 April and 1 October. The last interest payment made by the business was on 1 April 2017, representing interest owing for the previous six months 7. The Services Revenue account has a normal balance of $72,000. Included in this amount is $4,300 for services to be provided in July 2017. 8. The Equipment account has a balance of $20,000, and the Accumulated Depreciation account a balance of $12,000. The equipment was six years old as of the beginning of the current financial year. The straight line method is used. 9. The Motor Vehicle account has a balance of $50,000. The vehicle was purchased on 1 January 2017 and has an estimated useful life of 5 years. The straight line method is used. 10. No invoice has been received for property taxes, but it is estimated that the unpaid rates at 30 June 2017 were $3,400. Prepare the adjusting journal entries required on 30 June 2017 ET 7890 1 October 20161 year 1 February 2017 6 months 720 CQA 3120 540 4. Advertising Expense has a normal balance of $12,000. Included in this amount is $2,000 paid to the local newspaper for advertising space in their July and August 2017 papers. 5. The last payroll of $3,500 was paid on Friday, June 27, and represented five days of work. No workers worked on the weekend, and June 30 fell on a Monday, on which day all workers worked. The next payroll will be paid in July. 6. At the end of the year, the business had outstanding a long-term loan of $20,000 with an interest rate of 7%. Interest only payments take place semi- annually, every 1 April and 1 October. The last interest payment made by the business was on 1 April 2017, representing interest owing for the previous six months 7. The Services Revenue account has a normal balance of $72,000. Included in this amount is $4,300 for services to be provided in July 2017. 8. The Equipment account has a balance of $20,000, and the Accumulated Depreciation account a balance of $12,000. The equipment was six years old as of the beginning of the current financial year. The straight line method is used. 9. The Motor Vehicle account has a balance of $50,000. The vehicle was purchased on 1 January 2017 and has an estimated useful life of 5 years. The straight line method is used. 10. No invoice has been received for property taxes, but it is estimated that the unpaid rates at 30 June 2017 were $3,400. Prepare the adjusting journal entries required on 30 June 2017