Question

ET owns a tract of land which it purchased in 2011 for P100,000. The land is held as a future plant site and has

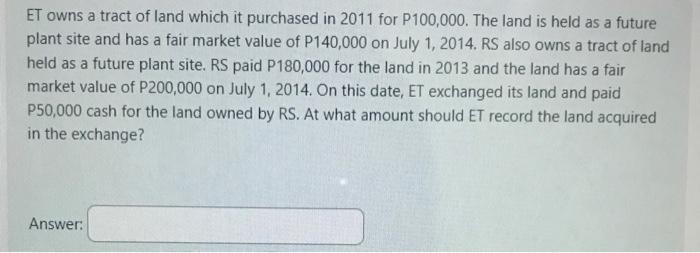

ET owns a tract of land which it purchased in 2011 for P100,000. The land is held as a future plant site and has a fair market value of P140,000 on July 1, 2014. RS also owns a tract of land held as a future plant site. RS paid P180,000 for the land in 2013 and the land has a fair market value of P200,000 on July 1, 2014. On this date, ET exchanged its land and paid P50,000 cash for the land owned by RS. At what amount should ET record the land acquired in the exchange? Answer:

Step by Step Solution

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

On July 1 2014 ETs parcel of land had a fair market value o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: J. David Spiceland, James Sepe, Mark Nelson, Wayne Thomas

9th Edition

125972266X, 9781259722660

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App