Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Interest rates (with continuous compounding) are 1.20%. Arasaka shares trade at $55.31, and will pay a dividend of $4.67 in 6 months time. You

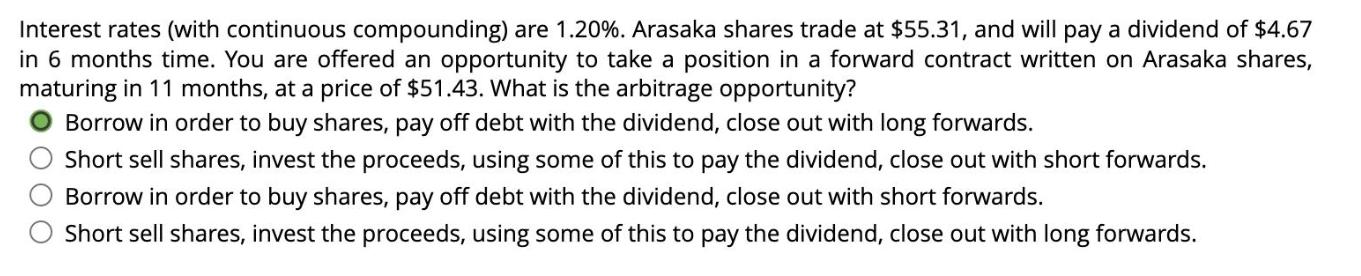

Interest rates (with continuous compounding) are 1.20%. Arasaka shares trade at $55.31, and will pay a dividend of $4.67 in 6 months time. You are offered an opportunity to take a position in a forward contract written on Arasaka shares, maturing in 11 months, at a price of $51.43. What is the arbitrage opportunity? Borrow in order to buy shares, pay off debt with the dividend, close out with long forwards. Short sell shares, invest the proceeds, using some of this to pay the dividend, close out with short forwards. Borrow in order to buy shares, pay off debt with the dividend, close out with short forwards. Short sell shares, invest the proceeds, using some of this to pay the dividend, close out with long forwards.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer The correct answer is Portfolio 1 Borrow in order to buy shares pay off debt with the dividen...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started