Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your company has just been awarded a large earthmoving contract that would be well suited for a Caterpillar 950H tire loader to load trucks

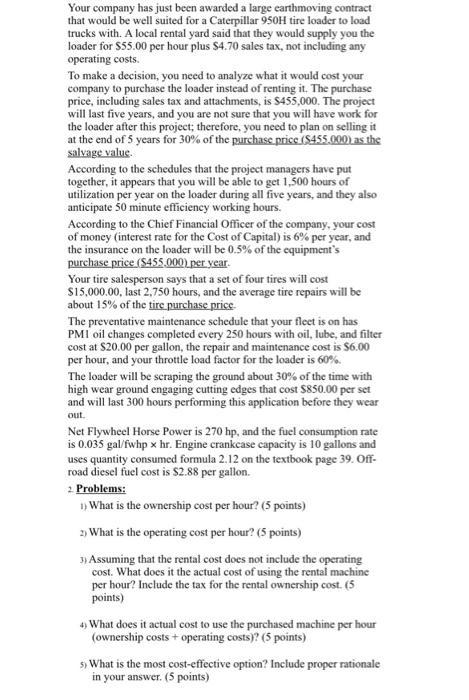

Your company has just been awarded a large earthmoving contract that would be well suited for a Caterpillar 950H tire loader to load trucks with. A local rental yard said that they would supply you the loader for $55.00 per hour plus $4.70 sales tax, not including any operating costs. To make a decision, you need to analyze what it would cost your company to purchase the loader instead of renting it. The purchase price, including sales tax and attachments, is $455,000. The project will last five years, and you are not sure that you will have work for the loader after this project; therefore, you need to plan on selling it at the end of 5 years for 30% of the purchases price (S455.000) as the salvage value. According to the schedules that the project managers have put together, it appears that you will be able to get 1,500 hours of utilization per year on the loader during all five years, and they also anticipate 50 minute efficiency working hours. According to the Chief Financial Officer of the company, your cost of money (interest rate for the Cost of Capital) is 6% per year, and the insurance on the loader will be 0.5% of the equipment's purchase price (S455.000) per year. Your tire salesperson says that a set of four tires will cost S15,000.00, last 2,750 hours, and the average tire repairs will be about 15% of the tire purchase price The preventative maintenance schedule that your fleet is on has PMI oil changes completed every 250 hours with oil, lube, and filter cost at S20.00 per gallon, the repair and maintenance cost is $6.00 per hour, and your throttle load factor for the loader is 60%. The loader will be scraping the ground about 30% of the time with high wear ground engaging cutting edges that cost $850.00 per set and will last 300 hours performing this application before they wear out. Net Flywheel Horse Power is 270 hp, and the fuel consumption rate is 0.035 gal/fwhp x hr. Engine crankcase capacity is 10 gallons and uses quantity consumed formula 2.12 on the textbook page 39. Off- road diesel fuel cost is $2.88 per gallon. 2 Problems: What is the ownership cost per hour? (5 points) 2) What is the operating cost per hour? (5 points) 3 Assuming that the rental cost does not include the operating cost. What does it the actual cost of using the rental machine per hour? Include the tax for the rental ownership cost. (5 points) 4) What does it actual cost to use the purchased machine per hour (ownership costs + operating costs)? (5 points) 5) What is the most cost-effective option? Include proper rationale in your answer. (5 points)

Step by Step Solution

★★★★★

3.50 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

1 The ownership cost per hour is 3359 P 455000 i 6 n 5 s 455000 03 PV FV1in PV 45500010065 PV 27571667 i 6 n 10 FV 27571667 100610 FV 104490709 PV FV1in PV 104490709100610 PV 455000 A PV i A 455000 00...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started