Eternity Company manufactures two products, IPX and IPY. Each product is started in the Machining Department and completed in the Assembly Department. The budgeted outputs

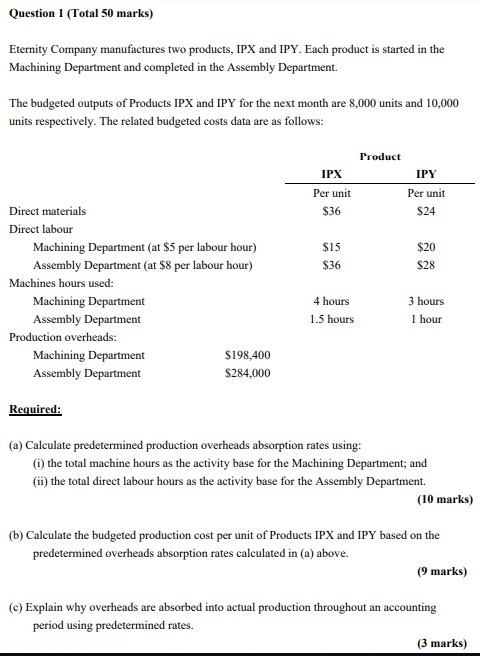

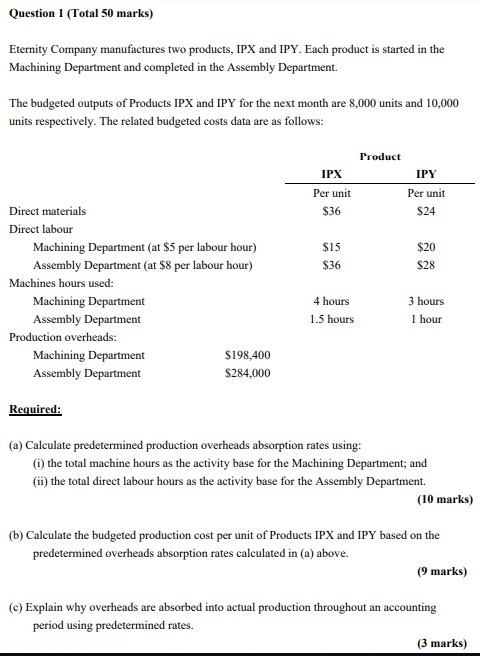

Eternity Company manufactures two products, IPX and IPY. Each product is started in the Machining Department and completed in the Assembly Department. The budgeted outputs of Products IPX and IPY for the next month are 8,000 units and 10,000 units respectively. The related budgeted costs data are as follows: Product IPX IPY Per unit Per unit Direct materials $36 $24 Direct labour Machining Department (at $5 per labour hour) $15 $20 Assembly Department (at $8 per labour hour) $36 $28 Machines hours used: Machining Department 4 hours 3 hours Assembly Department 1.5 hours 1 hour Production overheads: Machining Department $198,400 Assembly Department $284,000

Required: (a) Calculate predetermined production overheads absorption rates using: (i) the total machine hours as the activity base for the Machining Department; and (ii) the total direct labour hours as the activity base for the Assembly Department. (10 marks) (b) Calculate the budgeted production cost per unit of Products IPX and IPY based on the predetermined overheads absorption rates calculated in (a) above. (9 marks) (c) Explain why overheads are absorbed into actual production throughout an accounting period using predetermined rates. (3 marks)

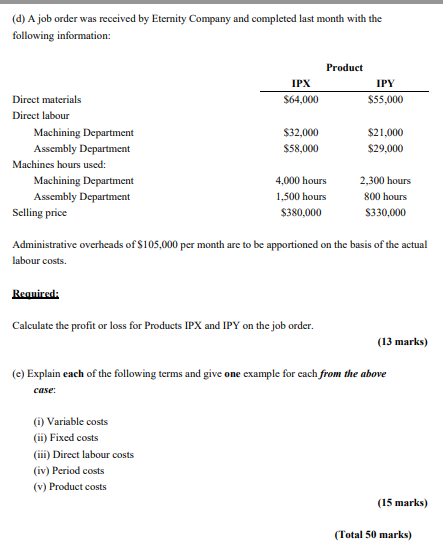

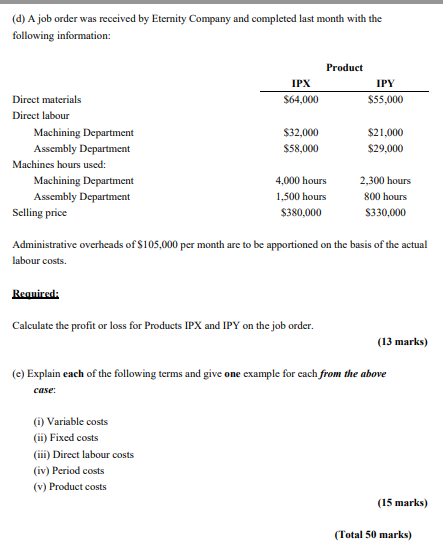

(d) A job order was received by Eternity Company and completed last month with the following information: Product IPX IPY Direct materials $64,000 $55,000 Direct labour Machining Department $32,000 $21,000 Assembly Department $58,000 $29,000 Machines hours used: Machining Department 4,000 hours 2,300 hours Assembly Department 1,500 hours 800 hours Selling price $380,000 $330,000 Administrative overheads of $105,000 per month are to be apportioned on the basis of the actual labour costs. Required: Calculate the profit or loss for Products IPX and IPY on the job order. (13 marks) (e) Explain each of the following terms and give one example for each from the above case: (i) Variable costs (ii) Fixed costs (iii) Direct labour costs (iv) Period costs (v) Product costs (15 marks)

(Total 50 marks)

Question 1 (Total 50 marks) Eternity Company manufactures two products, IPX and IPY. Each product is started in the The budgeted outputs of Products IPX and IPY for the next month are 8,000 units and 10,000 units respectively. The related budgeted costs data are as follows: Product IPY Per unit $24 IPX Per unit S36 Direct materials Direct labour Machining Department (at $5 per labour hour) Assembly Department (at $8 per labour hour) $15 S36 $20 $28 Machines hours used Machining Department 4 hours 1.5 hours 3 hours l hour Production overheads $198,400 $284,000 Assembly Department Required: (a) Calculate predetermined production overheads absorption rates using: (i) the total machine hours as the activity base for the Machining Department; and (ii the total direct labour hours as the activity base for the Assembly Department. (10 marks) (b) Calculate the budgeted production cost per unit of Products IPX and IPY based on the predetermined overheads absorption rates calculated in (a) above. (9 marks) (c) Explain why overheads are absorbed into actual production throughout an accounting period using predetermined rates. (3 marks) (d) A job order was received by Eternity Company and completed last month with the Product IPX $64,000 IPY S55.000 Direct materials Direct labour Machining Department 32,000 S58,000 $21,000 $29,000 Machines hours used: 2,300 hours 800 hours $330,000 Machining Department 4,000 hours 1,500 hours S380,000 Selling price Administrative overheads of $105,000 per month are to be apportioned on the basis of the actual labour costs. Calculate the profit or loss for Products IPX and IPY on the job order (13 marks) (e) Explain each of the following terms and give one example for cach from the above (i) Variable costs (ii) Fixed costs (iii) Direct labour costs (iv) Period costs (v) Product costs (15 marks) (Total 50 marks) Question 1 (Total 50 marks) Eternity Company manufactures two products, IPX and IPY. Each product is started in the The budgeted outputs of Products IPX and IPY for the next month are 8,000 units and 10,000 units respectively. The related budgeted costs data are as follows: Product IPY Per unit $24 IPX Per unit S36 Direct materials Direct labour Machining Department (at $5 per labour hour) Assembly Department (at $8 per labour hour) $15 S36 $20 $28 Machines hours used Machining Department 4 hours 1.5 hours 3 hours l hour Production overheads $198,400 $284,000 Assembly Department Required: (a) Calculate predetermined production overheads absorption rates using: (i) the total machine hours as the activity base for the Machining Department; and (ii the total direct labour hours as the activity base for the Assembly Department. (10 marks) (b) Calculate the budgeted production cost per unit of Products IPX and IPY based on the predetermined overheads absorption rates calculated in (a) above. (9 marks) (c) Explain why overheads are absorbed into actual production throughout an accounting period using predetermined rates. (3 marks) (d) A job order was received by Eternity Company and completed last month with the Product IPX $64,000 IPY S55.000 Direct materials Direct labour Machining Department 32,000 S58,000 $21,000 $29,000 Machines hours used: 2,300 hours 800 hours $330,000 Machining Department 4,000 hours 1,500 hours S380,000 Selling price Administrative overheads of $105,000 per month are to be apportioned on the basis of the actual labour costs. Calculate the profit or loss for Products IPX and IPY on the job order (13 marks) (e) Explain each of the following terms and give one example for cach from the above (i) Variable costs (ii) Fixed costs (iii) Direct labour costs (iv) Period costs (v) Product costs (15 marks) (Total 50 marks)