Ethan is Valeries qualifying child for which of the following benefits?

A. Exemption for a dependent

B child tax credit

C. Earned income credit

D none of the above

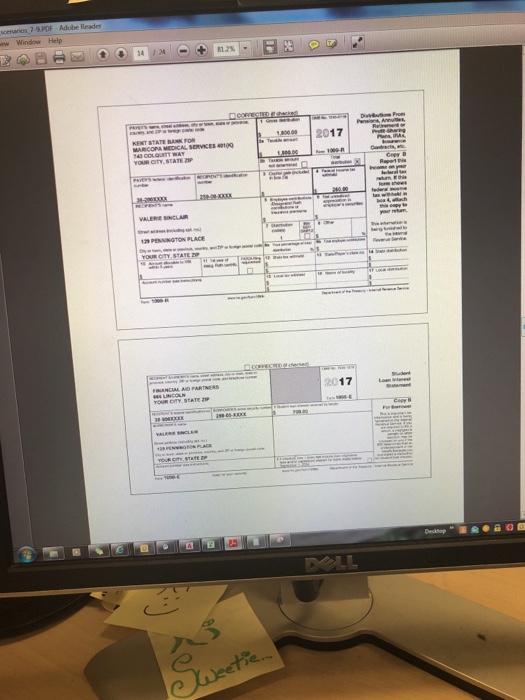

What is Valeries credit for child and dependent care expenses shown on her form 1040, page 2?

A. 396

B. 414

C. 432

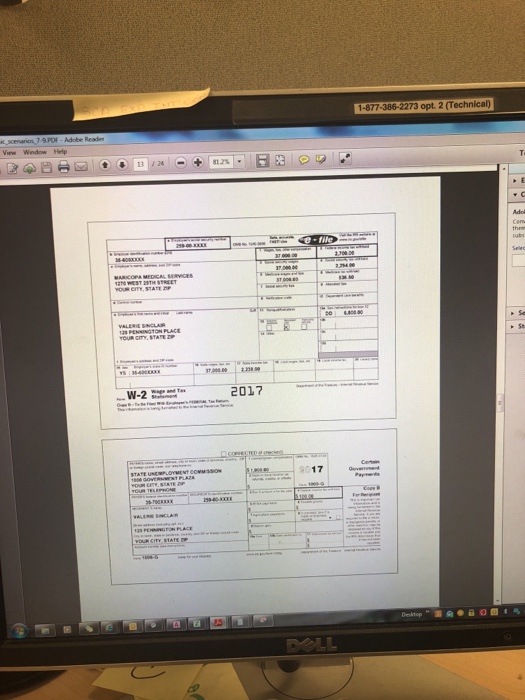

What is the amount of additional tax on the distribution from Valeries 401k, shown in the other taxes section of form 1040?

A.0

B. 130

C. 180

D.450

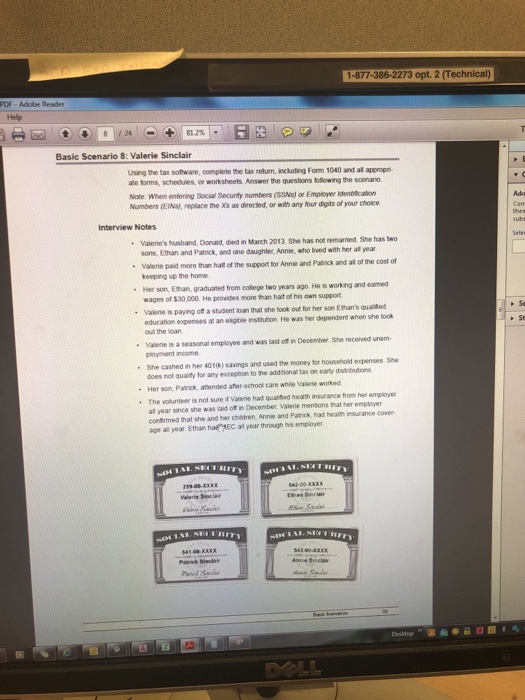

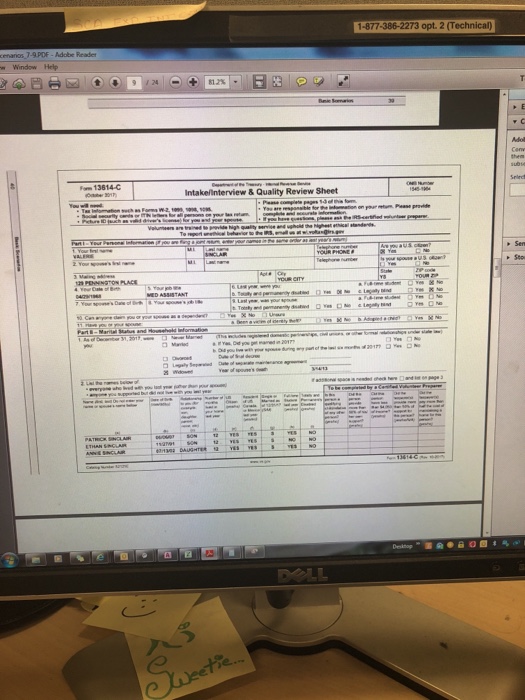

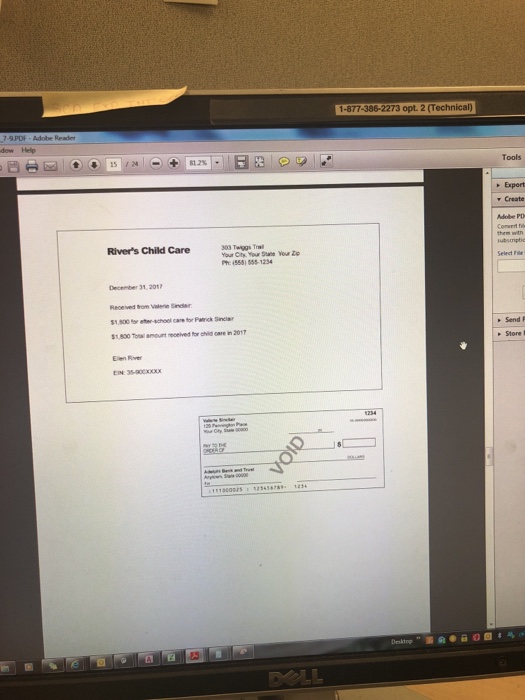

1-877-386-2273 opt. 2 (Technical) PDF-Adobe Help 24 81.2% Basic Scenario 8: Valerie Sinclair Using the tax software, complete the tax retun, inclding Form 1040 and all appropi ate forms, scheduies, or worksheets. Answer the questions tollowing the scenario. Note: When entering Social Security numbers (sSNs) or Employer identication Numbers (EINs), replace tme Xs as deected, or with any four digits of your choice Interview Notes Valerie's husband, Donald, died in March 2013. She has not remarmied She has two sons, Ethan and Patrick, and one daughter, Annie, who lived with her atl year Wene pad more than hat orthe support for Annie and Paterd al of the cost of keeping up the home Her son, Ehan, graduated from college two years ago He is working and wages of $30,000. He provides more than halt of his own support Valerie is paying off a student loan that she took out for her son Ethan's quaited earned expenses at an elgible institution He was her dependent when she took vaene is a seasonal employee and was ladoi, Decemb. She received unen- poyment income She cashed in her 4010) savings and used the money for household expenses She does not quality for any exceptoon to the addtional tax on early distributions Her son, Paanick, amended afher-school care whie Valerie worked The volunteer is not surevaiene had qualted health rsuance from her employer all year cornrmed that she and her chldren. Ann" and Pate had heam imsurance cover. age all year Ethan hae MEC all year through his employer e she was laid of in December. Valerie mentons that her employer 1-877-386-2273 opt. 2 (Technical) PDF-Adobe Help 24 81.2% Basic Scenario 8: Valerie Sinclair Using the tax software, complete the tax retun, inclding Form 1040 and all appropi ate forms, scheduies, or worksheets. Answer the questions tollowing the scenario. Note: When entering Social Security numbers (sSNs) or Employer identication Numbers (EINs), replace tme Xs as deected, or with any four digits of your choice Interview Notes Valerie's husband, Donald, died in March 2013. She has not remarmied She has two sons, Ethan and Patrick, and one daughter, Annie, who lived with her atl year Wene pad more than hat orthe support for Annie and Paterd al of the cost of keeping up the home Her son, Ehan, graduated from college two years ago He is working and wages of $30,000. He provides more than halt of his own support Valerie is paying off a student loan that she took out for her son Ethan's quaited earned expenses at an elgible institution He was her dependent when she took vaene is a seasonal employee and was ladoi, Decemb. She received unen- poyment income She cashed in her 4010) savings and used the money for household expenses She does not quality for any exceptoon to the addtional tax on early distributions Her son, Paanick, amended afher-school care whie Valerie worked The volunteer is not surevaiene had qualted health rsuance from her employer all year cornrmed that she and her chldren. Ann" and Pate had heam imsurance cover. age all year Ethan hae MEC all year through his employer e she was laid of in December. Valerie mentons that her employer