Answered step by step

Verified Expert Solution

Question

1 Approved Answer

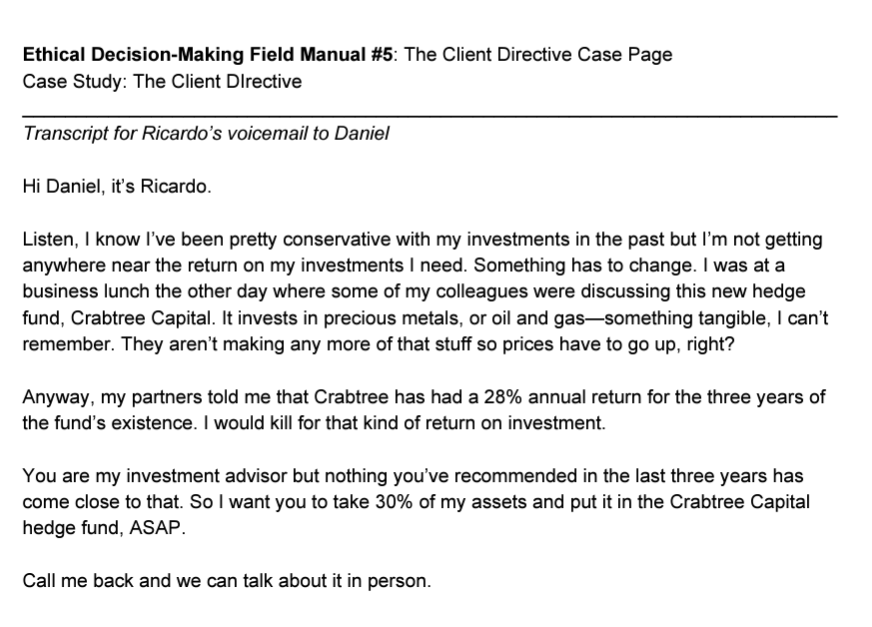

Ethical Decision-Making Field Manual #5: The Client Directive Case Page Case Study: The Client DIrective Transcript for Ricardo's voicemail to Daniel Hi Daniel, it's Ricardo.

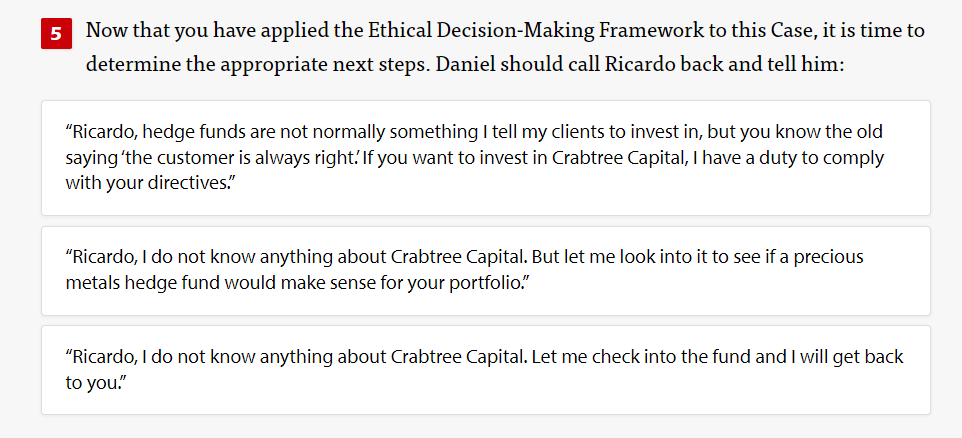

Ethical Decision-Making Field Manual \#5: The Client Directive Case Page Case Study: The Client DIrective Transcript for Ricardo's voicemail to Daniel Hi Daniel, it's Ricardo. Listen, I know l've been pretty conservative with my investments in the past but I'm not getting anywhere near the return on my investments I need. Something has to change. I was at a business lunch the other day where some of my colleagues were discussing this new hedge fund, Crabtree Capital. It invests in precious metals, or oil and gas-something tangible, I can't remember. They aren't making any more of that stuff so prices have to go up, right? Anyway, my partners told me that Crabtree has had a 28% annual return for the three years of the fund's existence. I would kill for that kind of return on investment. You are my investment advisor but nothing you've recommended in the last three years has come close to that. So I want you to take 30% of my assets and put it in the Crabtree Capital hedge fund, ASAP. Call me back and we can talk about it in person. Now that you have applied the Ethical Decision-Making Framework to this Case, it is time to determine the appropriate next steps. Daniel should call Ricardo back and tell him: "Ricardo, hedge funds are not normally something I tell my clients to invest in, but you know the old saying 'the customer is always right.' If you want to invest in Crabtree Capital, I have a duty to comply with your directives." "Ricardo, I do not know anything about Crabtree Capital. But let me look into it to see if a precious metals hedge fund would make sense for your portfolio." "Ricardo, I do not know anything about Crabtree Capital. Let me check into the fund and I will get back to you

Ethical Decision-Making Field Manual \#5: The Client Directive Case Page Case Study: The Client DIrective Transcript for Ricardo's voicemail to Daniel Hi Daniel, it's Ricardo. Listen, I know l've been pretty conservative with my investments in the past but I'm not getting anywhere near the return on my investments I need. Something has to change. I was at a business lunch the other day where some of my colleagues were discussing this new hedge fund, Crabtree Capital. It invests in precious metals, or oil and gas-something tangible, I can't remember. They aren't making any more of that stuff so prices have to go up, right? Anyway, my partners told me that Crabtree has had a 28% annual return for the three years of the fund's existence. I would kill for that kind of return on investment. You are my investment advisor but nothing you've recommended in the last three years has come close to that. So I want you to take 30% of my assets and put it in the Crabtree Capital hedge fund, ASAP. Call me back and we can talk about it in person. Now that you have applied the Ethical Decision-Making Framework to this Case, it is time to determine the appropriate next steps. Daniel should call Ricardo back and tell him: "Ricardo, hedge funds are not normally something I tell my clients to invest in, but you know the old saying 'the customer is always right.' If you want to invest in Crabtree Capital, I have a duty to comply with your directives." "Ricardo, I do not know anything about Crabtree Capital. But let me look into it to see if a precious metals hedge fund would make sense for your portfolio." "Ricardo, I do not know anything about Crabtree Capital. Let me check into the fund and I will get back to you Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started